How to Keep Overhead Costs Low in a Competitive Hospitality Market

Running a restaurant, café, or boutique inn these days feels like walking a financial tightrope. Rent is up. Utilities are unpredictable. Labor costs are rising. And you’ve still got to deliver the quality and service your guests expect—without raising prices beyond what the market can bear.

If you’ve found yourself wondering how to reduce overhead costs in hospitality without sacrificing service or staff morale, you’re in the right place.

In this guide, we’ll walk through smart, practical strategies that local South Jersey hospitality businesses—like yours—can implement right away. Whether you’re managing a bar in Glassboro, a bakery in Pitman, or a shore-town eatery in Ocean City, we’ve got tips to help you stay competitive and profitable.

🔍 Quick Summary

- Ideal for small businesses in Gloucester County, NJ.

- Stay compliant with New Jersey tax laws.

- Schedule regular check-ins to manage accounting and payroll effectively.

What Counts as Overhead in Hospitality?

Before you can cut costs, you have to know where your money’s going.

Overhead refers to all the expenses it takes to keep your doors open—regardless of how many customers walk through them.

Common Overhead Expenses:

-

Fixed costs: rent, insurance, licenses, internet, security

-

Variable costs: utilities, wages, supplies, subscription software

-

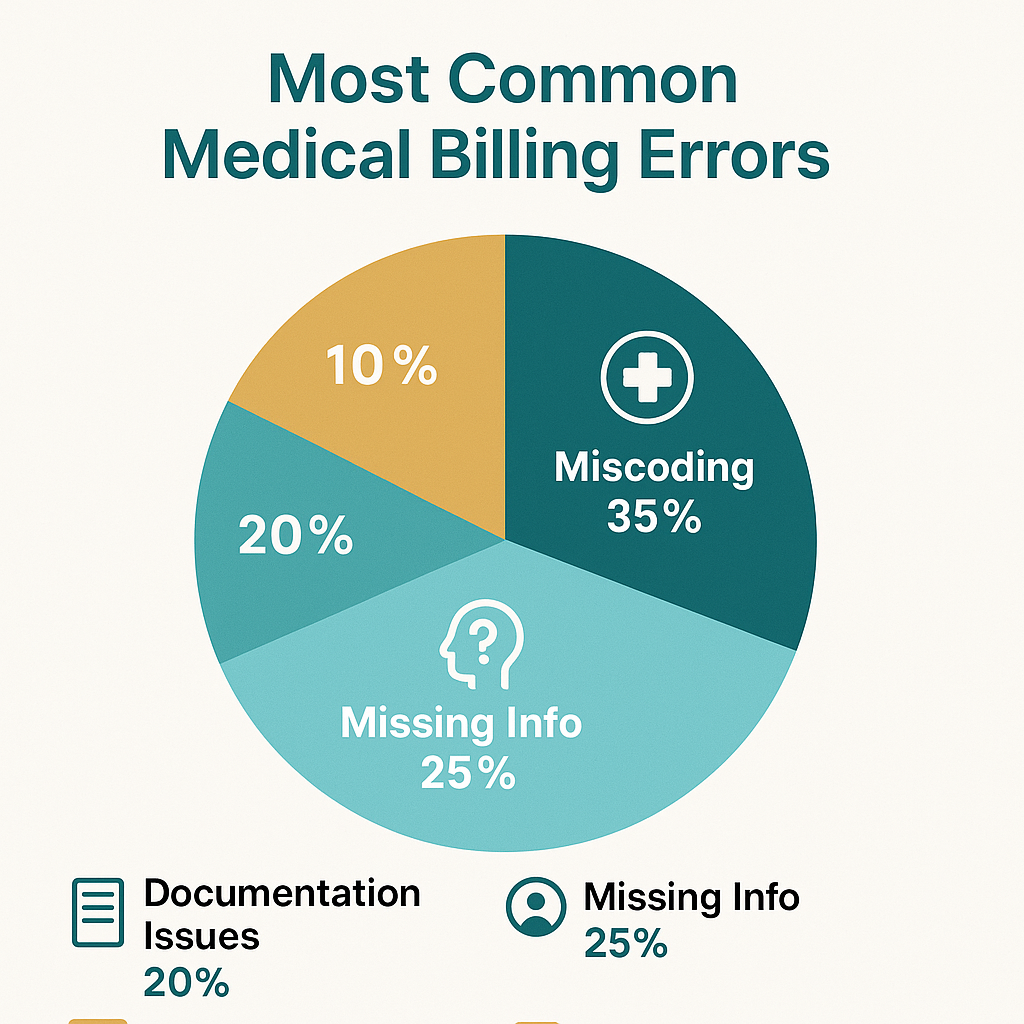

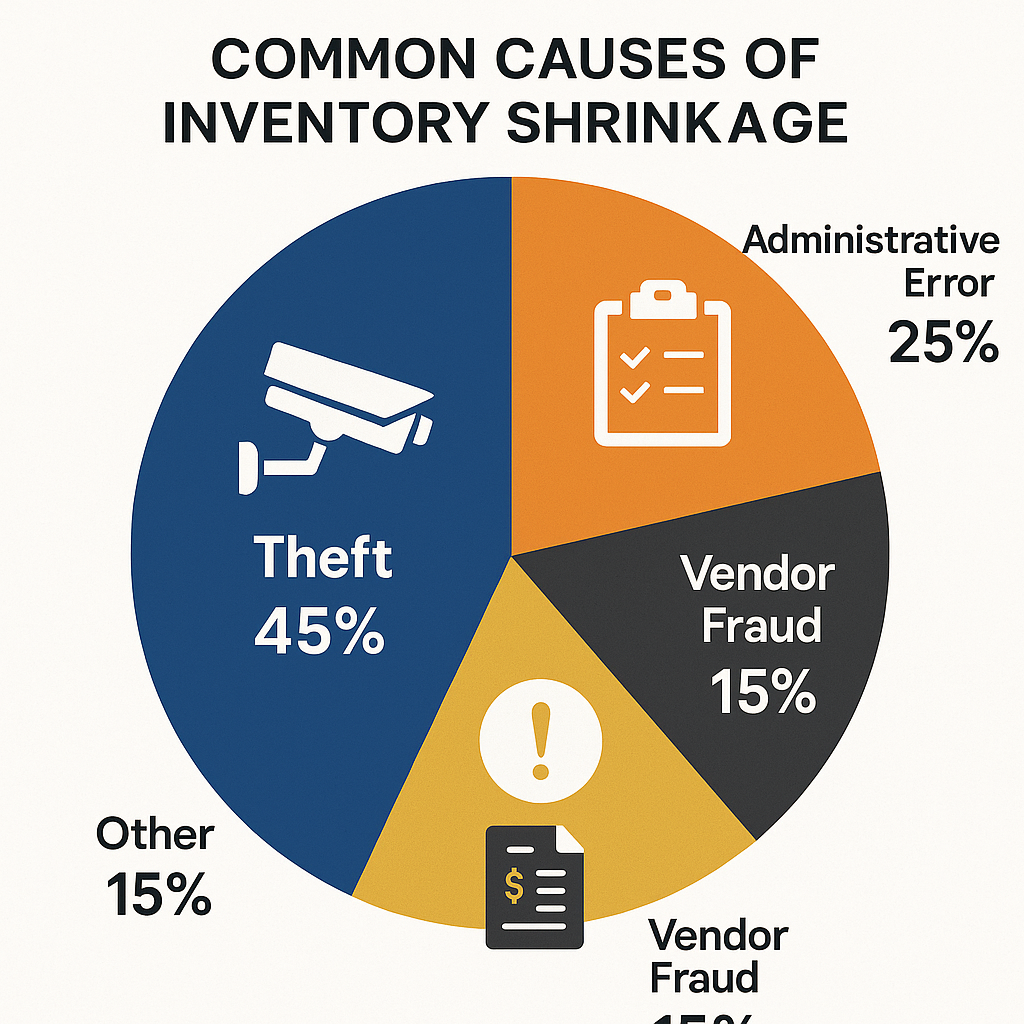

Hidden costs: credit card processing fees, delivery service commissions, waste, shrinkage

