Smart Accounting Practices for Independent Contractors In New Jersey

Under the law, an independent contractor is classified as a business. As a result, you are responsible for paying taxes and maintaining those financial records. You might have become an independent contractor to get away from those mundane tasks, but it is vital to keep up with accounting and bookkeeping for your business. Here are a few ways to track your finances as an independent contractor.

Differences Between an Independent Contractor and an Employee

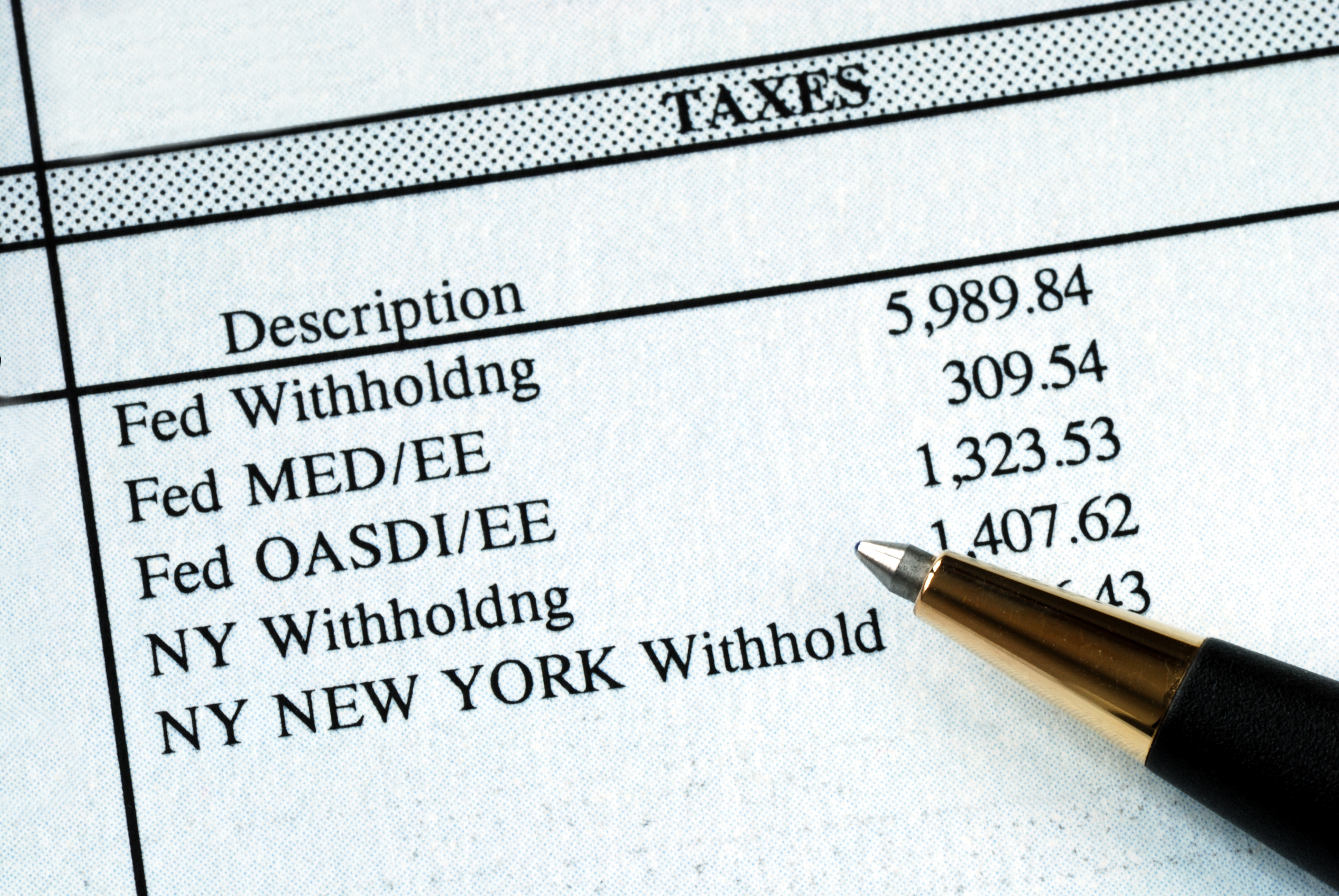

Those who work for a company are classified as employees. The business will withhold and report a portion of the individual’s wages to the IRS. Unemployment, Social Security, Medicare, and tax liabilities are all deducted from those paychecks. All taxable income is listed on a W-2 form and filed with the IRS.

