Why Medical Practices Struggle with Cash Flow and How to Fix It

Introduction

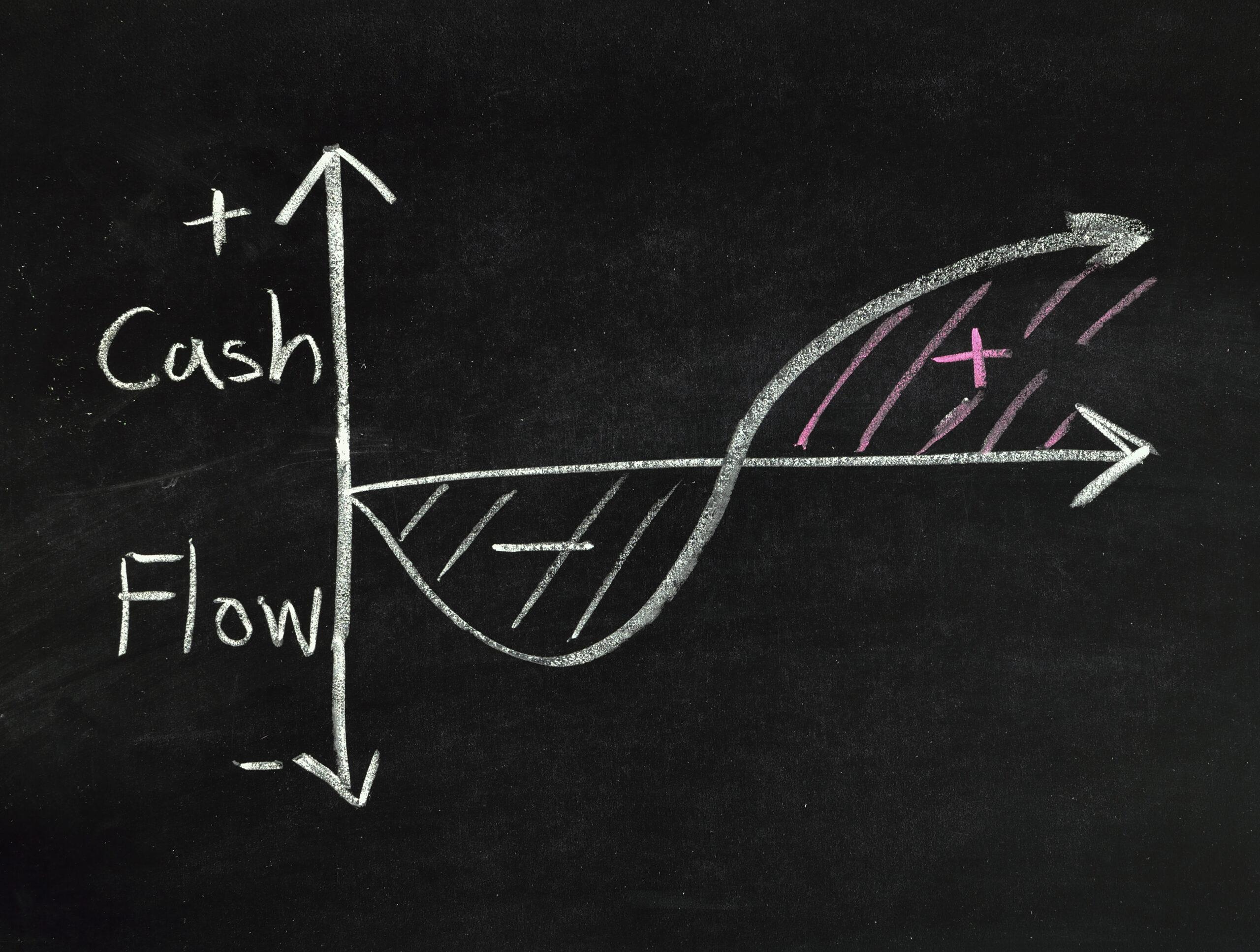

You’ve got a fully booked calendar, dedicated staff, and a waiting room filled with patients. So why does your practice’s bank account still feel… empty?

If you’re running a medical practice in South Jersey or anywhere across New Jersey, chances are you’ve felt this disconnect: working hard without seeing consistent financial results. You’re not alone. Many providers deliver excellent care but face ongoing challenges when it comes to managing their medical practice cash flow.