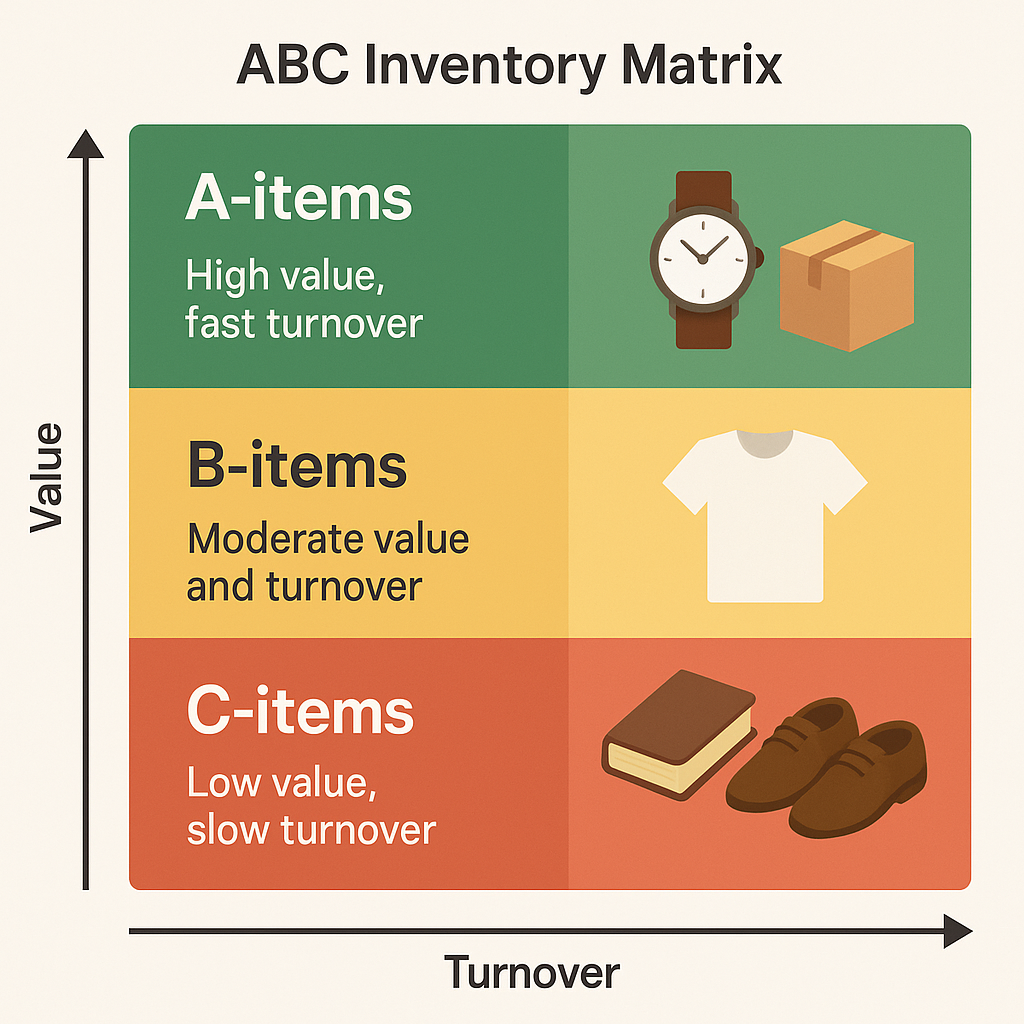

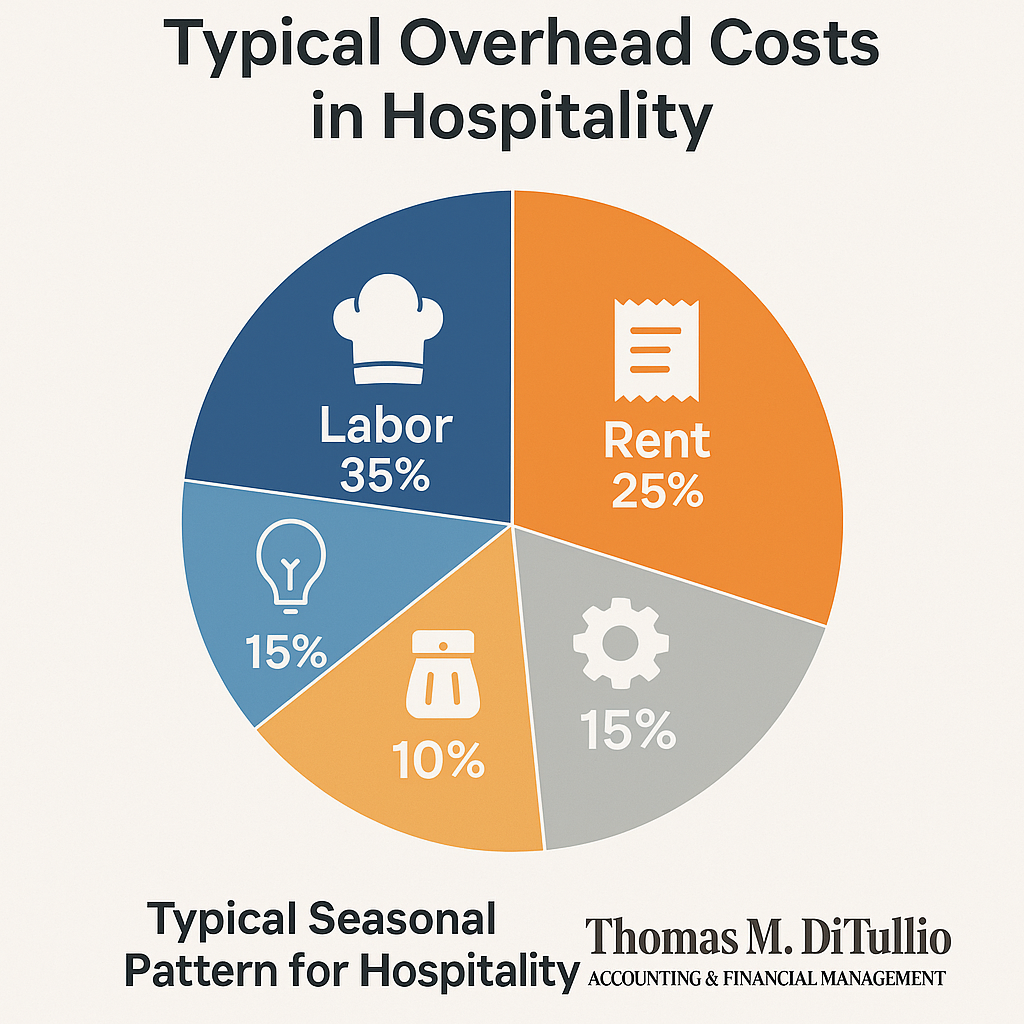

A pie chart showing the typical breakdown of hospitality overhead (Labor 35%, Rent 25%, Utilities 15%, Supplies 10%, Admin 15%)

