How to Avoid Payroll Mistakes: Tips for Gloucester County Employers

Managing payroll is one of the most important tasks for any business owner, but it can also be one of the most challenging. Whether you’re running a small business in Glassboro, Deptford Township, or Washington Township, payroll errors can lead to unhappy employees, compliance issues, and costly penalties. Fortunately, you can avoid these mistakes by understanding common pitfalls and implementing best practices.

In this guide, we’ll share practical tips for Gloucester County employers on how to avoid payroll mistakes, ensuring your business stays compliant and your employees remain satisfied.

1. Understand and Comply with New Jersey Payroll Laws

Payroll laws in New Jersey are complex, and failing to follow them can lead to serious consequences. As an employer in Gloucester County, you need to stay updated on state-specific regulations, including wage rates, overtime laws, and tax requirements.

- Tip: Regularly review New Jersey’s payroll laws and make adjustments as needed. This ensures you stay compliant with minimum wage changes, overtime rates, and tax laws.

- Example: The New Jersey minimum wage is subject to annual increases. Make sure you’re paying your employees the correct amount to avoid fines.

- Related Content: Learn more about payroll regulations by visiting our article on Navigating NJ Payroll Laws: Why Expertise Matters.

2. Accurately Classify Your Employees

One of the most common payroll mistakes is misclassifying employees as either independent contractors or regular employees. Misclassification can lead to serious tax issues, penalties, and even legal action.

- Tip: Understand the difference between an independent contractor and an employee. Independent contractors typically control how they perform their work, while employees follow company guidelines.

- Why It Matters: Misclassification affects payroll taxes, benefits, and workers’ compensation. To avoid mistakes, regularly review employee classifications.

- Related Content: For more insight, read our guide on Understanding Payroll Services for Small Businesses.

3. Use Reliable Payroll Software or Outsource Payroll Services

Manual payroll processing increases the chances of errors. Instead, consider using payroll software or outsourcing to a professional payroll company. This helps you automate calculations, tax withholdings, and reporting, reducing the risk of mistakes.

- Benefit: A reliable payroll service provider can handle complex tasks, such as calculating overtime, handling deductions, and filing taxes.

- Local Insight: Many businesses in Gloucester County partner with payroll companies in NJ to manage payroll efficiently.

- Related Content: Check out Payroll Companies In New Jersey for more details on the benefits of outsourcing.

