Running a small business comes with numerous challenges, and one area that often proves to be a hurdle for entrepreneurs is bookkeeping. Small business owners often lack the necessary experience and knowledge to manage their financial records effectively, leading to inaccuracies and potential compliance issues. However, there is a solution to this problem. You need to hire a local bookkeeping service. Learn more about the importance of bookkeeping services and discover how they can help with these essential tasks.

What Are Bookkeeping Services?

Businesses can rely on bookkeeping services to maintain accurate and organized financial records. These services handle everything from:

- Recording and categorizing financial transactions

- Managing accounts receivable and payable

- Reconciling bank statements

- Generating financial reports

Outsourcing these tasks to a professional bookkeeping service allows owners to focus on other aspects of the business while ensuring their financial records are in good hands.

What Are Key Bookkeeping Tasks?

Bookkeeping involves several key tasks that contribute to the overall financial health of a business. Several crucial bookkeeping tasks must be carried out to achieve effective record-keeping and financial management. These essential tasks include:

Recording Financial Transactions

Bookkeeping is founded on the accurate recording of financial transactions. This practice involves capturing information about sales, purchases, expenses, and payments, which bookkeepers ensure are properly documented, categorized, and entered into the accounting system. By maintaining a comprehensive record of transactions, businesses can easily track their financial activities and have a clear audit trail for reference.

Accurately recording financial transactions is crucial for numerous reasons. It enables businesses to monitor their revenue and expenses, assess profitability, and make informed decisions about resource allocation. Additionally, companies with a detailed transaction history can analyze trends, identify patterns, and evaluate the financial impact of specific activities or initiatives.

Categorizing Transactions

Bookkeepers categorize financial transactions into appropriate accounts, such as revenue, cost of goods sold, expenses, assets, liabilities, and equity. This categorization ensures that financial information is well-organized and easily accessible for analysis.

By categorizing transactions, businesses can generate accurate financial statements and calculate gross profit, net profit, and various financial ratios. This information is essential for assessing a business’s financial health, identifying improvement areas, and making strategic decisions based on informed data.

Managing Accounts Receivable and Accounts Payable

Bookkeepers play a role in managing a company’s financial records. They oversee accounts receivable and accounts payable, which are vital for maintaining a healthy cash flow. Bookkeepers ensure customer invoices are issued promptly, accurately recorded, and paid on time. They also manage vendor bills by verifying their accuracy and scheduling timely payments.

By maintaining organized and up-to-date financial records, bookkeepers help businesses manage their cash flow effectively and minimize the risk of unpaid invoices and late payment penalties. Effective accounts receivable and accounts payable management is key to maintaining positive relationships with customers and suppliers and ensuring the financial stability of a company.

Bank Reconciliation

Bank reconciliation is a vital aspect of bookkeeping that involves carefully comparing and reconciling a company’s financial records with the bank statements. Professional South Jersey bookkeepers will scrutinize bank transactions, match them with corresponding entries in the accounting system, and promptly identify any discrepancies.

In addition to detecting errors or omissions in financial records, bank reconciliation is vital in uncovering unauthorized transactions, potential fraud, or banking errors. By ensuring that the company’s financial records align with the bank statements, bookkeepers provide businesses with accurate and reliable financial information, enhancing transparency and accountability. Bank reconciliation is a necessary process that every business should prioritize.

Financial Reporting

Generating financial reports is a crucial aspect of bookkeeping that cannot be overlooked. Bookkeepers are essential in compiling and analyzing financial data to prepare various reports, including balance sheets, income statements, cash flow statements, and customized reports tailored to the business’s specific needs.

Financial reports provide a comprehensive overview of a company’s financial position, performance, and cash flow, making them an invaluable tool for decision-making. They offer valuable insights into revenue generation, cost management, profitability, and liquidity. All those aspects are vital for internal decision-making by external stakeholders, such as investors, lenders, and regulatory authorities.

Accurate financial reporting is essential for tax compliance since businesses must report their financial information to tax authorities. By ensuring that financial reports comply with relevant accounting standards and tax regulations, bookkeepers help companies to meet their legal obligations and avoid penalties. For that reason, it is important to have a competent bookkeeper to guarantee that financial reports are always accurate and reliable.

Are Bookkeeping and Accounting the Same Thing?

Bookkeeping and accounting are two distinct functions in financial management. While bookkeeping involves recording and organizing financial transactions, accounting focuses on interpreting, analyzing, and reporting financial information. Bookkeeping is the foundation of accounting since it provides accurate and reliable financial data that accountants use to provide strategic financial advice and ensure regulatory compliance. Professional bookkeeping services are vital to the success of any financial management process.

The Benefits of Professional Bookkeeping Services in South Jersey

Outsourcing your bookkeeping needs to professional services in South Jersey is the best way to manage your small business’s financial aspects. Hiring someone to handle your bookkeeping will provide numerous benefits, such as:

Boosting Efficiency

Expert bookkeeping services in South Jersey provide an unmatched level of efficiency when handling your financial tasks. These specialists possess the necessary knowledge, skills, and resources to seamlessly manage your bookkeeping needs, saving you valuable time and effort. With their expertise and specialized software, they can streamline processes, automate repetitive tasks, and ensure that your financial records are always up to date.

