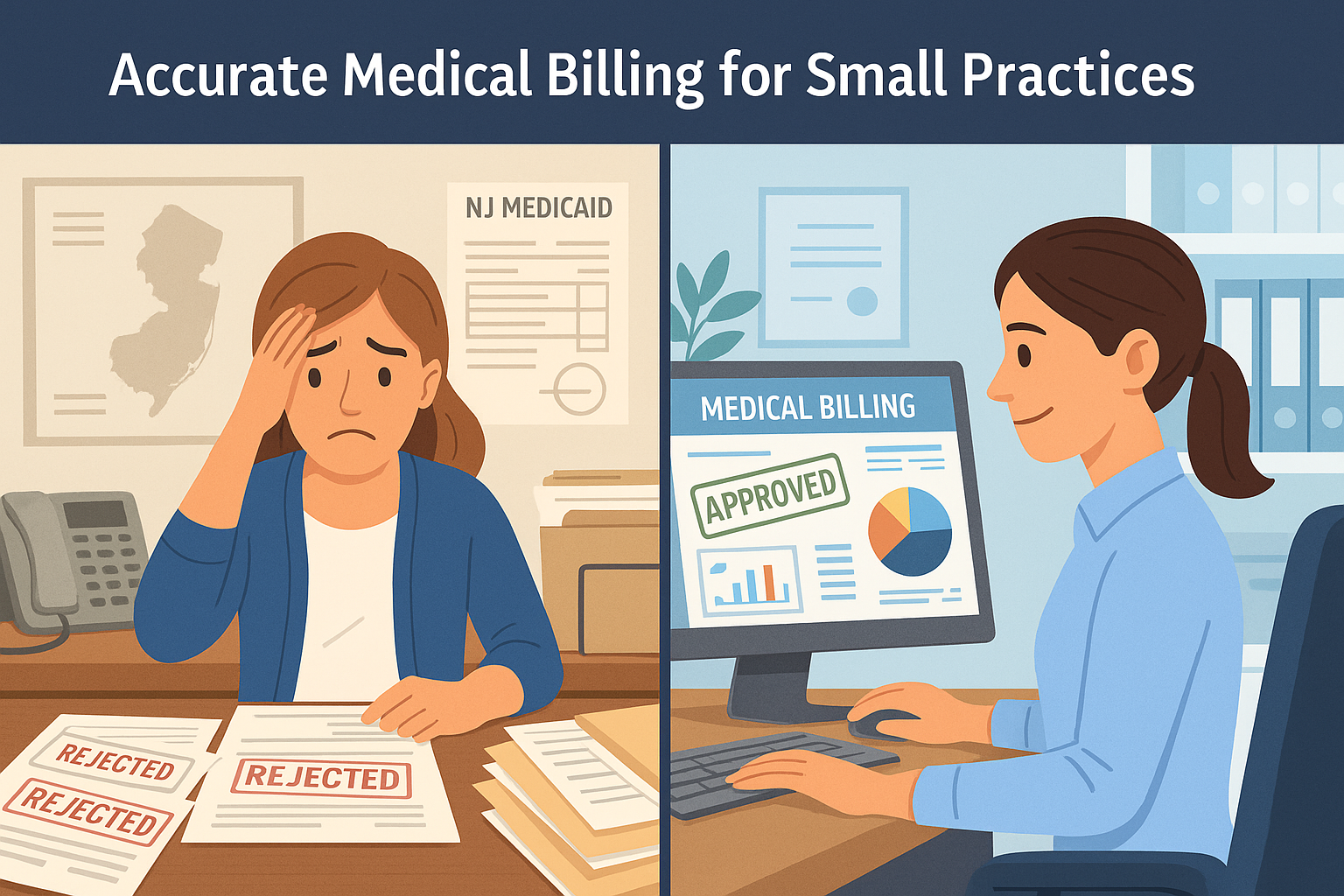

The Importance of Accurate Billing in Small Healthcare Practices

Are you losing revenue due to billing errors or delayed reimbursements?

For small healthcare practices, accurate medical billing services aren’t just helpful—they’re essential. Whether you’re managing a family clinic in Glassboro or a specialty practice in Washington Township, mistakes in medical billing can lead to denied claims, compliance risks, and unhappy patients.

In this guide, we’ll walk you through why billing accuracy is critical, common challenges practices face, and proven solutions to help you improve your bottom line—starting today.