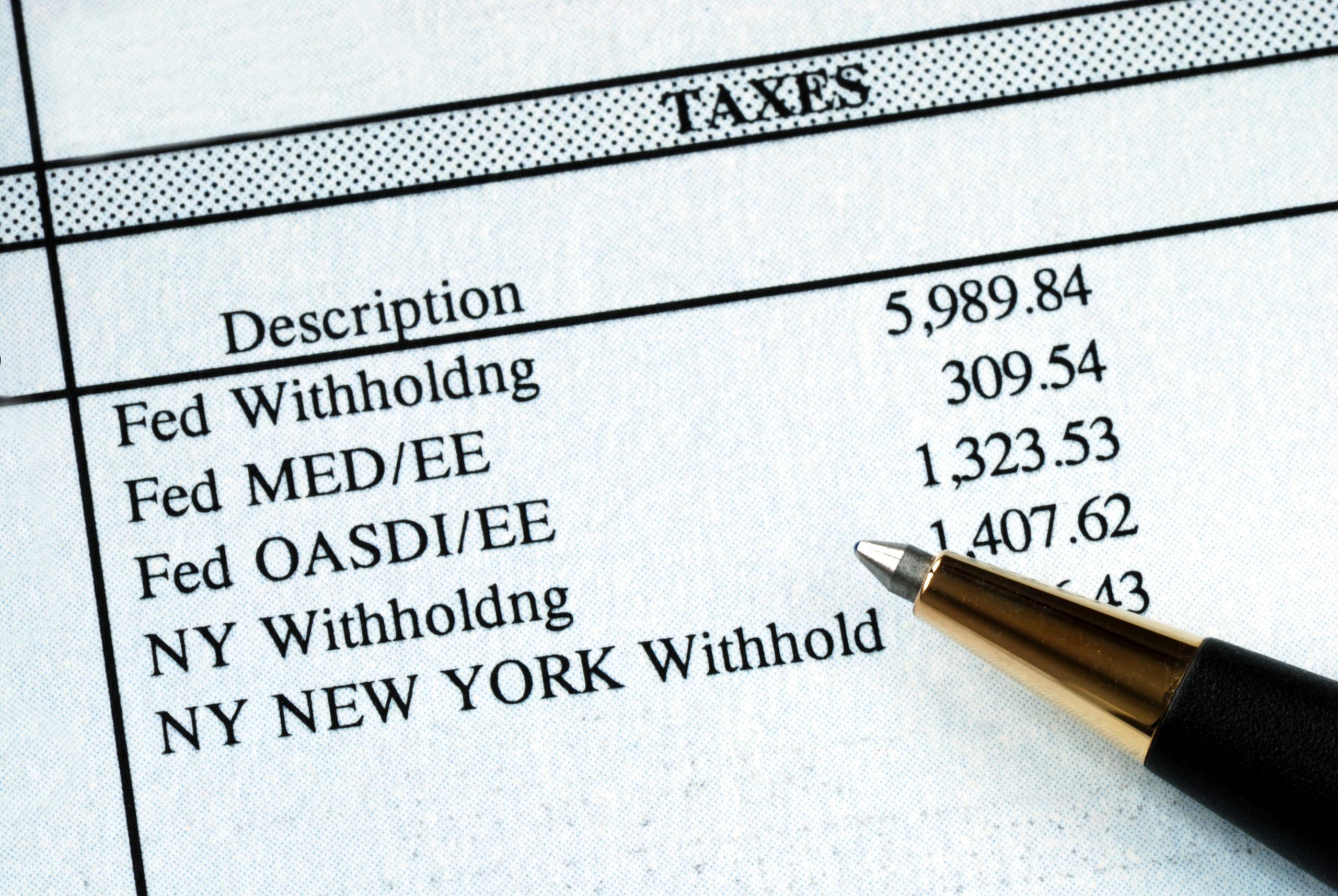

4. Stay Updated on Tax Withholding Rates

Tax withholding rates can change frequently, and it’s crucial to stay informed. Using outdated rates can lead to incorrect tax deductions, resulting in potential fines and penalties for your business.

- Tip: Review federal, state, and local tax rates regularly. Make adjustments to your payroll system as soon as changes occur.

- Related Content: Visit our Tax Services page for more tips on staying compliant with tax regulations.

5. Keep Accurate Records

Accurate record-keeping is essential for payroll management. It helps you track hours worked, wages paid, taxes withheld, and other critical details. Moreover, maintaining proper records ensures you’re prepared for any potential audits.

- Why It Matters: New Jersey requires employers to keep payroll records for at least six years. Failing to do so can result in penalties.

- Related Content: Check out our Record Retention Guide for more information on how long to keep business records.

6. Review Payroll Reports Regularly

Mistakes can happen, even with automated payroll systems. Therefore, it’s essential to review payroll reports regularly. This practice helps you catch and correct errors before they become a bigger problem.

- Tip: Schedule monthly or bi-weekly payroll audits to identify discrepancies in employee hours, wages, or tax withholdings.

- Example: If an employee’s tax withholdings seem incorrect, addressing the issue early can prevent future headaches.

- Related Content: Learn about common payroll mistakes in our article on Avoiding Common Payroll Mistakes: How NJ Companies Can Benefit from Outsourcing.

7. Set Clear Payroll Policies

Clear payroll policies help prevent misunderstandings between you and your employees. They also ensure consistency in how payroll is handled. Include details on pay periods, overtime calculations, deductions, and how employees should report hours worked.

- Tip: Communicate these policies to all employees and make them easily accessible, such as in an employee handbook or an online portal.

- Why It’s Important: Transparent payroll policies reduce confusion and disputes, making payroll management smoother.

8. Train Your Payroll Staff

Payroll management requires attention to detail and knowledge of tax laws, employee classifications, and payroll processes. Therefore, it’s essential to invest in training for staff who handle payroll.

- Benefit: Training helps your payroll team stay updated on laws, procedures, and software systems. As a result, they are less likely to make costly mistakes.

- Related Content: Discover more tips on improving payroll processes in The Importance of Accuracy in Payroll Processing for NJ Businesses.

9. Address Payroll Mistakes Immediately

Even with the best systems in place, payroll mistakes can still occur. The key is to address them quickly and effectively. This approach minimizes the impact on your employees and your business.

- Tip: As soon as you identify an error, correct it and communicate the solution to the affected employee. This transparency builds trust and shows that you take payroll seriously.

10. Partner with a Professional Accounting Firm

Managing payroll can be overwhelming, especially when you’re focused on running your business. Partnering with a professional accounting firm, like TMD Accounting, can help you avoid payroll mistakes and stay compliant.

- Why Choose TMD Accounting: We offer comprehensive Payroll Services tailored to the needs of Gloucester County employers. Our team ensures your payroll is accurate, compliant, and on time.

- Local Expertise: As a trusted small business accountant in NJ, we understand the unique challenges Gloucester County businesses face and provide personalized support.

Final Thoughts

Payroll mistakes can be costly and damaging to your business. However, by following these tips, you can reduce errors, stay compliant, and keep your employees happy. Remember, the key to successful payroll management is staying informed, being proactive, and seeking professional assistance when needed.

If you want to avoid payroll headaches and ensure accuracy, consider partnering with TMD Accounting. Contact us today for reliable and expert payroll services in Gloucester County.

Ready to simplify your payroll process? Reach out to TMD Accounting and let our experts help you manage payroll with confidence!