Is Your Business Bleeding Money? The Hidden Accounting Errors You Might Be Making

🔹 Introduction

You’re doing everything right—serving customers, growing your team, and staying afloat in a tough economy. But something’s off. The profits you expected aren’t showing up. If you’ve ever asked yourself, “Where’s all the money going?”, you’re not alone.

🔍 Quick Summary

- Many small businesses in South Jersey are unknowingly losing money due to hidden accounting mistakes.

- Common errors include misclassified expenses, missed reconciliations, and overlooked deductions.

- These mistakes lead to increased taxes, poor cash flow, and lost growth opportunities.

- TMD Accounting helps identify and fix these issues—saving businesses thousands each year.

Many South Jersey small business owners are unknowingly losing thousands each year to avoidable accounting errors. These hidden pitfalls in your books—misclassified expenses, outdated reconciliations, or overlooked deductions—could be draining your finances faster than you realize. And unless you fix them, your business might be bleeding money silently.

🔹 The High Cost of Small Errors

Even minor mistakes in accounting can snowball into serious financial trouble. A Gloucester County café owner once discovered their part-time staff was incorrectly classified as independent contractors. That one slip cost them over $7,000 in back taxes and penalties.

How One Missed Entry Can Snowball

- A single duplicate expense entry can inflate your costs and hurt your bottom line.

- Overreported income due to incorrect invoicing might mean paying more in taxes than necessary.

- Mislabeling vendor payments can lead to audit risks—and we all know how stressful that can be.

Case Study: Gloucester County Retailer’s Overlooked Expense

A Turnersville retailer failed to record monthly credit card processing fees—amounting to over $1,800 per year. Once identified and corrected, their year-end tax liability dropped, freeing up funds for new inventory.

🔹 Top Hidden Accounting Errors Small Businesses Make

Whether you’re managing your books yourself or relying on basic software, these common accounting errors can creep in unnoticed:

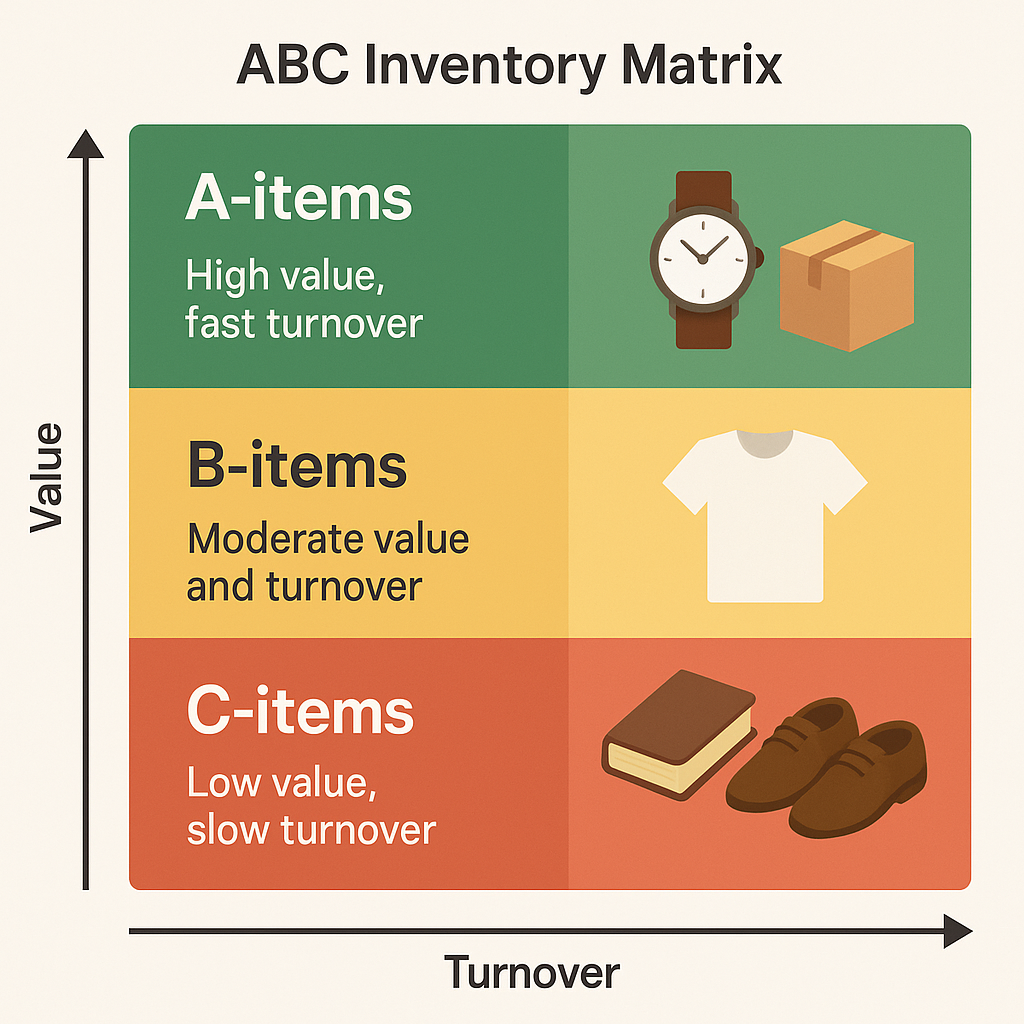

Misclassified Expenses

- Personal meals logged as business dining.

- Equipment labeled as office supplies instead of capital assets.

Failing to Reconcile Accounts Monthly

- Missed bank charges and deposits.

- Duplicate entries or bounced checks not reflected in the books.