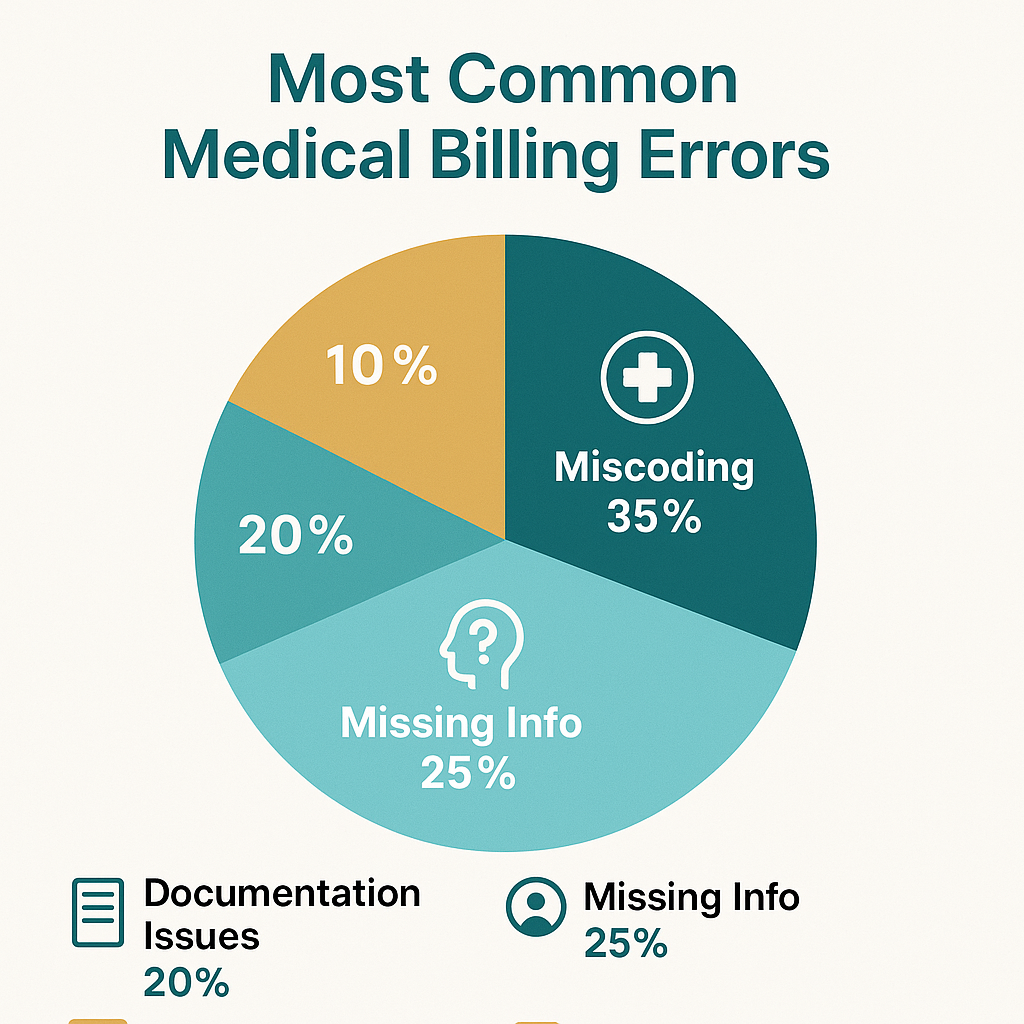

Most Common Medical Billing Errors

🔍 Quick Summary

- Billing errors and delayed reimbursements are a leading cause of revenue loss in small healthcare practices.

- Challenges include coding complexity, staff overload, and outdated systems.

- Switching to healthcare-specific software and auditing claims improves accuracy and cash flow.

- TMD Accounting helps South Jersey practices streamline billing and stay compliant with healthcare regulations.