Step-by-Step Guide to Cutting Overhead Without Cutting Corners

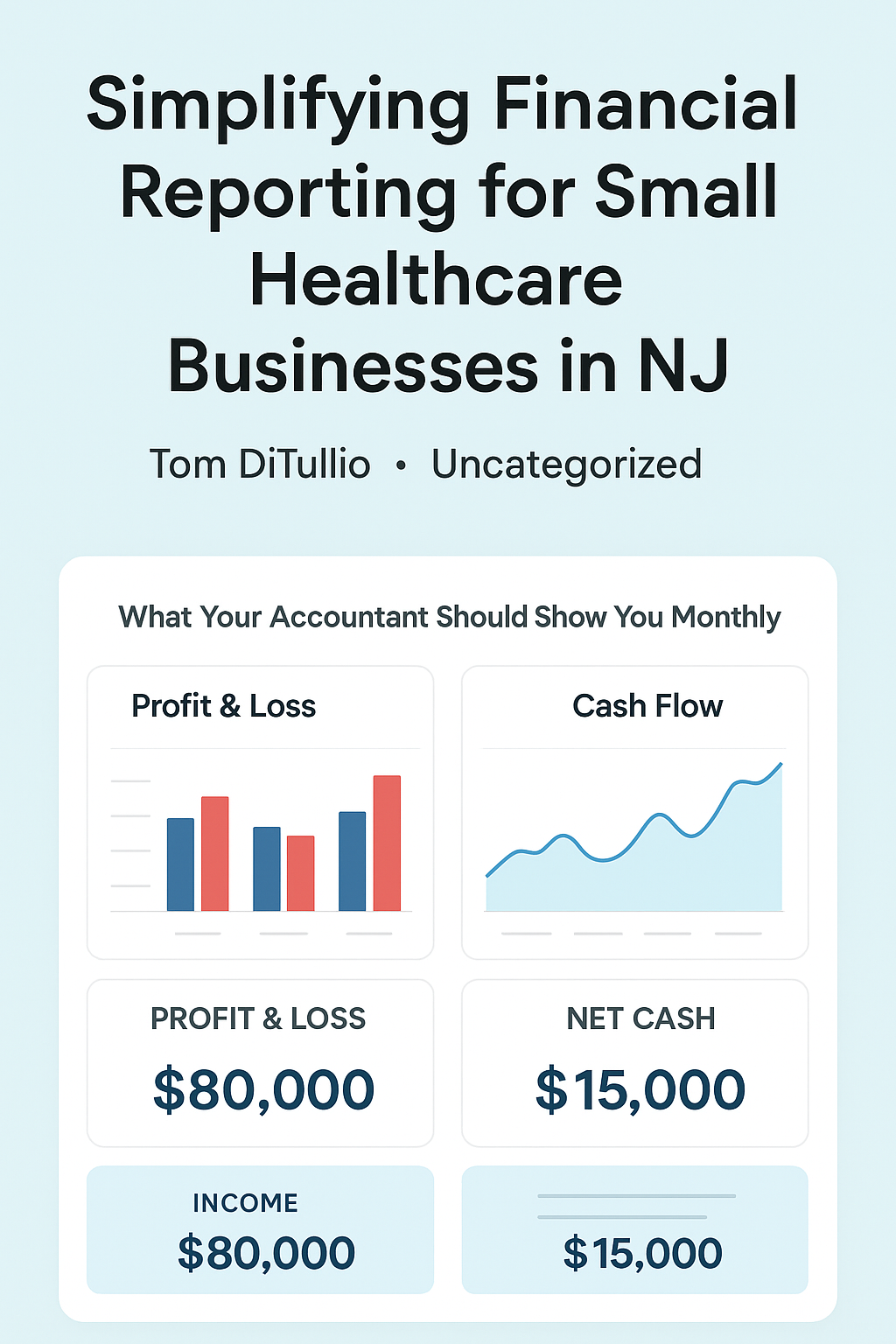

Step 1: Start with a Cost Audit

Think of this as spring cleaning for your finances. Pull your last 3–6 months of P&L statements and start categorizing.

-

Which costs are fixed and which fluctuate?

-

Where are your biggest monthly swings?

-

Are there recurring charges for things you don’t even use anymore?

