The Silent Killer of Small Businesses: Ignoring Financial Red Flags

Are You Seeing the Signs—Or Hoping They’ll Go Away?

You pour your heart into your business. You’re up early, working late, and hustling for every client. But then, slowly and quietly, things begin to unravel. You’re making sales, but the cash isn’t adding up. Vendors start calling. You skip a monthly report, then another.

And before you know it, the business you built starts slipping away.

This is how it happens. Not with one big crash, but a slow, silent bleed.

🔍 Quick Summary

- Financial red flags can quietly erode small business stability before you realize it.

- Common signs include rising expenses, late payments, aged receivables, and lack of reporting.

- Ignoring these issues leads to debt, tax problems, and potential business failure.

- TMD Accounting helps Gloucester County businesses detect and address early warning signs.

Across Gloucester County and South Jersey, small business owners are being blindsided by the financial red flags they never saw—or chose to ignore. But it doesn’t have to be that way.

What Are Financial Red Flags?

They’re not just numbers. They’re warning signals that your business’s foundation might be weaker than it appears.

The Most Common Warning Signs:

- Expenses rising faster than revenue

- Constantly juggling bills to make payroll

- Customers taking longer to pay

- Invoices and receipts piling up—but never reviewed

- No consistent financial reporting

How They Escalate:

These aren’t temporary setbacks. When ignored, small issues morph into:

- Overdrafts and debt accumulation

- Missed tax deadlines

- Damaged credit or vendor relationships

- IRS audits and late penalties

5 Financial Red Flags That Demand Immediate Attention

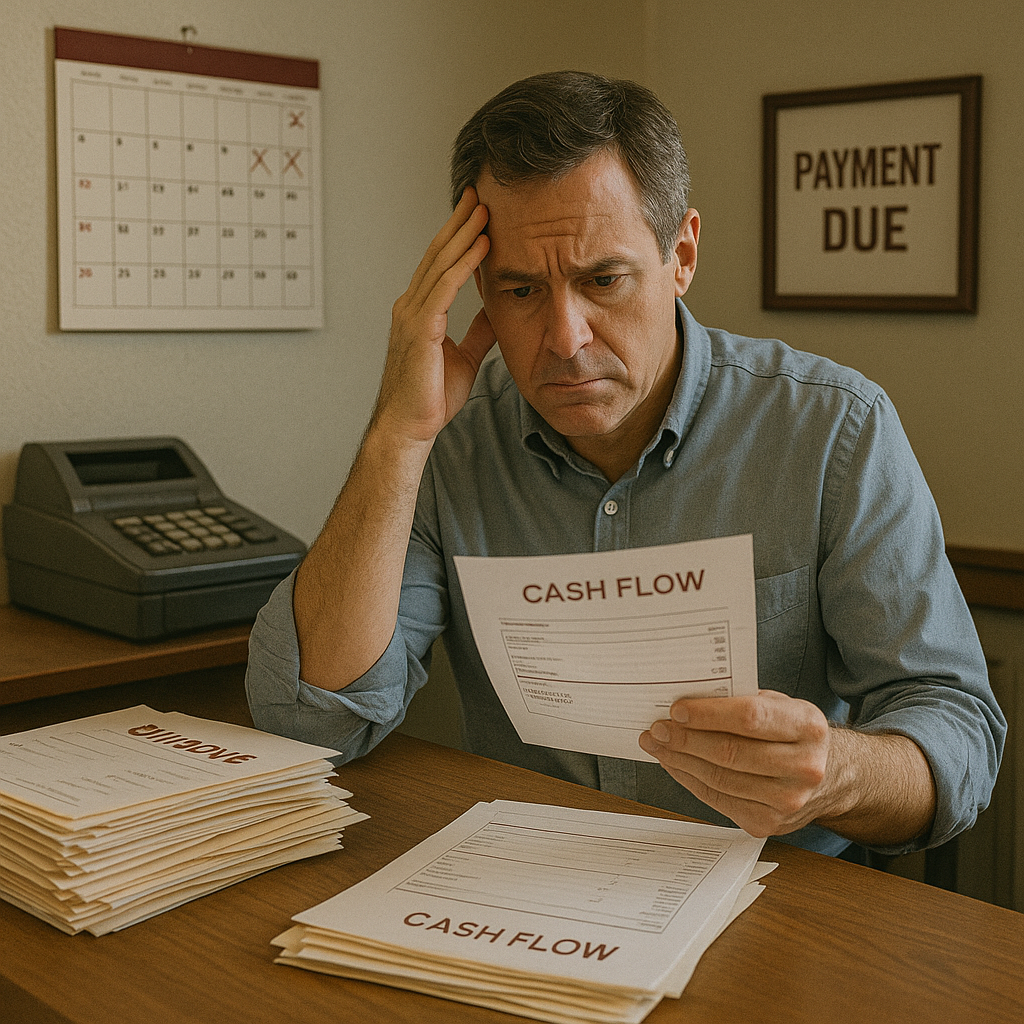

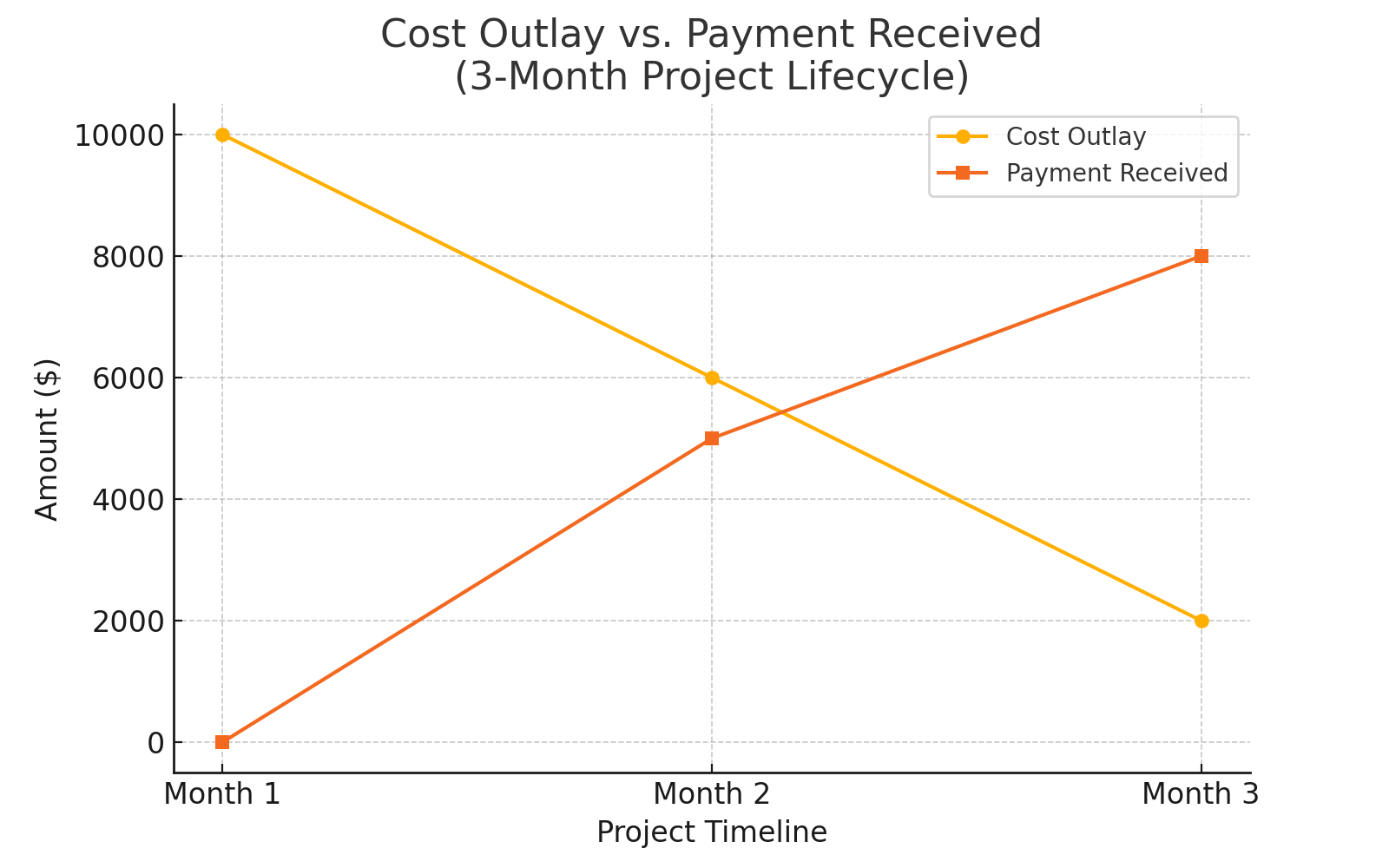

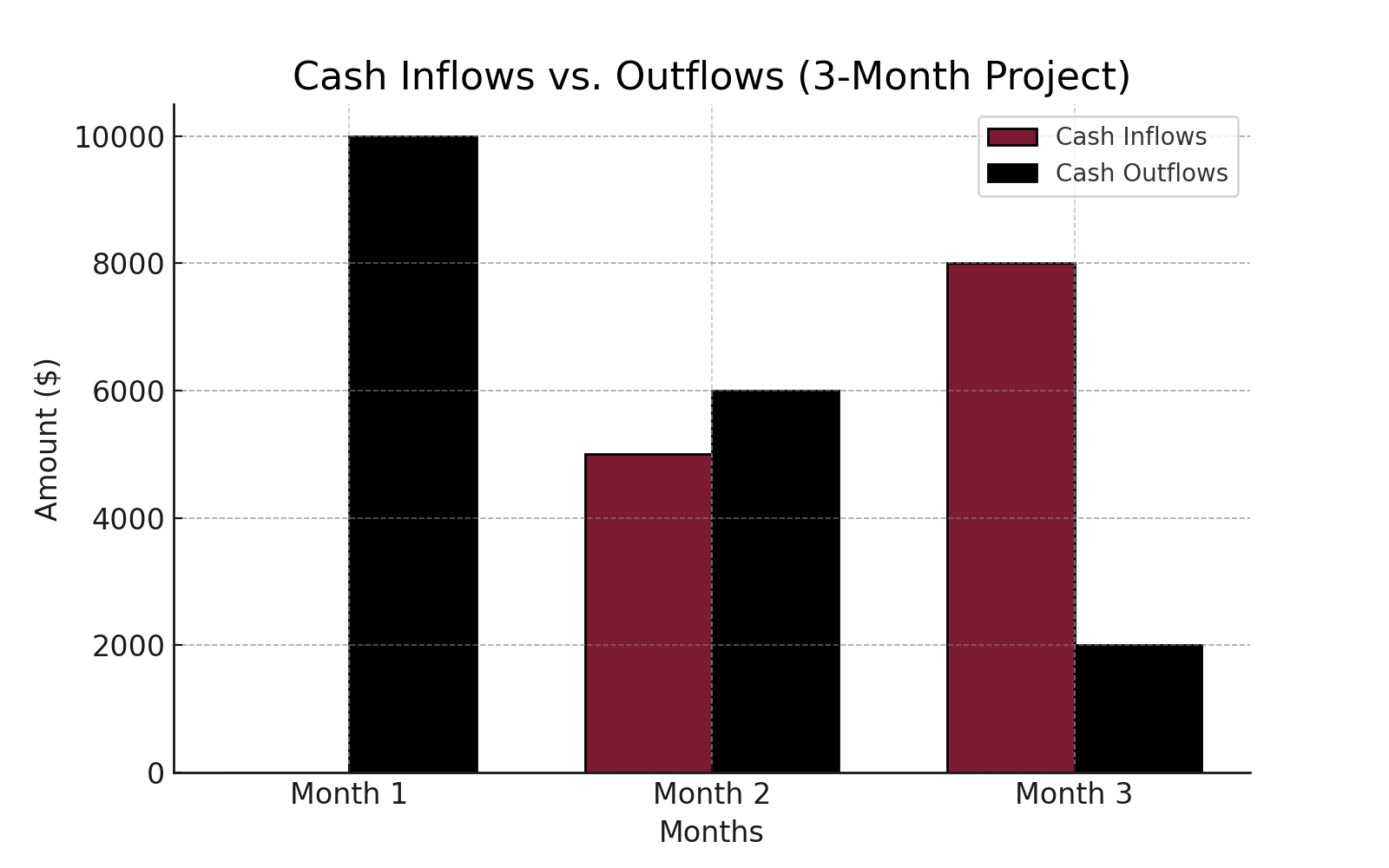

1. Negative Cash Flow—Month After Month

Profit on paper doesn’t pay the bills. If more cash is going out than coming in, you’re headed for a crash. Understanding cash flow is vital.

2. Mounting Debt With No Paydown Plan

If your credit lines are maxing out, and you’re using one card to pay off another, your business is running on borrowed time.

3. Aged Accounts Receivable

Are your customers paying 30, 60, or 90 days late? You’re not a bank. Without steady receivables, your business’s oxygen supply is cut off.

