How to Pay Yourself From an LLC

When you have an LLC (limited liability company), paying yourself can be complicated. How you take out money will depend on whether you are a multi-member, single-member, or corporation LLC. Here is how you can pay yourself through an LLC and make sure those earnings meet the IRS guidelines.

What Is an LLC?

An LLC is a business structure that combines the features of a sole proprietorship and corporation. Like a corporation, LLCs have limited protection against personal liability and debt. You will report business profits and losses on a personal tax return rather than a business one. There are three types of LLCs: single-member, multi-member, and corporate.

Single-member LLCs will have only one member. The IRS views single-member LLCs in the same way as sole proprietorships for tax purposes. Multi-member LLCs have more than one member. For tax purposes, the IRS treats these LLCs as a partnership.

Finally, there are corporate LLCs. In these situations, the LLCs are taxed as a corporation. If you want to establish your business as a corporate LLC, you must make a formal request to the IRS.

How LLCs Are Taxed

There are different ways that the IRS taxes an LLC. If you have an LLC, you will want to work with a company that specializes in small business accounting services. They can help simplify the process as your tax situation becomes more complex with an LLC.

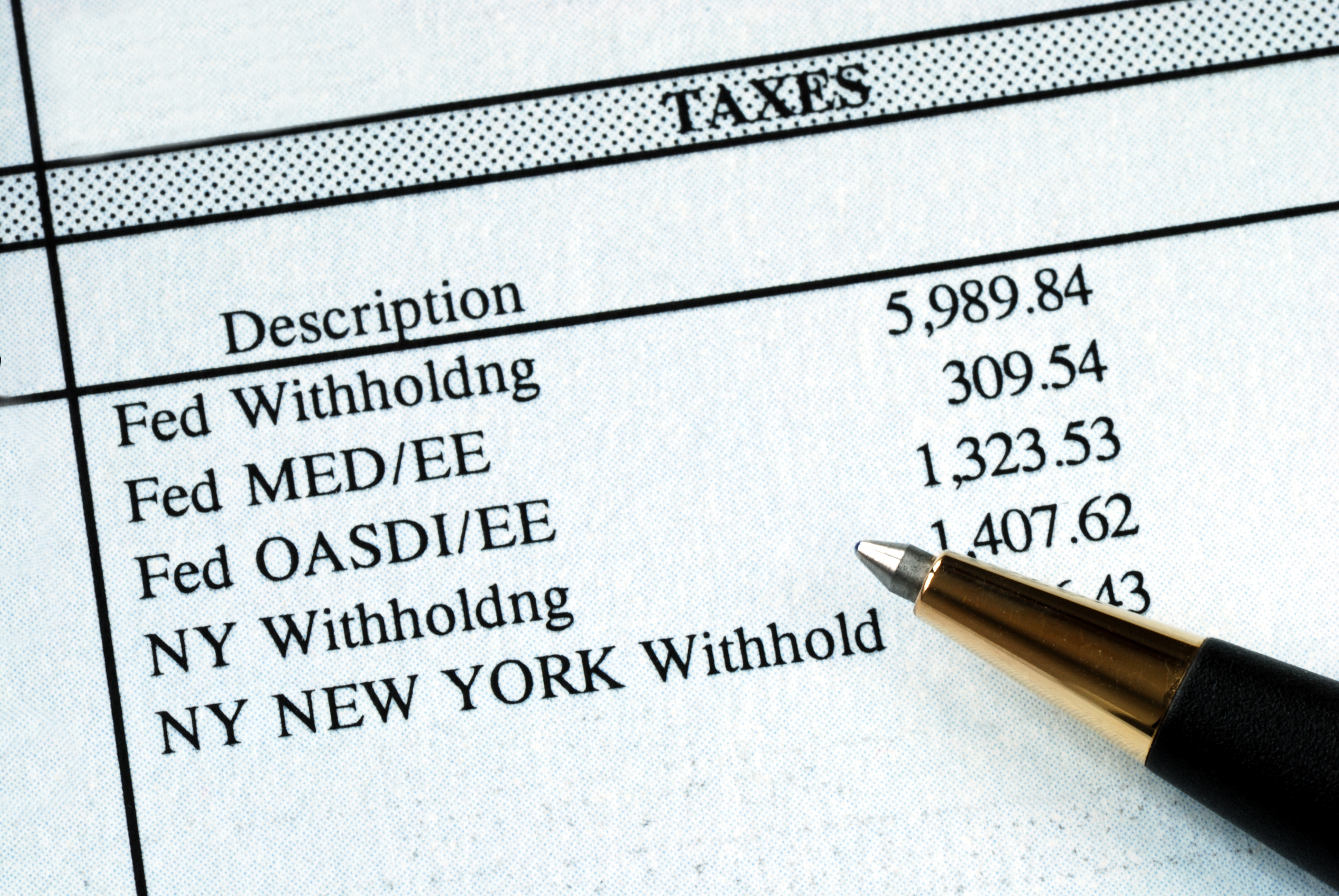

Sole proprietorships and single-member LLCs are considered “disregarded entities.” That means the company’s losses, profits, deductions, and other financial information are reported on a Schedule C with a personal tax return.

Multi-member LLCs are a bit different. These partnerships do not file separate tax returns. Instead, they file a return with Form 1065 or Schedule K-1. These forms detail each member’s guaranteed payments and distributions for the year.

After that, the members will report their income with a K-1 on Schedule E for the tax return. Plus, they must report all self-employment tax on Schedule SE. Single- or multi-member LLCs do not pay corporate taxes. Keep in mind that single owners and LLC members are responsible for income tax on the company’s income. Along with that, they must pay a self-employment tax on their withdrawals for the year.

If the LLC is a corporation, the business must file Form 1120. All of the standard corporate tax rules apply. If the LLCs have elected to be considered an S corporation, all owners must report their portion of the corporate income, and the company needs to file Form 1120S.

Taxes can be tricky for LLCs. Some of the rules are different depending on your LLC structure. While you can use software to figure out your taxes, consider hiring a professional accountant for the job. With their help, you can make sure you pay the right amount of taxes for your LLC.

How You Pay Yourself as an LLC

The business structure of your LLC will determine how you can pay yourself. Even if you are an employee of your business, you need to find the proper way to pay yourself to avoid tax liabilities.

