Managing Employee Turnover in Retail: Payroll and Financial Implications

When Every Goodbye Costs You More Than You Think

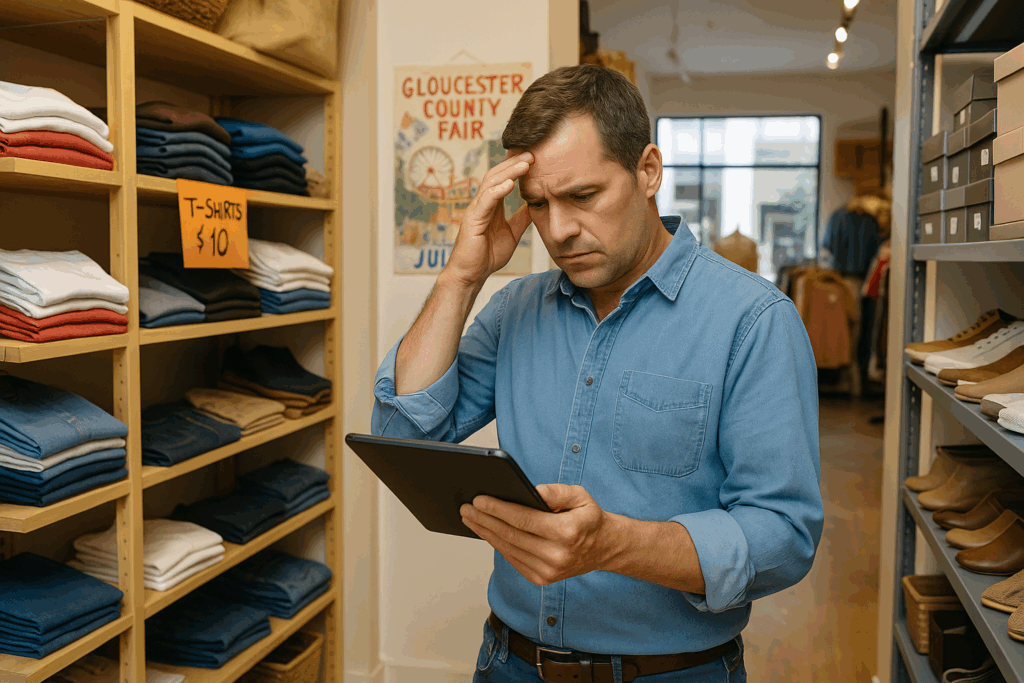

You hire. You train. You hope they stay. And then—just like that—they quit. Retail turnover isn’t just frustrating, it’s expensive. And if you’re a small business owner in South Jersey, especially in Gloucester County, you’ve likely felt the sting more than once.

But the real pain? It’s not just the cost of finding someone new. It’s the payroll chaos, compliance stress, and financial loss that follows each departure.

🔍 Quick Summary

- Retail turnover in South Jersey is costly—often exceeding $3,000 per employee.

- Frequent staff changes disrupt payroll accuracy and compliance.

- Smart scheduling, retention bonuses, and payroll tools reduce financial impact.

- TMD Accounting helps local retailers streamline payroll and minimize hiring disruptions.

The Real Cost of Turnover in Retail

Retail businesses, especially boutiques, gift shops, and seasonal stores, experience some of the highest turnover rates of any industry. While national turnover hovers around 60% for retail, many local businesses report even higher churn during peak seasons.

Let’s break down the impact:

- Hiring Costs: Advertising, interviewing, and onboarding new staff.

- Training Time: Weeks before new hires become productive.

- Overtime: Existing staff pick up extra shifts, increasing payroll.

- Customer Service Impact: Less experienced employees = lost sales.

One South Jersey boutique reported losing over $8,000 in a single quarter due to repeat hiring costs and payroll inefficiencies—without even realizing it.