💡 Pro Tip: A local accountant (like TMD Accounting) can help you spot areas to trim that you may not see on your own.

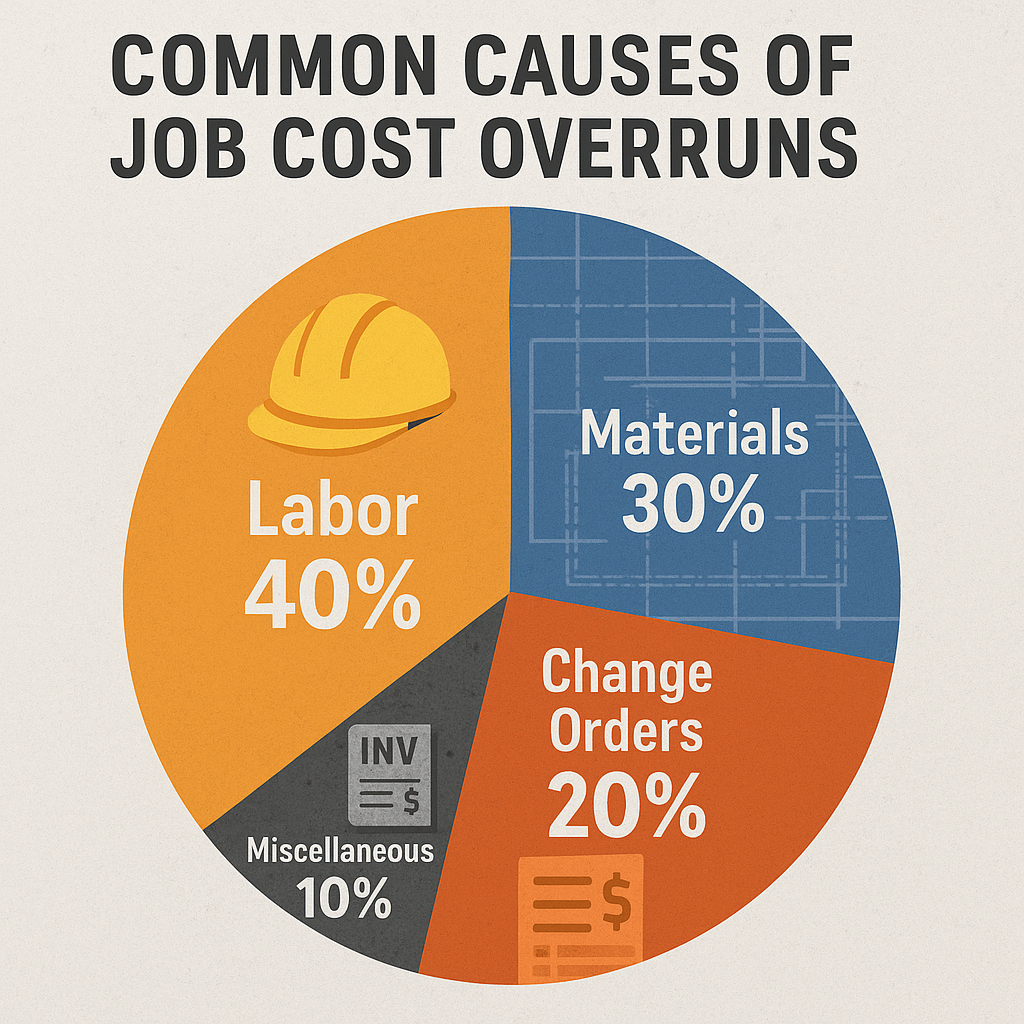

Step 2: Schedule Smarter, Not Harder

Labor is your biggest controllable expense—and often the most emotional one to manage. But overstaffing slow shifts hurts your margins just as much as understaffing busy ones hurts your customer reviews.