In this guide, we’ll unpack why cash flow issues are so common in healthcare—and more importantly, how to fix them. With the right systems, insights, and support, your practice can become financially healthy without sacrificing patient care.

The Unique Cash Flow Challenges of Medical Practices

The Unique Cash Flow Challenges of Medical Practices

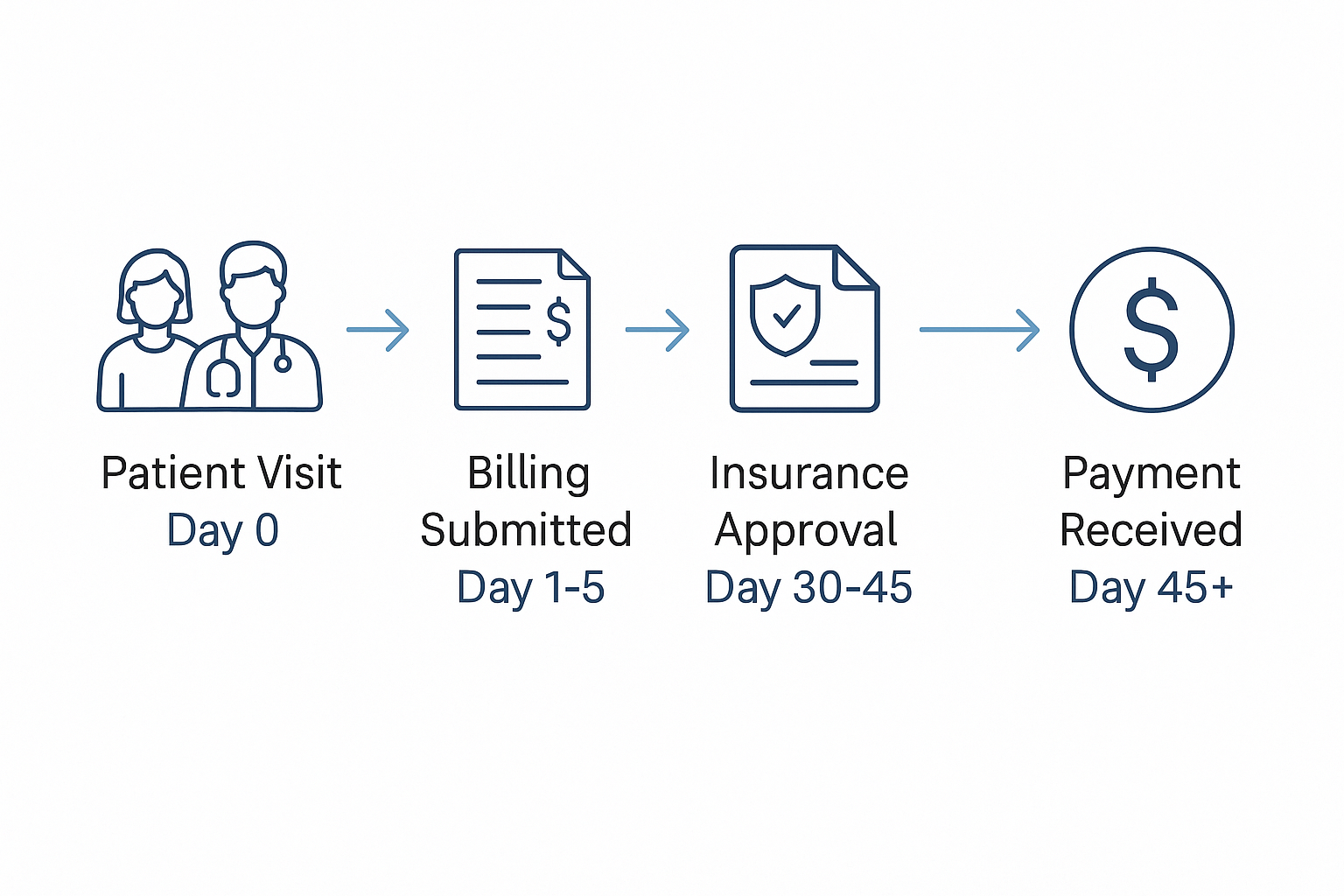

Delay Between Service and Payment

Unlike most industries, medical practices don’t get paid at the point of sale. Insurance claims can take 30, 60, or even 90 days to process—and that’s if everything is coded and submitted correctly. Add in patient co-pays, high-deductible plans, or uncollected balances, and cash flow becomes a waiting game.