Why Turnover Hits Retail Payroll So Hard

Hourly Pay + Flexible Scheduling = Payroll Nightmares

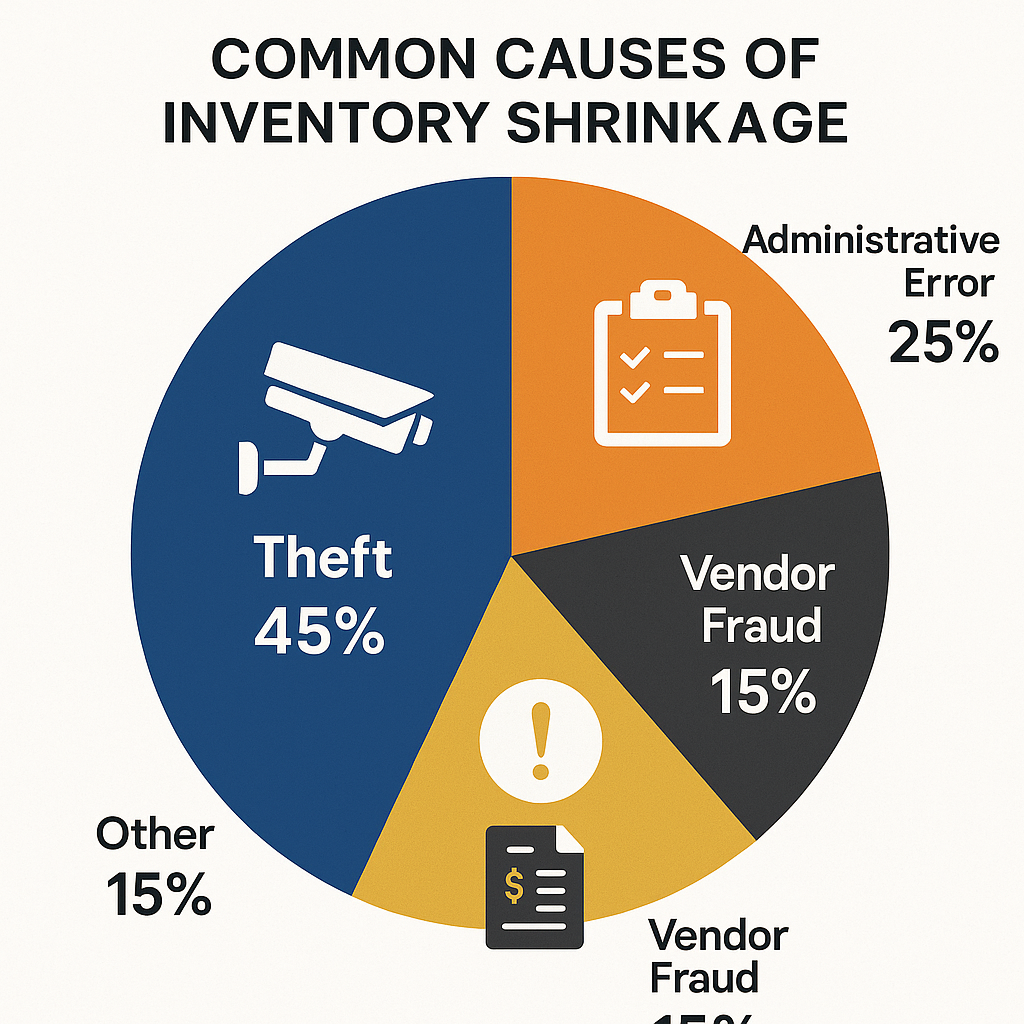

Most retail shops rely on flexible part-time help. That creates fluctuating schedules, last-minute changes, and mistakes in payroll entries—especially when staff are leaving and joining frequently.

Compliance Traps with Termination

Did you know NJ requires timely final paychecks? Miss that window, and you could face legal penalties. And if a terminated employee disputes their hours or overtime, unclear records could cost you even more.

That’s why a structured payroll system is essential.

Calculating Your Turnover Cost

Here’s how it adds up:

- Cost to Hire (per person):

$500–$1,500 (advertising, interviews, background checks) - Training Cost:

$1,000+ in manager time and lost productivity - Payroll Impact:

Overtime, incorrect pay, payroll adjustments = $500–$1,000 - Revenue Loss:

Missed sales, lower conversion rates from inexperienced staff

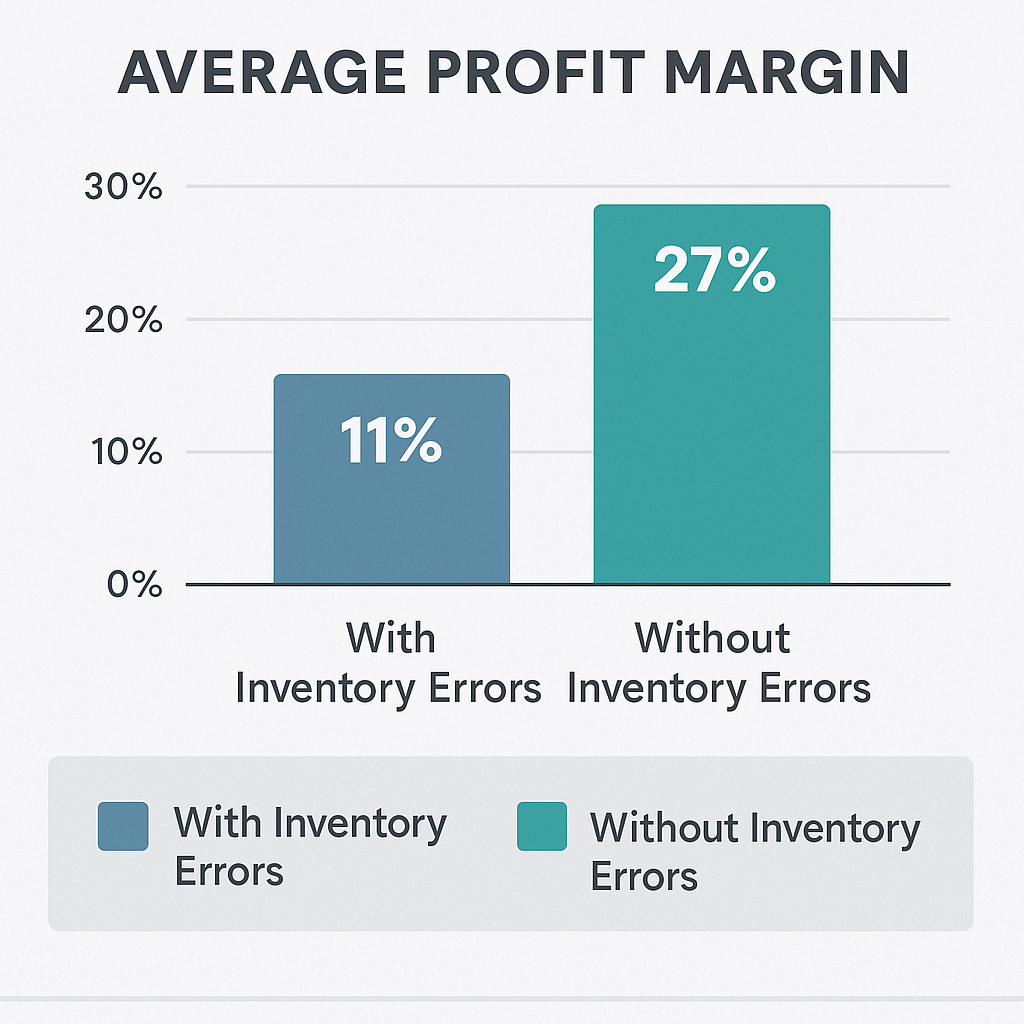

The true cost of one departure can easily exceed $3,000+—even for a part-time role.

Financial Strategies to Minimize Turnover Cost

🧠 Smart Scheduling = Smarter Payroll

Use tools like Square, Homebase, or Gusto to integrate scheduling with payroll. Automate shift changes and hours worked to reduce errors.

Need help syncing systems? TMD can help with implementation.

🎯 Retention Starts With Recognition

Offer small bonuses, end-of-season rewards, or even a shoutout board to retain staff longer. A $100 gift card may save $1,000 in turnover cost.

🤝 Work With a Payroll Partner

A good payroll partner can:

- Issue compliant termination paychecks

- Prevent under/overpayments

- Track PTO and hours seamlessly

- Alert you to payroll red flags early

Explore TMD’s payroll services for South Jersey retailers.

Local Success Story: A Boutique in Turnersville

After seeing 40% staff turnover during the holidays, this boutique owner turned to TMD. We helped:

- Set up automated time tracking

- Create a clear new-hire onboarding system

- Streamline payroll with direct deposit and PTO tracking

Result? Turnover dropped by 30%, payroll errors vanished, and the owner finally had peace of mind—and time to grow.

The Bottom Line: Don’t Let Turnover Drain Your Business

Turnover is part of retail. But it doesn’t have to be a financial nightmare.

At TMD Accounting, we work with retailers across Gloucester County to reduce payroll errors, simplify hiring transitions, and reclaim profitability—even during your busiest seasons.

👚 Retail payroll feels chaotic? Turnover out of control?

🧾 Book your free payroll and turnover review with TMD Accounting today and take back control of your business’s finances.

❓ Frequently Asked Questions

1. Why is employee turnover so high in retail?

Flexible schedules, part-time roles, and seasonal work contribute to frequent changes in staff, especially in small shops and boutiques.

2. How much does one retail employee turnover really cost?

Factoring in hiring, training, payroll errors, and lost sales, one departure can exceed $3,000 in losses.

3. What payroll problems does high turnover cause?

Inaccurate hours, late final paychecks, and compliance issues with NJ laws are common risks.

4. Can technology help reduce payroll stress?

Yes—tools like Homebase and Gusto automate scheduling, integrate payroll, and reduce manual errors.

5. How can TMD Accounting help with retail payroll?

TMD offers payroll setup, compliance support, automated tracking, and customized onboarding tools for South Jersey retailers.