4. No Financial Reports—or Inconsistent Ones

Can’t remember the last time you saw a profit & loss statement or balance sheet? That’s a red flag waving loud and clear.

Want to fix that? Here’s how TMD Accounting supports accurate, timely reporting.

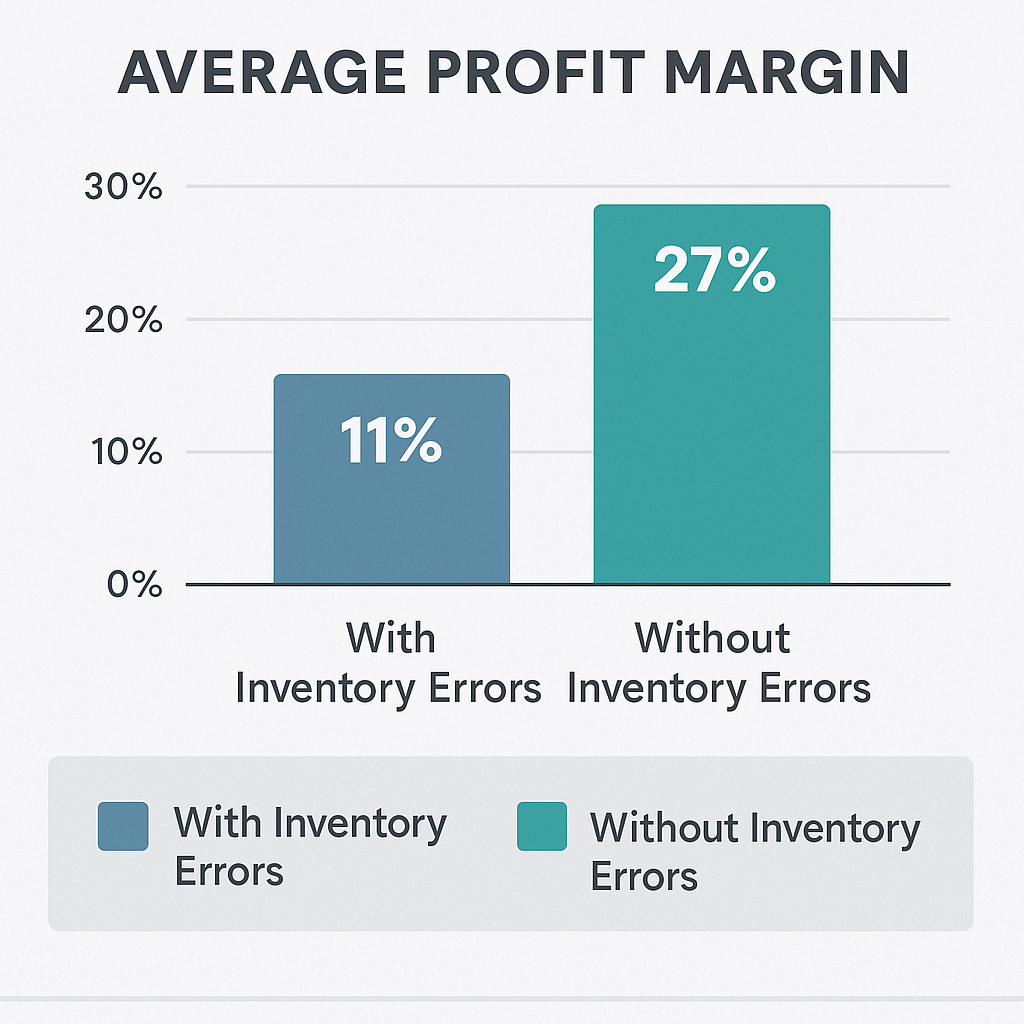

5. Falling Gross Margins

If your cost of goods sold is rising but your pricing isn’t, you’re earning less on each sale. That slow erosion could be the first crack in your financial foundation.