Try this:

-

Use apps like 7shifts or Homebase to match staffing to sales trends

-

Cross-train your staff so fewer people can do more

-

Monitor labor as a % of sales weekly (aim for 25–30%)

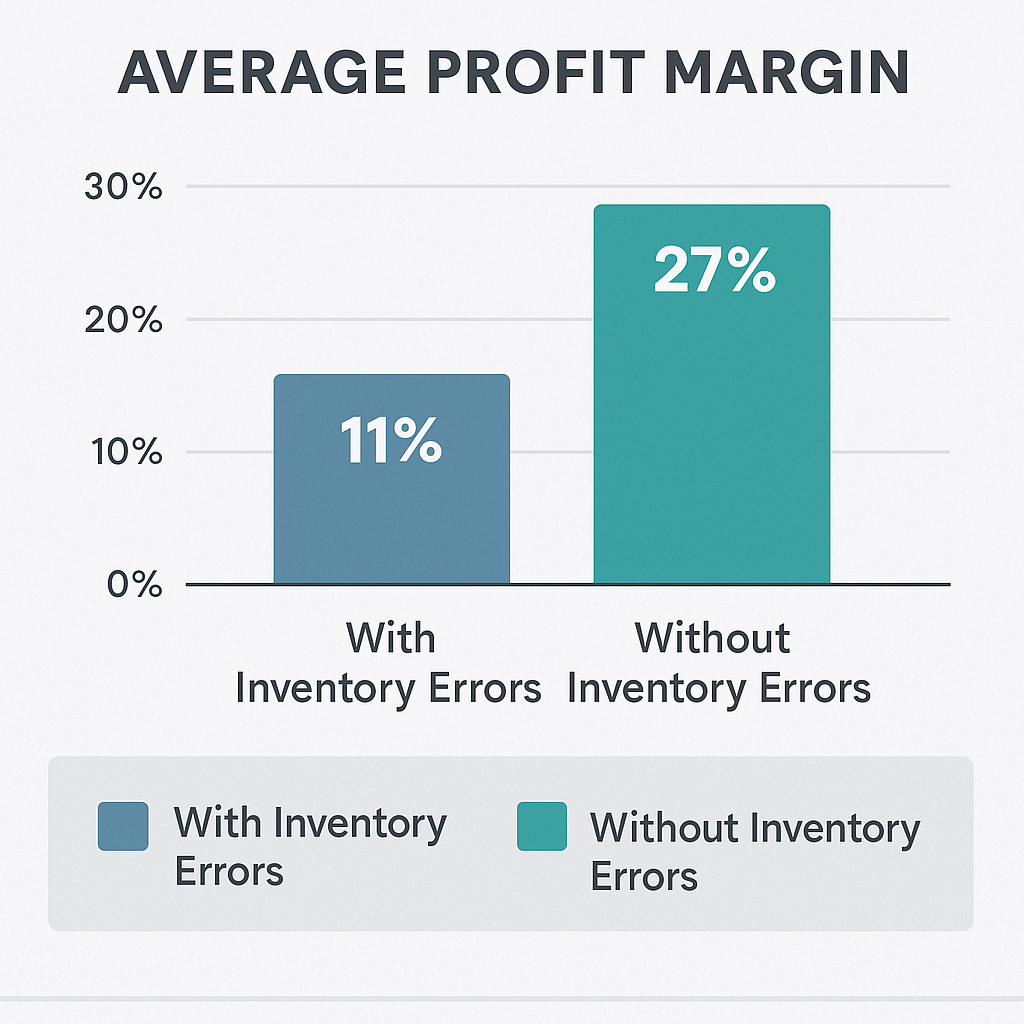

Step 3: Take Control of Inventory

Food waste, liquor shrinkage, and overordering are profit killers—especially when you’re operating on tight margins.

