How to Do Accounting for Your Construction Business in New Jersey

Construction accounting is very different from those other types of businesses. You must keep track of the accounts receivable, accounts payable, and payroll transactions. Along with that, construction companies need to monitor job costs, change orders, retention, customer deposits, and progress billing. All of these components can make construction accounting a challenging task. Here are a few tips that you need to know about construction accounting.

Record All Financial Transactions

The double-entry methods are the best techniques for recording financial transactions in the construction industry. With this, there must be two entries on the ledger for every single transaction. Some companies track these transactions with the help of accounting software or an outsourced bookkeeper.

Keep a General Ledger and Chart of Accounts

A chart of accounts lists all of your general ledger accounts to categorize those transactions. You have the names and a brief description of every account in the list.

Some of these account types could include:

- Current assets

- Current liabilities

- Equity

- Cost of goods sold

- Indirect expenses

- Administrative expenses

Know the Common Cost Types of Construction Accounting

There are several types of cost types associated with construction accounting.

They include the following:

- Job costing: Construction accounting keeps track of the costs of the job. You need to know the project costs as they relate to specific jobs. All of the expenses must be tracked throughout the project’s life. The actual costs and projected estimates are compared during several points of the project. With that information, you can see whether the project is on or over budget. Job costs affect the income of the construction company. In some situations, companies can receive financial incentives for delivering a job under the projected budget.

- Work in progress: Any active or under contract job is known as a work in progress. Construction companies need to track these jobs since it can help to indicate the income and cash flow. Some companies use this cost type to determine the current project’s progress, recognize any revenue, and list other costs coming from the job.

- Cost of goods sold: These costs refer to the expenses incurred for those projects in progress. These costs include labor, equipment rentals, material, and other costs tied directly to the project.

