Simplifying Financial Reporting for Small Healthcare Businesses in NJ

Running a medical practice is a full-time job—and then some.

Between patient care, staff management, and billing headaches, there’s rarely time left to analyze balance sheets or review profit margins. And let’s be honest—most financial reports look like they’re written in a foreign language.

But here’s the truth: simplifying financial reporting for small healthcare businesses is one of the smartest, most empowering moves you can make. It doesn’t require an MBA or hours of number-crunching—just the right approach, tools, and a bit of expert guidance.

If you’re a healthcare provider in South Jersey trying to make sense of your finances (and stay compliant with NJ tax laws), this guide is for you.

🔍 Quick Summary

- Small healthcare businesses often struggle with complex financial reporting—leading to cash flow problems and compliance risks.

- Key reports like P&L, Balance Sheets, and Cash Flow Statements provide essential visibility.

- Using healthcare-specific software and customized tracking simplifies your practice’s finances.

- TMD Accounting helps NJ healthcare providers turn confusing data into strategic clarity.

Why Financial Reporting Matters in Healthcare

Financial reporting is more than just bookkeeping—it’s the heartbeat of your business operations.

Here’s why it’s crucial:

-

Track what you’re really earning: Patient payments, insurance reimbursements, and co-pays add complexity. A clear report shows you actual profitability.

-

Spot problems early: Delayed reimbursements or high overhead can be caught quickly.

-

Stay compliant: Accurate financial reporting helps you avoid IRS penalties or misfilings with the NJ Division of Revenue.

-

Plan for growth: Want to open a second location or invest in new equipment? You’ll need clean financials to secure a loan or investor confidence.

🧠 Pro Tip: Financial clarity isn’t about perfection—it’s about visibility and consistency.

