Why 70% of Small Businesses Fail to Catch Tax Credits They’re Entitled To

The Silent Drain on Your Bottom Line

Imagine running a successful small business—sales are steady, your team is growing, and you’re hitting milestones. But behind the scenes, you’re unknowingly losing thousands each year. The culprit? Unclaimed tax credits.

For small businesses across South Jersey, especially in Gloucester County, this isn’t a rare mistake—it’s a silent epidemic. According to industry studies, up to 70% of eligible businesses fail to claim the tax credits they’re entitled to. That’s not just an oversight; it’s money left on the table—money that could cover payroll, upgrade equipment, or fund your next expansion.

🔍 Quick Summary

- 70% of small businesses miss out on valuable tax credits every year.

- Credits like R&D, WOTC, and ERC offer real cash savings—not just deductions.

- Most are missed due to lack of awareness, misconceptions, or poor documentation.

- TMD Accounting helps South Jersey businesses recover thousands in retroactive and current credits.

Deductions vs. Credits: The Game-Changing Difference

Before diving into the missed opportunities, let’s set the record straight:

- Tax Deductions reduce the amount of income you’re taxed on.

- Tax Credits directly reduce your tax bill dollar-for-dollar.

For example, a $5,000 deduction might save you $1,000 in taxes. But a $5,000 tax credit saves you $5,000 outright. The financial impact? Immediate and significant.

Most Commonly Missed Tax Credits (And Why They Matter)

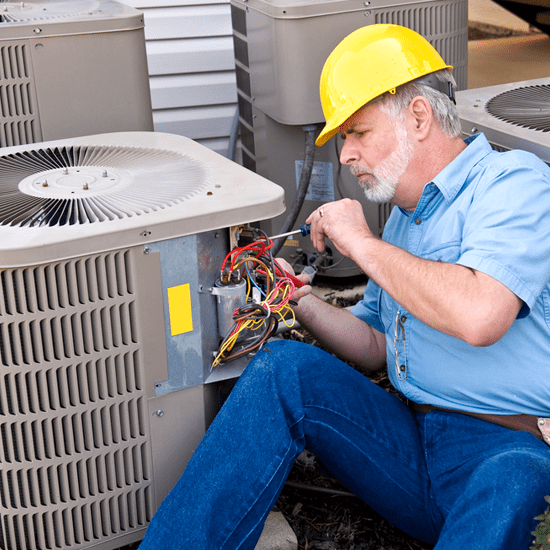

✅ Research & Development (R&D) Tax Credit

Think it only applies to tech firms? Think again. Local businesses—like contractors developing new materials or restaurants refining systems—can qualify. Here’s how contractors in Gloucester County improve their bottom line with professional accounting.

✅ Work Opportunity Tax Credit (WOTC)

If you’ve hired veterans or individuals from other targeted groups, you may qualify for thousands in credits per employee. It’s part of why our payroll management services include compliance screening.

✅ Employee Retention Credit (ERC)

Many businesses still don’t realize they can file retroactively for this pandemic-era credit. One of our tax planning clients recovered over $80,000 after a strategic review.

✅ Disabled Access Credit

Upgrades to improve accessibility aren’t just good ethics—they can qualify for significant tax offsets.

✅ Small Business Health Care Tax Credit

If you provide employee insurance through the SHOP marketplace, this credit could reimburse up to 50% of premiums. Don’t guess—our specialists can run a benefits check.

Why Are These Credits So Often Overlooked?

Quick Stats:

- 70% of eligible small businesses miss tax credits (source: U.S. Chamber).

- 1 in 3 believes they’re not eligible—yet qualify under IRS rules.

- Fear of audits deters 28% from claiming credits, even when legal.

❌ Misconceptions About Eligibility

Many business owners think credits are “for bigger firms.” That belief alone causes countless businesses to miss out.

❌ Lack of Awareness

Credits change yearly. Without a proactive advisor, you might never know what’s available.

❌ Documentation Gaps

Not keeping good records? You could be missing proof required to claim credits. Here’s a record retention guide to help.

What Happens When You Do Claim the Credits?

Before:

You’re overpaying taxes, running lean, and wondering why cash flow is always tight.

After:

You reinvest $10K–$50K in savings back into your business—hiring, marketing, upgrading systems.

That’s not fantasy—it’s the difference real clients in Washington Township and Turnersville have experienced with TMD Accounting’s help.

How to Start Catching Every Credit You’re Owed

Step 1: Schedule a Strategic Review

Let our team perform a personalized audit of your last 3 years of returns.

Step 2: Identify & Document

We’ll help uncover missed opportunities and prepare the documentation you need.

Step 3: File or Amend

We handle the paperwork, file retroactive claims where applicable, and help set up systems to avoid missing credits in the future.

Already have a bookkeeper or accountant? We can collaborate or offer a second opinion.

Real Gloucester County Example

A small Glassboro-based manufacturer developing eco-friendly packaging had no idea their process improvements qualified them for the R&D tax credit. After engaging TMD, they recovered over $38,000 in retroactive credits.

Visual Enhancements (Suggestions):

- Infographic: “Top 5 Missed Tax Credits by NJ Small Businesses”

- Before/After Table: Revenue impact of claiming vs. missing credits

- Quote Block: “We thought tax credits were out of reach—TMD showed us how wrong we were.”

The Bottom Line: You’ve Earned It—Now Claim It

Missing tax credits isn’t just unfortunate—it’s avoidable. The real tragedy isn’t overpaying, it’s continuing to do so when the solution is right in front of you.

If you’re ready to stop leaving money on the table, it’s time to act.

👉 Book your free tax credit review with TMD Accounting

Your future self—and your balance sheet—will thank you.

❓ Frequently Asked Questions

1. What’s the difference between a tax deduction and a tax credit?

Deductions lower taxable income, while credits reduce your tax bill dollar-for-dollar—making credits far more powerful.

2. Why do so many businesses miss out on credits?

Misconceptions, outdated advice, and lack of proper documentation often prevent business owners from claiming what’s rightfully theirs.

3. Can I still claim credits from past years?

Yes. Many credits like the ERC and R&D can be claimed retroactively, often up to 3 years back.

4. What kind of businesses qualify?

Almost any business can qualify, from contractors and retailers to restaurants and manufacturers, depending on hiring, innovation, or accessibility improvements.

5. How does TMD Accounting help?

We audit past returns, uncover eligible credits, help gather documentation, and file claims—maximizing your return with no guesswork.