Recognize Your Revenue

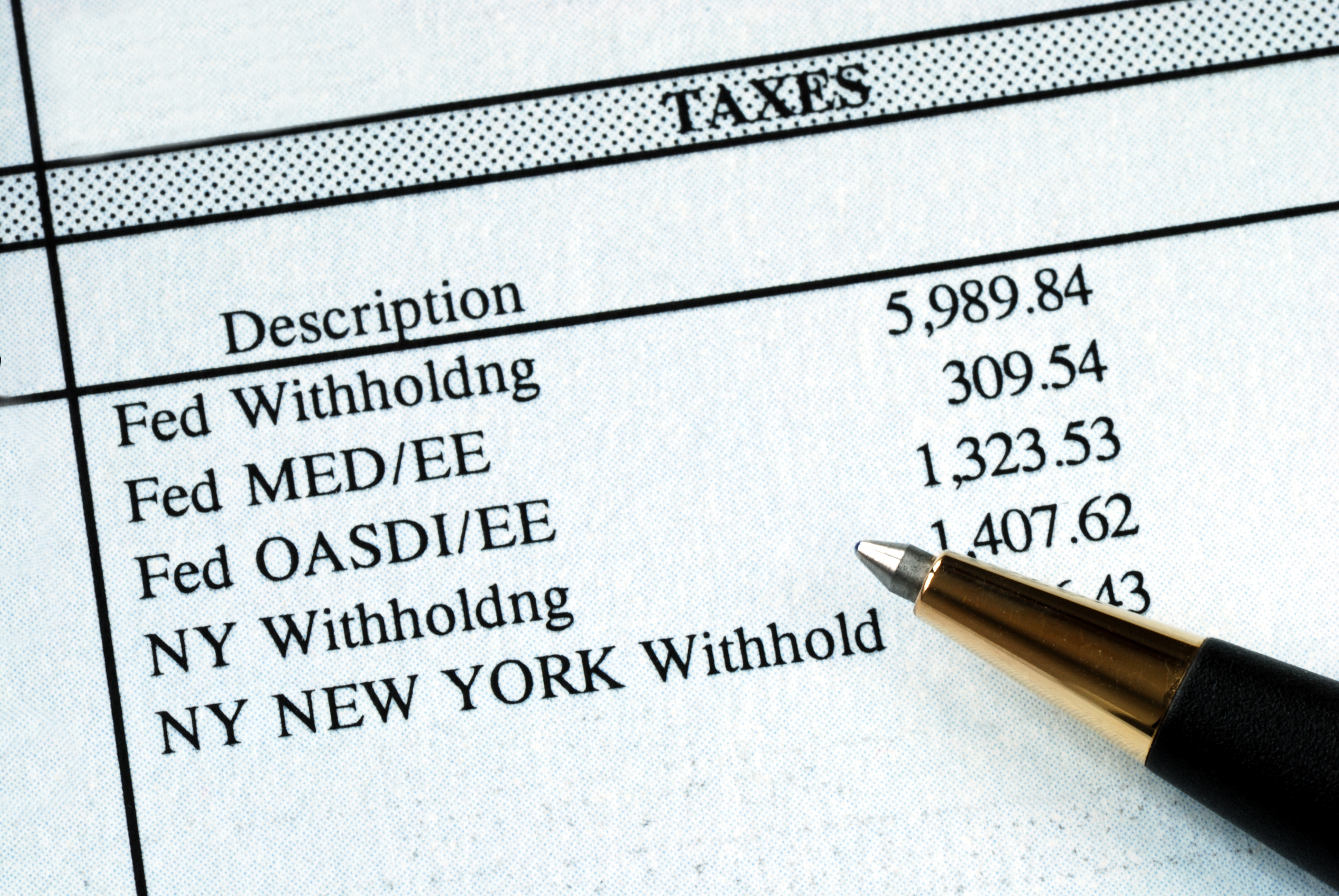

In the construction industry, there are several ways to recognize revenue. Those methods can change depending on the type and duration of a project. For example, some companies recognize their revenue through cash or accrual accounting. Income and costs are recognized when cash changes hands with cash basis accounting. With that, the payables are not recognized until the bill is paid, and there is no record of the payment until the money is in the company’s account. This type of reporting allows the construction company to represent its cash flow. Unfortunately, it does not accurately recognize all costs and revenue.

Accrual accounting is much more accurate. The income and costs are recognized when received from the vendor, and the client is billed. Many companies use accrual accounting over the cash accounting method.

Completed Contract vs. Percent Completed Income Recognition

You can track income in two ways: completed contract or percent completed. With percent completed, the revenue is recognized on the percentage of costs for the project. When revenue comes in from the project, it is tracked. A completed contract only records revenue once the project is considered completed. Many companies track their revenue with the percent completed method for better accuracy.

Construction Accounting Common Reports

If you want to know the financial health of your construction business, you should know these common reports.

Accounts Receivable Aging

Within your accounts receivable (AR), you can track all of those outstanding payments that have been billed but not paid. The accounts receivable aging report shows which companies need to pay their bills by indicating the age of the invoices. With that, you can know which accounts are heading to collections by splitting them into categories for 30, 60, and 90 days past due. You will have healthier accounts receivable reports when there is a shorter time between billing and collection. Keep in mind that the construction industry has some of the longest payment delays out of any sector.

Accounts Payable Aging

On the other side is the accounts payable aging report. This report keeps track of the money you owe to other contractors or vendors. Like the accounts receivable, this report shows when those invoices were created. You can prioritize vendor payments with these accounts payable aging reports.

Profit and Loss/Income Statements

As you may have guessed, a profit and loss report shows the amount of expenses and income accrued during a specific period. You can also view the net loss and profit for any period of time.

Balance Sheet

This report shows your liabilities, assets, and equity holdings in the company. You can use these numbers to determine your financial position to lend or borrow money.

Job Cost Report

During a specific project period, you can get a breakdown of the costs. These reports are helpful to show the progress of the project and inform the customer of billing amounts.

Job Profitability Report

You need a job profitability report to analyze the difference between the actual and estimated costs. These reports show you whether the project is profiting or losing money in the process.

These tips are some of the basics of construction accounting. It can be complicated for anyone to figure out, especially if you don’t have experience with accounting or bookkeeping. These duties should be left in the hands of a professional. For that reason, there are small business accounting services for the task. These accountants understand your company’s needs, and they can help you reduce the headaches associated with managing your finances.

Finding an Accountant for My Small Business

At TMD Accounting, our company has over 40 years of experience. We will help you manage your finances with various services, including payroll help, financial management, and tax assistance. Schedule a consultation by calling 1-856-228-2205.