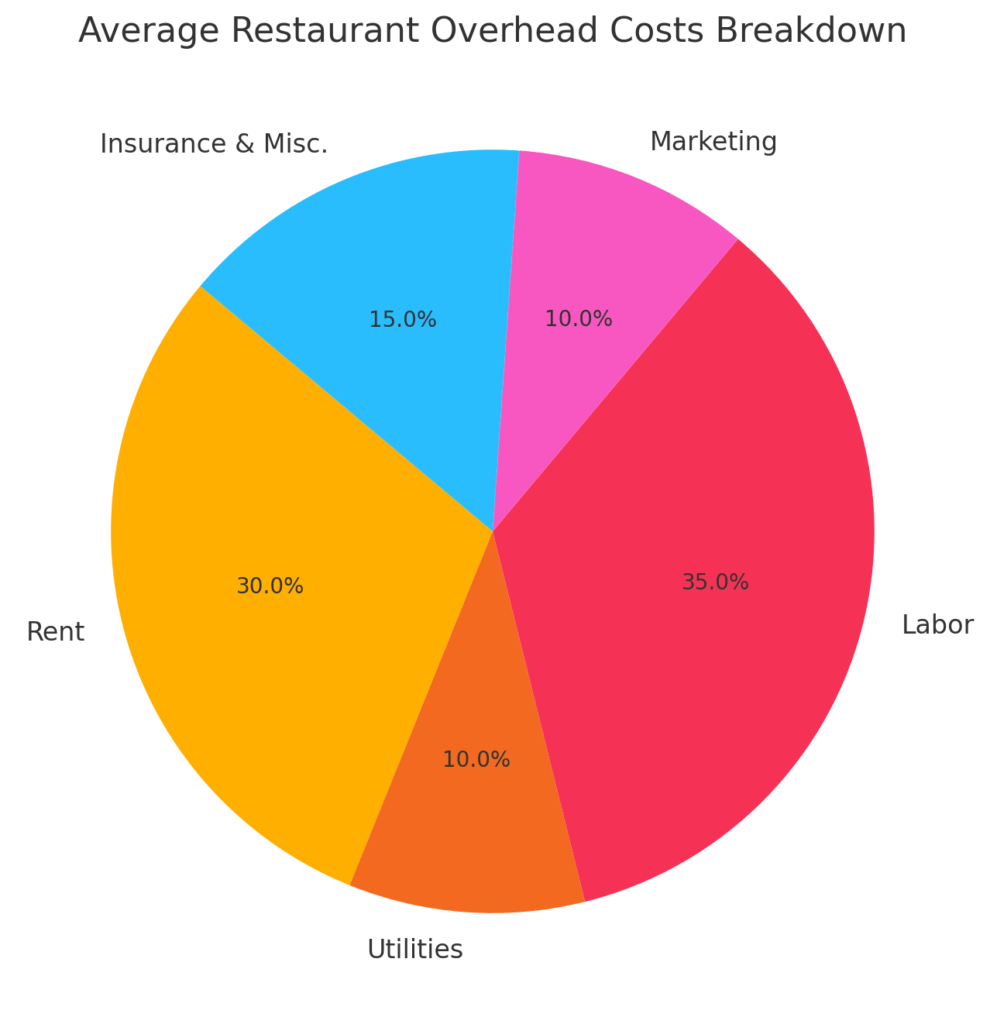

High Overhead and Fixed Costs

Every day your doors are open, you’re incurring costs: salaries, rent, utilities, equipment leases, and malpractice insurance. These costs don’t pause when reimbursements are delayed or appointments cancel.

The challenge? Your expenses are immediate, but your income is delayed.

Inefficient Billing and Collections

Many small practices rely on outdated or manual billing systems. Denied claims may go unnoticed. Patient balances may fall through the cracks. Without strong follow-up processes, you’re leaving money on the table.