How to fix it:

-

Use inventory tools like MarketMan or Toast Inventory

-

Set par levels to avoid overstocking

-

Monitor COGS weekly, not monthly

-

Run weekly specials using surplus ingredients

Learn how TMD Accounting helps restaurants track COGS

Step 4: Cut Your Utility Costs—Without Freezing Out Customers

Energy is another overhead cost you can influence. Even small changes can lead to big savings over time.

Try:

-

Installing smart thermostats (check for NJ Clean Energy rebates)

-

Switching to LED lighting

-

Using motion sensors in restrooms or back offices

-

Scheduling HVAC maintenance quarterly

🌡️ Local Tip: Gloucester County sees big seasonal swings—program your thermostat accordingly for shoulder seasons when business slows down.

Step 5: Renegotiate with Vendors

Are you still using the same vendors you signed with 5 years ago? It might be time to shop around.

-

Ask suppliers to match or beat competitor rates

-

Join a local restaurant co-op or buying group

-

Consider local sourcing to reduce delivery fees

🛒 Bonus Tip: Revisit your credit card processor, POS provider, and linen service every 12–18 months to renegotiate terms or fees.

Use Tech to Streamline, Not Add Cost

Technology is your ally when used right. The key is picking tools that talk to each other and actually save time.

Top picks:

-

Square for Restaurants: All-in-one POS, payroll, and marketing

-

QuickBooks Online: Real-time accounting and cost tracking

-

7shifts: Staff scheduling + labor forecasting

-

MarketMan: Inventory control + recipe costing

| Platform | Features (POS, Inventory, Payroll, Reporting, Cost Tracking) | Price Tier (Relative) | Best For |

|---|---|---|---|

| Square for Restaurants | POS: ✔️ Inventory: ✔️ (Basic to Advanced) Payroll: ✔️ (Add-on) Reporting: ✔️ Cost Tracking: ✔️ (via POS/Inventory data) |

Low–Medium | All-in-one POS for quick-service restaurants and smaller operations. Includes marketing tools and no long-term contracts. |

| QuickBooks Online | POS: ❌ (Integrates) Inventory: ✔️ (Plus & Advanced plans) Payroll: ✔️ (Add-on) Reporting: ✔️ (Comprehensive) Cost Tracking: ✔️ (Core accounting features) |

Low–Medium | Robust small business accounting, financial reporting, and budgeting. Integrates with various hospitality platforms. |

| 7shifts | POS: ❌ (Integrates) Inventory: ❌ Payroll: ✔️ Reporting: ✔️ (Labor-focused) Cost Tracking: ✔️ (Labor cost tracking) |

Low–Medium | Employee scheduling, time tracking, team messaging, and labor cost insights tailored for restaurants. |

| MarketMan | POS: ❌ (Integrates) Inventory: ✔️ (Core Feature) Payroll: ❌ Reporting: ✔️ (COGS, Profitability) Cost Tracking: ✔️ (Food/COGS, Recipe costing) |

Medium–High | Ideal for restaurants with high inventory turnover. Offers detailed vendor, recipe, and inventory cost control. |