Single-member LLCs will function as sole proprietorships. According to the IRS, these companies are considered a “pass-through” business, which means the income “passes through” the partnership to be taxed under the owner’s personal income tax. As a result, an owner of a single-member LLC or sole proprietorships can pay themselves using the owner’s draw method. With that, you write a check from your LLC to your personal account.

The pass-through designation also extends to multi-member LLCs. According to each partner’s ownership percentage, all partners are taxed on the LLC’s income. In some cases, the partners will receive an owner’s draw. That income is considered a prepayment for profit distribution, and these draws can happen at the end of the quarter or year.

Other owners prefer a steady salary and will take a guaranteed payment. These payments are paid out even if the business has income loss. Guaranteed payments are considered business expenses, and they will increase the company’s net income. Multi-member LLCs will pay their members with owner’s draw, guaranteed payments, or a combination of these options. Once again, an owner’s draw is simply writing a check. The owner’s draw payments are subject to the self-employment tax.

Some LLCs have elected to be treated as an S corporation or C corporation. In those situations, the payout can be more complicated. With these tax classifications, the owners cannot take an owner’s draw, and they must be treated as an employee of the LLC. The owner-employee must receive reasonable compensation. You must issue all payments through a payroll system that withholds employee taxes. Along with that, the owner-employee can take a dividend or distribution of the company’s yearly profit. Those payments are considered taxable income.

Guidelines for Paying Yourself

While you might want to forgo paying yourself to help the business grow, you will still be taxed on the total amount of business income. Remember to pay yourself. You want to follow some basic guidelines when forming your payment structure.

If you have a partnership, always establish a guarantee payment amount or dividend schedule for the other members. You can set this up using your articles of corporation or partnership agreement.

You will want to work with an accountant to figure out your estimated tax payments. Ensure there is always a paper trail for your payments, whether guaranteed payment or owner’s draw. Record the payments in your company’s books so that you are protected in the event of an audit.

Understand Payouts for Your LLC Situation

As you can tell, LLCs do protect you from debts and liabilities, but they can lead to complications for tax time. At TMD Accounting, we can ensure your small business is covered for tax season. We have over 40 years of experience helping small and large companies with their taxes, payroll, and bookkeeping. When you need an accountant for your business in South Jersey, schedule a consultation by calling 856-228-2205.