Common Cash Flow Mistakes in Healthcare

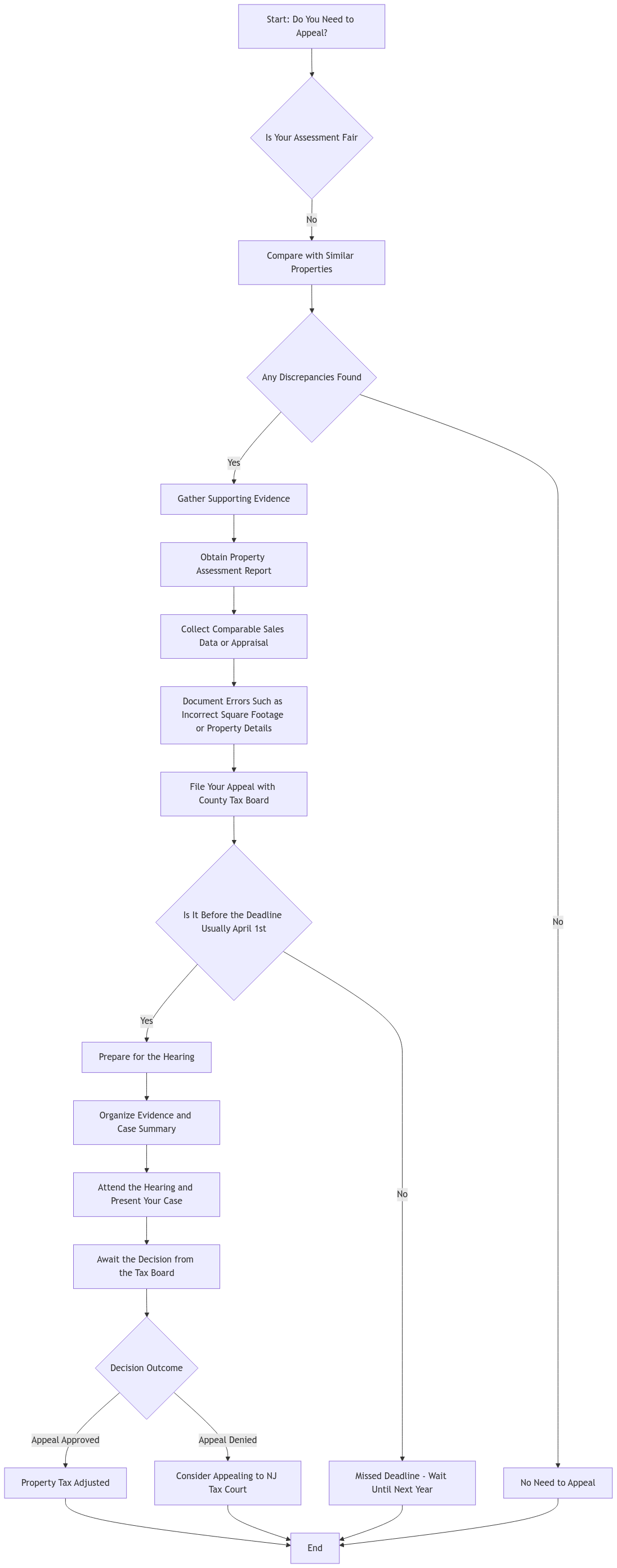

Poor Revenue Cycle Management (RCM)

Revenue cycle management isn’t just about billing—it’s everything from insurance verification to collections. And when any link in that chain breaks, so does your cash flow.

Common RCM pitfalls:

- Staff not verifying coverage at check-in

- Coding errors that delay claim approvals

- No system for following up on denied claims

Not Tracking KPIs Like Days in A/R

Days in accounts receivable (A/R) is a crucial cash flow metric. It tells you how long it takes, on average, to get paid. If your number is over 40–50 days, you’re likely experiencing cash flow stress.

Other key KPIs to monitor:

- Net collection rate

- First-pass resolution rate

- Patient no-show rate

Dashboard mock-up with KPI metrics

Lack of Budgeting and Forecasting

If you’re not projecting your income and expenses quarterly, you’re flying blind. Without forecasting, it’s hard to prepare for:

- Slow seasons (e.g., holidays)

- Large purchases (e.g., equipment upgrades)