Gloucester County Case Files: The Red Flag Effect

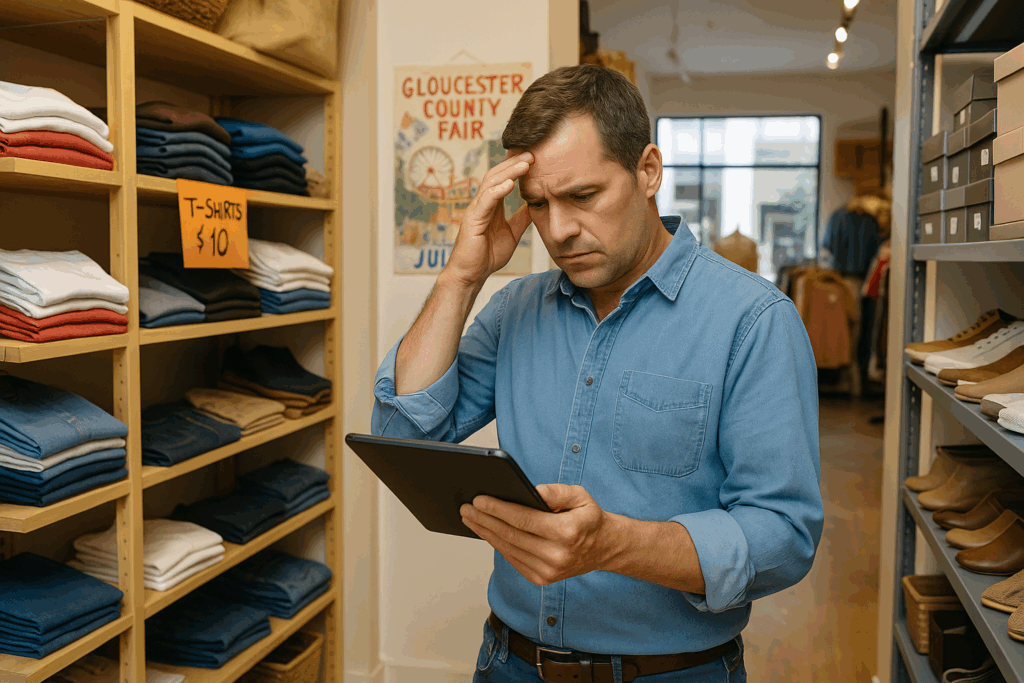

🚨 A Retailer Who Ignored the Signs

A Pitman shop owner noticed cash flow tightening but chalked it up to seasonality. A year later, inventory was piling up, rent was behind, and the lights went out—literally.

✅ A Restaurant That Took Action

In Washington Township, a family-owned restaurant saw a three-month dip in margins. They called TMD Accounting. We spotted over-reporting of labor and vendor overcharges. Within 90 days, they were back in the black.

Why Business Owners Miss the Signals

“It’s Just a Bad Month” Syndrome

We rationalize. We hope. But consistent financial stress is rarely about one bad month.

Trusting Gut Over Data

Intuition is great—but only when paired with real-time numbers and trends.

Lack of Oversight

Many owners don’t know how to read financial reports—or worse, they don’t receive them. If that’s you, this guide will help.

Your Financial Early Warning System (FEWS)

You don’t need to become a CPA—but you do need systems.

Monthly Must-Review Reports:

- Profit & Loss Statement

- Cash Flow Statement

- Accounts Receivable Aging Report

- Budget vs. Actual

Key KPIs to Watch:

- Gross margin %

- Net income trend

- Days Sales Outstanding (DSO)

- Current ratio (Assets vs. Liabilities)

When to Call a Pro:

- You haven’t reviewed your books in 3+ months

- You don’t know your gross profit margin

- You’re making decisions based on your bank balance

Sound familiar? Let us audit your red flags.

You Can’t Fix What You Don’t See

Small business failure doesn’t start with a bankruptcy filing. It starts with ignored reports, fuzzy numbers, and the hope that “things will work out.”

But hope isn’t a strategy.

Clarity is.

At TMD Accounting, we help businesses across Gloucester County spot red flags before they become fatal. We’re not here to shame—we’re here to partner with you. To stabilize, optimize, and protect what you’ve worked so hard to build.

🚨 Don’t wait for a financial crisis.

💼 Book your financial red flag audit with TMD Accounting today and take control of your business’s future.

❓ Frequently Asked Questions

1. What is a financial red flag in a small business?

It’s an early indicator—like falling margins or overdue receivables—that something in your finances needs urgent attention.

2. Is negative cash flow always a red flag?

If it’s consistent over multiple months, yes. It means you’re spending more than you’re earning, which is unsustainable.

3. Why do business owners ignore these red flags?

Many hope the issue is temporary or don’t understand financial reports well enough to spot the problem early.

4. What financial reports should I review monthly?

P&L, cash flow statement, accounts receivable aging, and budget vs. actual reports are essential to monitor trends and cash health.

5. Can TMD Accounting help me interpret financial reports?

Absolutely. We guide business owners in South Jersey to understand, optimize, and act on real financial data to prevent crises.