If you are an independent contractor, you are not an employee of a business. You get paid for projects, file taxes by yourself, and work when you want to work. In this role, you have more freedom than a regular employee. However, with the title comes plenty of responsibilities.

With that freedom, you are responsible for paying your own health insurance, unemployment taxes, and payroll taxes. For that reason, you need to keep accurate bookkeeping records of your finances. Any mistakes can lead to tax penalties and other problems down the road. While being an independent contractor has many benefits, all business responsibilities are in your own hands.

As an independent contractor, you are responsible for tax payments and other financial matters. While it might sound intimidating, there are a few steps that you can take to make it a less challenging process. Don’t think that this is an impossible task. You can use these smart accounting practices to keep accurate records and manage your finances as an independent contractor.

Becoming Financially Savvy With Your Accounting

There are many reasons why an individual chooses to become an independent contractor. Some people don’t like the 9 to 5 grind, while others want more freedom with their days. No matter the reasons, everyone wants to be successful in their careers. While it takes many skills to run your own business, you must pay attention to your finances.

Tax time can be challenging for anyone. If you don’t have the proper records and statements, it can become a headache. Use these smart accounting skills to get a better hold of your financial health. Not only will it help with your tax liabilities, but you can make better-informed decisions for your business.

Become Your Own Business

Make sure to request your own EIN or Employer ID Number from the IRS. With that, you will be classified as your own business rather than a “contractor for hire.” Becoming your own business provides you with the opportunity to receive tax breaks.

Separate Personal and Business Expenses

Along with an EIN, you should think about opening a separate bank account for your business. This process is a smart accounting move because it helps to separate finances. Along with that, if you happen to be audited, it can make the process a bit easier for you. A separate business account gives you the records to show that expenses are tied to your business. With one single account, you might have to justify whether the expenses were personal or business-related.

Track All of Your Expenses

Whether your business is large or small, you must record all of your expenses. With that information, you can take advantage of tax deductions. However, you need to back up your records with invoices and receipts. You always want to be prepared in case of an audit.

Always Pay Your Estimated Taxes

Those accurate financial records are the best ways to track your tax liability. If you fail to file your expenses and profits, you could be audited by the IRS. Unfortunately, all of your wages will be heavily scrutinized as an independent contractor. For that reason, you want to have accurate records of your estimated tax payments so that you are not hit with a large tax liability.

Plan for the Future

As a business owner, make sure to plan for the future. Even if your business is flourishing right now, things can change instantly. You should have a plan in place for times when business is slow. Think about what you would do to cover those financial humps. From getting sick to natural disasters, anything can impact your work and the demand for your services. Enjoy your current success, but always plan for the unexpected. With that, consider a few financial plans that can help during those tough times. If you are worried about your financial health, small business accounting services can provide some guidance to ease the stress of uncertainty with your work.

Learn About Tax Benefits

Take some time to learn about the advantages of business ownership and tax planning. You might be able to use some tax-saving benefits, such as retirement savings, family planning, and medical expenses.

Don’t Be Afraid To Ask for Help

If you are an independent contractor, you already know the benefits of outsourcing some parts of your business. When you focus on your projects, it can become a burden to record your own finances and handle those tasks for tax season.

When you work with a professional bookkeeper and accountant, you can eliminate some of that stress. In addition to that, you can stay on track financially and make better decisions for your business. Well-organized books even place you in a better position if you need to apply for a business loan.

Choose an Accountant Who Understands Independent Contractors

Need an accountant for my small business? Make sure to reach out to TMD Accounting. For over 40 years, small businesses and individuals have trusted Thomas M. Ditullio Accounting. Mr. Ditullio and his staff provide only the highest quality accounting services to the residents and businesses in the Gloucester County area. We understand that an independent contractor has specialized tax and financial needs. For that reason, you can count on us to get the job done for you. Schedule a consultation by calling 1-856-228-2205.