The Complete Guide to Accounting for Healthcare Practices in South Jersey

Did you know that 70% of healthcare practices lose money due to inefficient financial management? Is your practice one of them? Managing a healthcare practice is challenging enough without the added burden of complex accounting issues that pull your attention away from patient care.

At TMD Accounting, we’ve helped healthcare practices across South Jersey streamline their finances, reduce errors, and improve profitability. In this comprehensive guide, we’ll explore the unique accounting challenges faced by healthcare providers and how you can overcome them to focus on what matters most—delivering exceptional care.

Why Healthcare Accounting Is Unique

Why Healthcare Accounting Is Unique

Healthcare accounting is more complex than typical business accounting due to the industry’s unique financial challenges. These include:

- Complex Reimbursement Systems: Healthcare providers often deal with multiple payers—patients, insurance companies, and government programs like Medicare and Medicaid. This complexity makes billing and reimbursements more challenging to track.

- Strict Regulatory Requirements: Healthcare practices must comply with numerous financial regulations, including HIPAA and insurance reimbursement rules. Non-compliance can result in audits, penalties, or worse, legal action.

Because of these challenges, healthcare providers need specialized accounting practices that go beyond simple bookkeeping. Efficient accounting helps practices remain compliant, improve cash flow, and avoid costly mistakes.

Common Accounting Challenges for Healthcare Practices

- Medical Billing and Reimbursement Errors

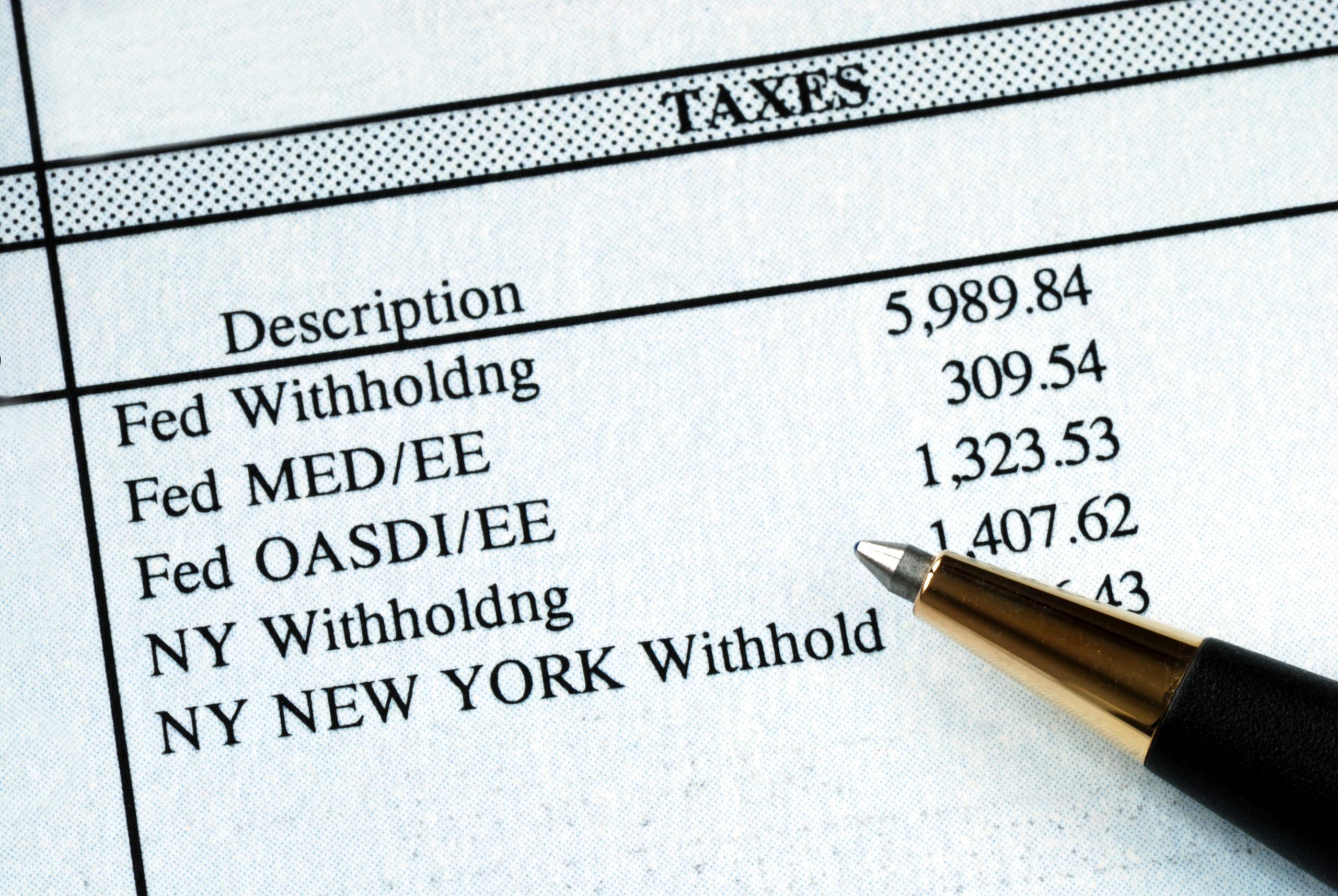

Incorrect billing codes, late submissions, or missing claims can result in delayed or denied payments. In fact, up to 30% of healthcare claims are initially denied, causing significant cash flow issues for practices. Addressing these issues requires a streamlined billing system that reduces errors and speeds up payment collection. - Managing Healthcare Payroll