Overlooked Tax Deductions

- Home office use

- Mileage for client meetings

- Health insurance premiums for self-employed individuals

Hiring a local bookkeeping expert can help you avoid these mistakes and even uncover deductions you’re entitled to. Looking for the best bookkeeping services near me? South Jersey has trusted professionals like TMD Accounting ready to help.

🔹 How These Errors Bleed Your Budget

Unchecked errors lead to real financial pain:

Increased Tax Liabilities

- Errors inflate income or underreport expenses, meaning you pay more.

Missed Growth Opportunities

- Misstated profits could mislead you into underinvesting in your business.

Damaged Cash Flow

- Late vendor payments from bad data can harm relationships and lead to penalties.

When you book your consultation with a tax and accounting professional, you gain insight into how to fix these leaks and rebuild trust in your financials.

🔹 Local Businesses Are at Higher Risk — Here’s Why

DIY Bookkeeping Challenges in South Jersey

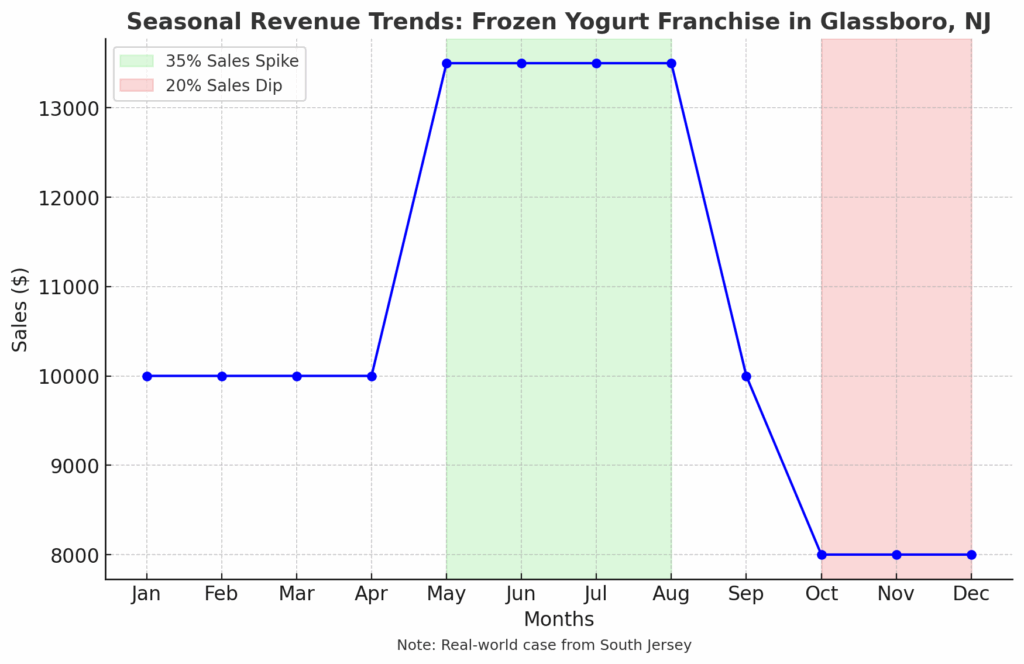

Many small business owners in towns like Glassboro or Williamstown manage their books themselves—often without formal training. The tools may be user-friendly, but one wrong click can create a ripple effect.

Limited Access to Experienced Accountants

Larger cities may have more firms, but in Gloucester County, quality local options like TMD Accounting make the difference between barely getting by and thriving.

🔹 How to Catch and Correct These Mistakes

You can start cleaning up your books with a simple three-step system:

- Create a monthly reconciliation checklist

Match every bank statement with your bookkeeping entries. - Use accounting software properly

Tools like QuickBooks or Wave can help—but only when set up correctly. - Get a second set of eyes

A professional review every quarter can reveal issues you missed.

Thinking about outsourcing? You can hire a bookkeeping expert today to bring accuracy and peace of mind back to your business.

🔹 Tools and Resources Every NJ Business Should Use

Recommended Software

- QuickBooks Online: Ideal for real-time cash flow monitoring.

- Gusto: Simplifies payroll, reducing misclassification risk.

- Bench: For hands-off monthly bookkeeping.

Free IRS and NJ Tax Tools

- IRS Withholding Estimator

- NJ Division of Taxation Forms & Publications

TMD Accounting’s Local Support

Tap into tailored services with TMD Accounting’s payroll solutions or small business tax planning. Trusted by South Jersey for over 30 years.

🔹 Conclusion

Your business doesn’t need to bleed money due to fixable accounting issues. From overlooked expenses to tax-time mistakes, these errors are common—but completely avoidable. You deserve to feel confident, in control, and financially stable.

Get your personalized financial review now with Gloucester County’s trusted accountants. Book your free consultation with TMD Accounting and start saving money where it matters most.

❓ Frequently Asked Questions

1. What are common accounting errors small businesses make?

Misclassifying expenses, failing to reconcile accounts monthly, and overlooking tax deductions are frequent and costly mistakes.

2. Can a small error really cost that much?

Yes—misclassifying workers or missing vendor charges can lead to thousands in penalties or overpaid taxes.

3. How do I know if my books are accurate?

Regular reconciliations, audits, and working with a professional bookkeeper help ensure accuracy.

4. What tools can help prevent these errors?

QuickBooks, Gusto, and Bench are top tools for automating payroll, expense tracking, and monthly reconciliation.

5. How does TMD Accounting help fix these problems?

We perform detailed financial reviews, correct misclassifications, and create systems to prevent future errors—backed by 30+ years in South Jersey.