Maintaining Accuracy

Bookkeeping professionals in South Jersey are highly skilled in maintaining accurate and error-free financial records. With their expertise in accounting principles and best practices, they can meticulously review and reconcile your financial transactions, leaving no room for potential errors or discrepancies. This level of accuracy is essential for making informed decisions and ensuring the financial stability of your business.

Staying Compliant

When it comes to compliance with tax regulations and financial reporting requirements, professional bookkeepers in South Jersey are the go-to experts. They stay current with the latest rules and regulations imposed by local, state, and federal authorities, ensuring that your financial records are always accurate, complete, and compliant with the applicable standards. By entrusting your bookkeeping tasks to these professionals, you can rest assured that your business remains compliant and avoids any costly penalties or legal issues.

Providing Convenience

With the help of professionals, you can confidently entrust your financial tasks and free up valuable time and resources for other business aspects. You’ll no longer need to worry about navigating complex financial tasks or keeping up with accounting regulations. This gives you the freedom to focus on growing your business, building strong customer relationships, and implementing strategic initiatives that drive success.

Building Your Financial Strategy

In South Jersey, professional bookkeepers are a valuable resource for gaining insights into your company’s financial performance. They analyze your financial data and generate comprehensive reports that equip you to make informed decisions and develop effective financial strategies. These experts identify trends, pinpoint areas for improvement, and offer recommendations on cost-saving measures, cash flow management, and budget allocation. By leveraging their expertise, you can optimize your financial position and drive the long-term growth of your business with confidence.

How to Choose the Right Bookkeeping Service for Your South Jersey Business?

When searching for a bookkeeping service for your South Jersey business, it is important to be aware of the following factors:

Experience and Expertise

You will want to opt for a bookkeeping service with a proven track record and extensive experience in your industry. Their expertise will guarantee accurate financial management and compliance with industry-specific regulations.

Technology and Software

You will also want to inquire about the bookkeeping service’s technology infrastructure and software capabilities. Ensure that they utilize modern tools that can streamline processes and enhance efficiency.

Communication and Accessibility

Make sure to select a bookkeeping service that maintains open and transparent communication. They should be readily available when you have questions or require assistance, providing prompt responses and guidance.

Scalability

Finally, always consider your future growth plans and ensure the bookkeeping service can adapt to your evolving needs. Scalability is vital to establish a long-term partnership.

Find Out How Our South Jersey Bookkeeping Services Can Help Your Business

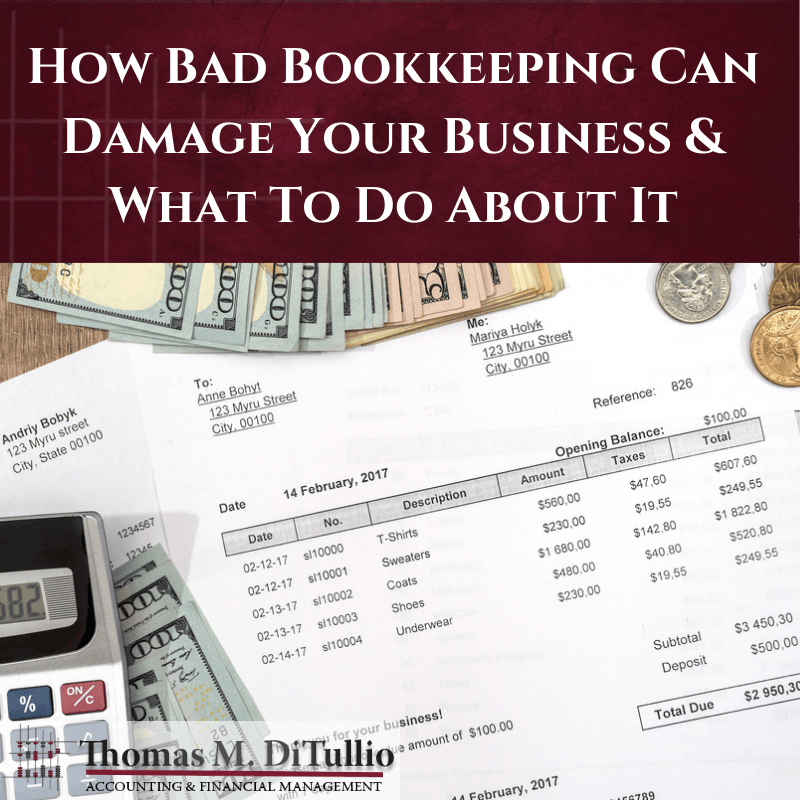

Maintaining accurate and up-to-date financial records is a daunting task for small businesses. Mistakes are easy to make, and important transactions can be easily overlooked. That can all lead to financial mismanagement and serious legal issues.

However, with TMD Accounting, you can outsource your bookkeeping and trust our experienced professionals to handle your financial tasks. We have the expertise to ensure accuracy and maintain comprehensive records, giving you peace of mind.

Outsourcing your bookkeeping needs to TMD Accounting is the smart choice for your small business. We are confident in our expertise, commitment to accuracy, and dedication to customer satisfaction. Our team knows we can effectively meet your bookkeeping requirements. Let us help your South Jersey business thrive by giving us a call today at 1-856-228-2205.