Payroll for healthcare providers is complicated by varying pay rates, overtime, and shift differentials. Incorrectly calculated payrolls can lead to legal issues, disgruntled employees, and high staff turnover rates. An organized payroll system ensures employees are paid correctly and on time, reducing turnover and legal risks. - Tracking and Reporting Business Expenses

Healthcare practices often struggle to manage operational expenses such as medical supplies, utilities, and rent. Without accurate tracking, it becomes difficult to control costs and plan for future financial needs. Proper expense management allows practices to cut unnecessary costs and improve their bottom line. - Regulatory Compliance

Staying compliant with healthcare regulations is a must. From HIPAA to IRS rules on medical expense deductions, practices must stay up-to-date with ever-changing regulations. Non-compliance can lead to audits and penalties, which can damage both the financial health and reputation of a practice.

Essential Financial Reports Every Healthcare Practice Needs

To stay financially healthy, healthcare practices should regularly review these key financial reports:

- Profit and Loss (P&L) Statement

A P&L statement shows your practice’s revenues and expenses over a specific period, providing a clear view of your profitability. Tracking profitability helps identify where your practice is overspending and what areas are generating the most revenue.

Pro Tip: Review your P&L statement quarterly to make timely financial adjustments.

- Cash Flow Statement

Cash flow is critical to ensuring that your practice can cover expenses. A cash flow statement tracks how much money is coming into your practice versus how much is going out. Consistent cash flow monitoring prevents shortfalls and helps you plan for future expenses. - Balance Sheet

The balance sheet is a snapshot of your practice’s financial position at any given moment, showing assets, liabilities, and equity. It’s a crucial tool for evaluating the financial stability of your practice. - Aging Accounts Receivable (A/R) Report

An aging A/R report tracks outstanding patient and insurance payments. Healthcare practices often struggle with overdue accounts, but regular monitoring of A/R helps ensure timely collection of payments and maintains steady cash flow.

Did you know? Healthcare practices lose an average of $125,000 annually due to uncollected A/R. Keeping a close eye on these payments is critical to minimizing revenue loss.

The Role of Technology in Healthcare Accounting

Technology is a game-changer in healthcare accounting. Practices that embrace accounting software and automation see improvements in efficiency, compliance, and financial accuracy.

- Automated Billing and Payment Systems

By automating billing, practices can reduce human error and ensure timely payment collection. Automated systems also allow real-time tracking of insurance reimbursements and patient payments, improving cash flow and reducing administrative workloads. - Payroll Management Software

Healthcare payroll systems need to handle complex structures, including overtime and shift differentials. Payroll management software reduces the risk of errors and ensures accurate, timely payments to staff, boosting morale and minimizing the risk of payroll-related disputes. - Cloud-Based Accounting Solutions

Cloud-based accounting platforms give healthcare providers secure, HIPAA-compliant access to their financial data from any location. These systems update in real time and allow for seamless collaboration between healthcare managers and accountants, improving financial transparency and decision-making.

How Professional Accounting Services Can Improve Your Bottom Line

Outsourcing your accounting to professionals who specialize in healthcare can significantly improve your practice’s financial health. Here’s how:

- Cost Savings and Efficiency

Professional accountants can help identify inefficiencies in your billing and payroll systems that may be costing your practice money. For example, TMD Accounting helped a South Jersey healthcare provider reduce overhead by 15% by streamlining their billing and payroll processes. - Risk Mitigation

Accountants specializing in healthcare stay up-to-date with changing healthcare regulations and tax laws. They ensure your practice complies with these rules, minimizing the risk of audits and penalties. - Time Savings

Managing the financial side of a healthcare practice takes valuable time away from patient care. By outsourcing accounting, you can focus on your core mission—providing excellent care—while leaving the financial details to the experts.

Case Study: One South Jersey medical clinic partnered with TMD Accounting and saw a 20% increase in operational efficiency within six months by offloading their financial management to our team.

Conclusion

Better accounting practices lead to better financial outcomes for healthcare practices. Whether you need help managing payroll, improving cash flow, or staying compliant with regulations, working with a professional accountant can free up your time and improve your bottom line.

Ready to take control of your healthcare practice’s finances? Contact TMD Accounting today for a free consultation and learn how we can help you streamline your financial operations, improve compliance, and maximize profitability. Act now before the next billing cycle—start optimizing your practice today!