- Staffing needs or unexpected changes

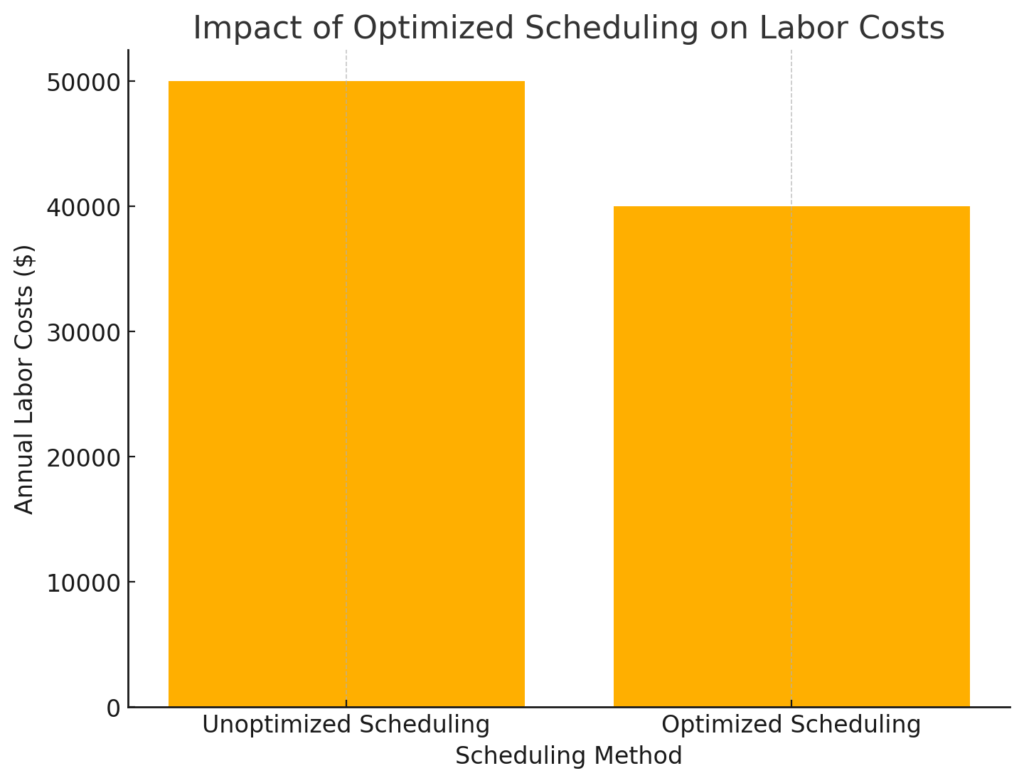

How to Improve Cash Flow in Your Medical Practice

Streamline the Billing Process

Automate wherever possible. Integrated billing tools within your Electronic Health Record (EHR) system can help ensure accuracy and speed.

Steps to improve billing:

- Use eligibility verification tools before appointments

- Automate charge capture and coding

- Implement real-time claim edits to reduce denials

Offer Clear and Flexible Patient Payment Options

Patients today expect convenience. Offering flexible payment options increases the likelihood you’ll collect balances sooner.

Ideas to try:

- Secure card-on-file systems

- Online payment portals

- Payment plans for high deductibles

Monitor Financial KPIs Monthly

Create a dashboard or spreadsheet to track cash flow-related KPIs, such as:

- Days in A/R

- Net collections

- Unpaid patient balances

- Average revenue per visit

Bonus: Share insights with your staff—especially front desk and billing teams—to build accountability and improvement.

Forecast Cash Flow Quarterly

Use simple cash flow models to estimate:

- Incoming reimbursements

- Outgoing expenses

- Gaps where you may need financing or payment adjustments

Accounting for Small Healthcare Practices

Partnering with Financial Experts Who Understand Healthcare

Why a Healthcare-Focused Accountant Matters

General accountants may not understand CPT codes, denial trends, or Medicare compliance—but a specialized healthcare accountant does. They can:

- Set up cash flow-friendly systems

- Advise on tax deductions for medical equipment

- Identify profit leaks in operations

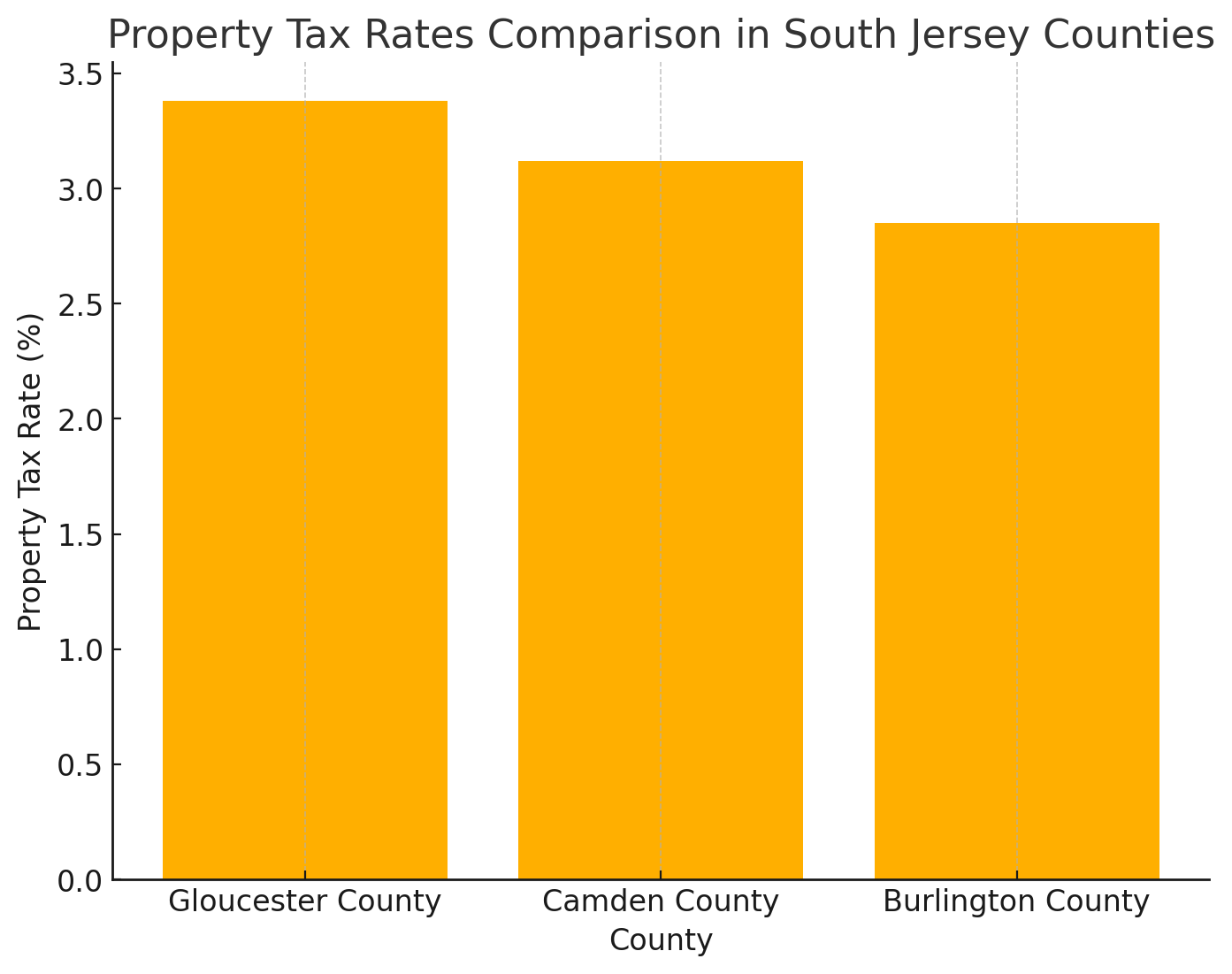

How TMD Accounting Supports Medical Practices in South Jersey

How TMD Accounting Supports Medical Practices in South Jersey

We help practices across Gloucester County and beyond:

- Forecast and stabilize cash flow

- Track patient revenue vs. insurance collections

- Align bookkeeping with compliance and growth goals

📍 Internal Link: Contact TMD Accounting for Healthcare Cash Flow Help

Conclusion: Turn the Financial Health of Your Practice Around

Cash flow challenges can feel overwhelming—but they’re fixable. With the right technology, consistent tracking, and the guidance of a healthcare-savvy accountant, your practice can finally enjoy financial peace of mind.

Imagine being able to pay staff, invest in new equipment, and grow your patient base—without constantly watching your bank account. That future is possible.

🎯 Ready to boost the financial health of your practice?

Schedule a consultation with TMD Accounting and discover how we can help your New Jersey healthcare business thrive.