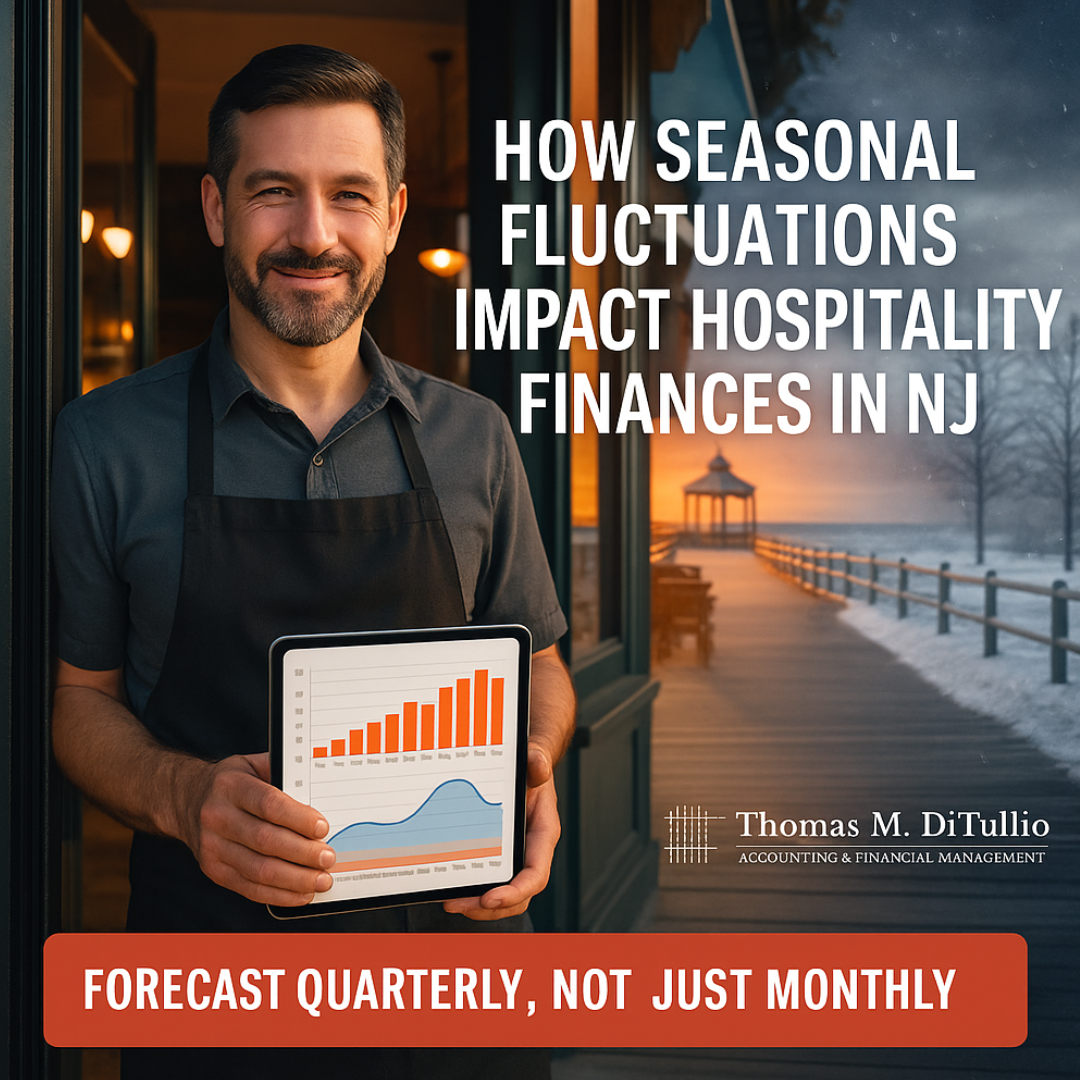

Adapting to Seasonal Trends in South Jersey

Your location matters. A hospitality business in Wildwood has a totally different cost rhythm than one in Woodbury.

What to Do:

-

Adjust staffing for beach season surges (May–Sept)

-

Offer local discounts or themed nights in off-peak months

-

Join town events (e.g., Deptford Harvest Festival or Glassboro Summer Fest) to boost visibility

🏖️ Real Talk: One café in Sewell cut January labor costs by 19% after analyzing past slow-season trends and adjusting hours proactively.

When to Bring in an Expert

Even with the best systems, it can be hard to see your own blind spots. That’s where a hospitality-focused accountant comes in.

TMD Accounting works with restaurants, cafes, and hotels across South Jersey to:

-

Identify hidden overhead drains

-

Set monthly budgets and KPIs

-

Monitor COGS, labor, and vendor costs in real time

See our Hospitality Accounting Services

Final Thoughts: Control Costs, Strengthen Your Business

In a competitive hospitality market, reducing overhead isn’t about cutting corners—it’s about operating smarter. When you get your costs under control, you gain freedom: to pay your team better, invest in new ideas, or simply sleep easier at night.

Want to uncover where your money’s really going and how to keep more of it?

Schedule a free consultation with TMD Accounting—and let’s start trimming the fat without losing your flavor.

❓ Frequently Asked Questions

1. Do I need an accountant if I use accounting software?

Yes—software tracks data, but an accountant ensures compliance, optimizes tax strategies, and helps you interpret your numbers, especially with New Jersey tax regulations.

2. How often should I meet with my accountant?

Quarterly meetings are ideal for most small businesses in Gloucester County to stay proactive about taxes, payroll, and budgeting.

3. What records should I keep for tax time?

Retain receipts, invoices, payroll reports, and bank statements for at least 7 years. This aligns with IRS and New Jersey state audit windows.

4. Are payroll services worth it for small teams?

Absolutely. Even with just one employee, payroll services reduce risk, automate tax filings, and keep you compliant with NJ labor laws.

5. What is the difference between bookkeeping and accounting?

Bookkeeping tracks daily transactions. Accounting interprets them, prepares financial statements, and ensures you’re meeting legal obligations.