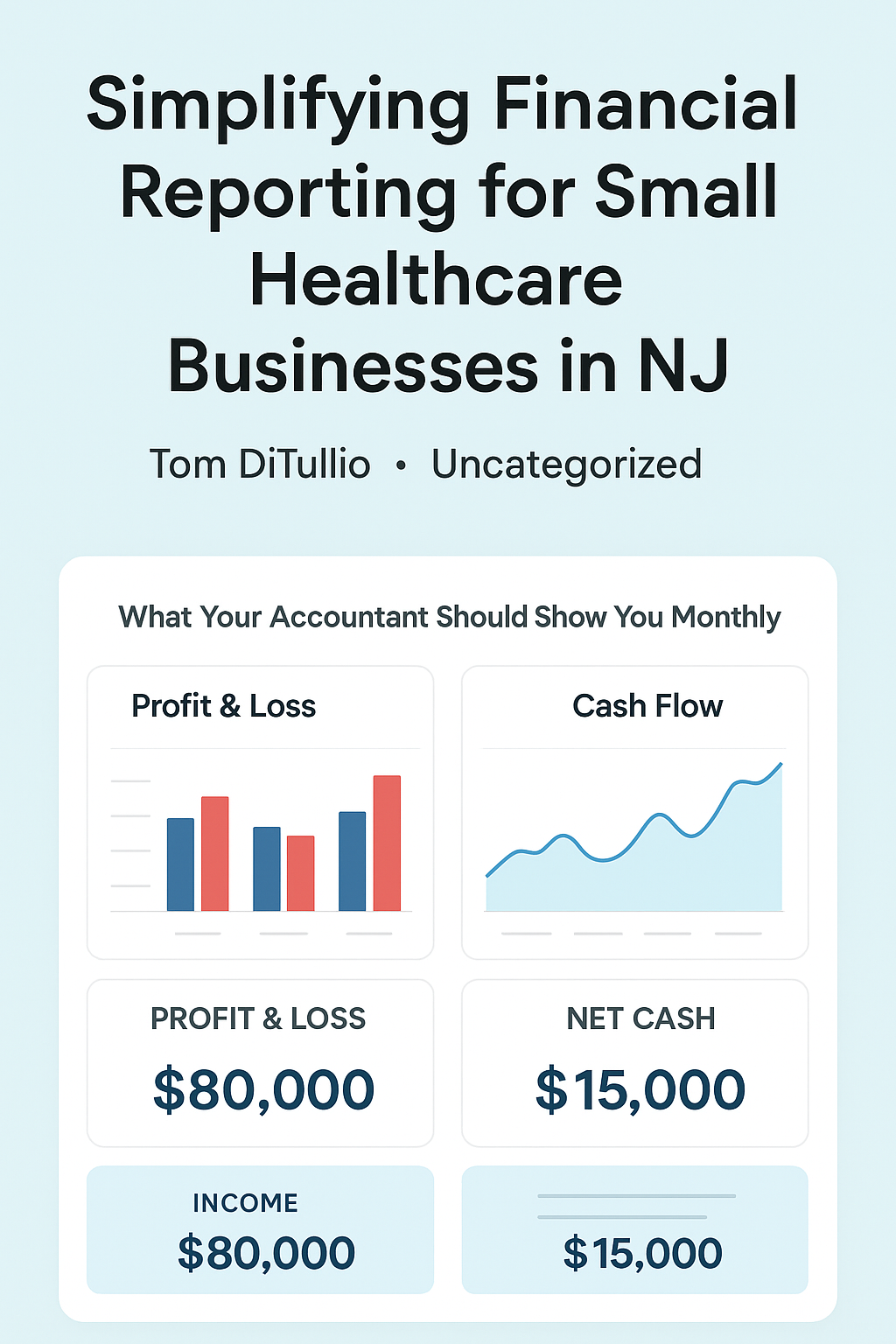

What Your Accountant Should Show You Monthly

Key Financial Reports Your Practice Should Use

You don’t need a thousand spreadsheets. Just a few targeted reports can give you a powerful snapshot of your practice’s health.

1. Profit & Loss Statement (P&L)

-

Shows income vs. expenses over a period (monthly, quarterly, annually)

-

Helps identify where you’re making—or losing—money

-

Tracks trends in patient revenue, insurance reimbursements, and operational costs

2. Balance Sheet

-

Lists assets, liabilities, and equity

-

Great for determining your net worth and preparing for expansion or financing

-

Especially helpful if you own your medical office building or have medical equipment loans

3. Cash Flow Statement

-

Shows how cash is entering and leaving your practice

-

Identifies cash shortages due to insurance delays or high overhead

-

Essential for covering payroll and monthly bills without stress\

Common Financial Reporting Pitfalls in Healthcare

Many practices don’t realize they’re struggling until it’s too late. Here are the top mistakes we see:

-

Using generic accounting software that doesn’t align with healthcare coding or billing

-

Confusing revenue with collections (just because you billed $10,000 doesn’t mean you’ve been paid)

-

No separation of patient payments vs. insurance reimbursements

-

Not tracking service-line profitability (e.g., is physical therapy really bringing in profit?)

-

Missing reports for co-pays, aging accounts receivable, or write-offs

💬 Real Example: One Washington Township family practice thought they were breaking even until a custom report showed their insurance collections were 60 days behind—and they were actually operating at a loss.

How to Simplify Financial Reporting in Your Practice

Step 1: Use Healthcare-Specific Software

Generic tools like Excel or basic QuickBooks versions don’t cut it. Instead, look for:

-

Kareo

-

AdvancedMD

-

DrChrono

-

Or QuickBooks integrated with medical billing software

These platforms can track patient billing, insurance reimbursements, and create healthcare-friendly reports.

Step 2: Automate and Sync Your Systems

-

Integrate your EHR or practice management system with your accounting platform

-

Automate payroll, expense categorization, and vendor payments

-

Tag income by payer source (insurance vs. self-pay)

Step 3: Customize Reports to Match Your Goals

You don’t need a flood of data—you need actionable insights. Work with your accountant to track:

-

Revenue by provider or service line

-

Overhead percentage (ideal range: 50–65%)

-

Monthly collections vs. charges

-

Patient retention and average visit revenue

Explore Our Healthcare Accounting Services in South Jersey

Why Work With a Local NJ Healthcare Accountant?

A general accountant might miss things like insurance coding issues, HIPAA-compliant tracking, or NJ-specific tax rules. At TMD Accounting, we specialize in working with medical practices throughout Gloucester County and surrounding areas.

Here’s what we offer:

-

Customized reports you’ll actually understand

-

Real-time dashboards and monthly check-ins

-

Support during audits or Medicare reconciliations

💬 Case Study: After partnering with us, a Sewell-based podiatry clinic increased net profit by 18% in one year—just by fixing their AR tracking and insurance follow-ups.

Conclusion: Clarity Is Power

Financial reporting doesn’t need to be a burden. In fact, with the right systems and support, it becomes one of your strongest tools for decision-making, compliance, and growth.

🎯 Want help simplifying your reports and seeing your true financial health—without drowning in spreadsheets?

Schedule a free consultation with TMD Accounting today and let’s bring clarity to your practice’s bottom line.

❓ Frequently Asked Questions

1. Why is financial reporting different for healthcare providers?

Healthcare income includes insurance reimbursements, co-pays, and billing codes, which require specialized tracking for accuracy and compliance.

2. What reports should I review monthly?

Start with your Profit & Loss statement, Balance Sheet, and Cash Flow report—then add custom reports for collections and aging receivables.

3. Can generic software handle my needs?

Often not. Medical practices benefit from tools like Kareo or QuickBooks paired with billing integrations for better accuracy.

4. How does poor reporting hurt my practice?

It leads to cash flow gaps, missed growth opportunities, and audit risk—especially if you’re misreporting insurance income or expenses.

5. How does TMD help healthcare businesses in NJ?

We simplify reporting, build custom dashboards, and ensure compliance with NJ healthcare tax rules—all tailored to your specific services.