Why Accurate Medical Billing Services Matter

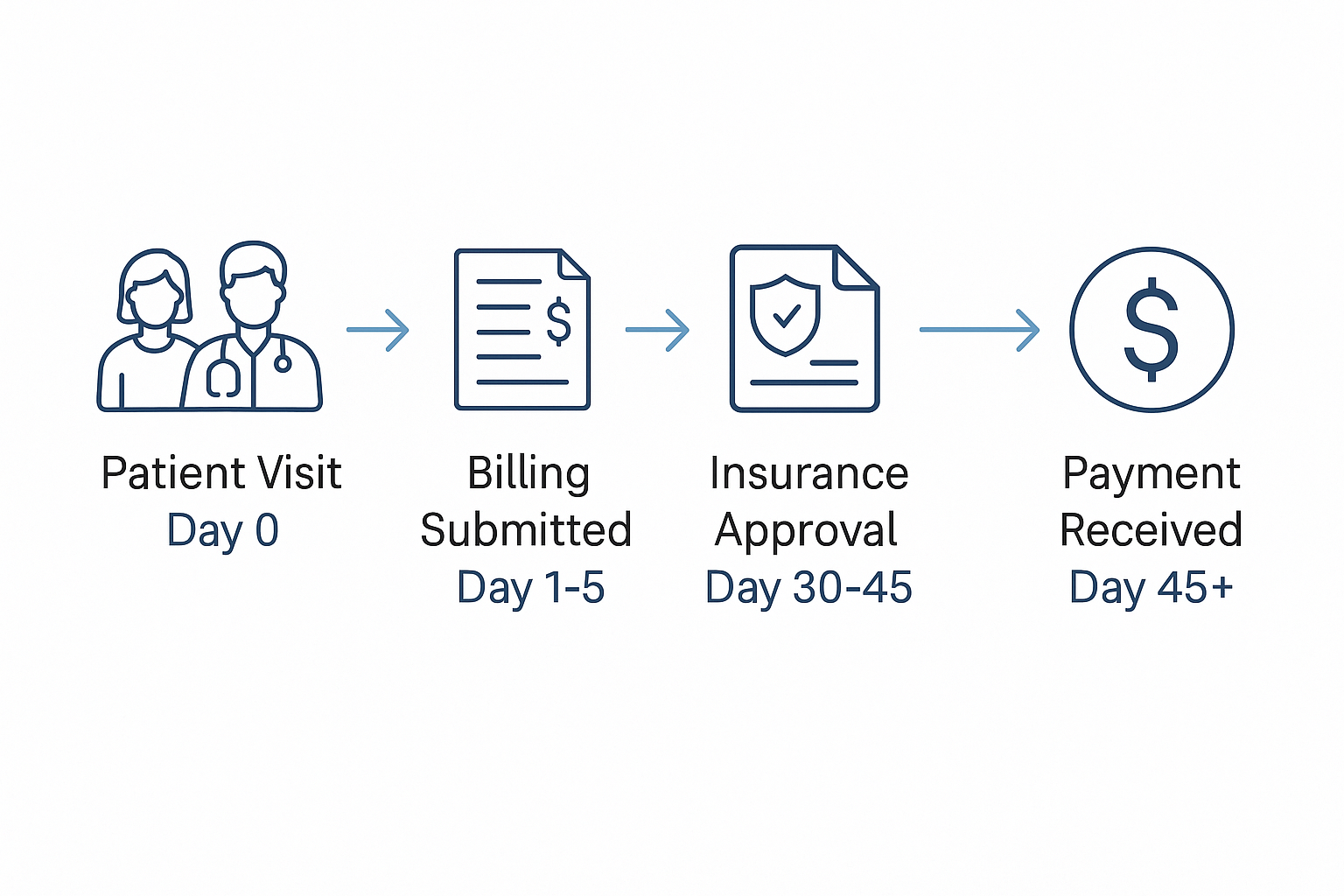

Keep Revenue Flowing Smoothly

Accurate medical billing ensures you’re paid correctly and on time. Delays caused by errors can choke your cash flow, which is especially dangerous for small, privately run healthcare offices.

Example:

According to the Medical Group Management Association (MGMA), practices that adopt accurate billing systems see up to 10% revenue growth annually by reducing claim denials and improving collections.

Avoid Compliance Pitfalls

Medical billing errors can expose your practice to serious compliance risks. HIPAA violations, incorrect coding, and mismanagement of patient data can lead to audits, fines, and legal trouble.

Quick Tip: Regular coding updates and software that flags compliance issues can keep your practice safe.

Common Billing Challenges in Small Practices

1. Inadequate Coding Knowledge

ICD-10, CPT, HCPCS… billing codes are complex. Without proper training or tools, errors are easy to make and hard to spot.

2. Limited Staff & Overload

Many small offices rely on one or two employees for billing. When those individuals are overworked or out sick, the entire system suffers.

3. Manual Billing Systems

Still using spreadsheets or outdated systems? Manual entry increases the risk of human error and slows reimbursement timelines.

Job Cost Drift- The Hidden Risk Of No Real-Time Tracking

How to Improve Billing Accuracy in Small Practices

Use the Right Medical Billing Software

Switching to cloud-based, healthcare-specific platforms like Kareo, DrChrono, or AdvancedMD streamlines claim submissions, reduces data entry errors, and allows easy tracking of payment statuses.

Key Features to Look For:

-

Real-time eligibility checks

-

EHR integration

-

Auto-coding suggestions

-

Alerts for missing information

Conduct Routine Billing Audits

Implement monthly internal reviews to catch discrepancies early. Auditing claims before submission helps ensure accuracy, improves cash flow, and lowers denial rates.

🛠️ Pro Tip: Use checklist templates to standardize your audits and assign staff accountability.

Should You Outsource Your Medical Billing?

Outsourcing your billing can be a cost-effective way to access expertise without expanding your staff. It also frees your internal team to focus on patient care.

| Feature | In-House Billing | Outsourced Billing |

|---|---|---|

| Control Over Process | ✅ | ⚠️ (depends on provider) |

| Coding Accuracy | ⚠️ (staff dependent) | ✅ (certified experts) |

| Time Savings | ⚠️ | ✅ |

| Cost Efficiency | ⚠️ (hiring/training costs) | ✅ (flat rate or % model) |

Learn how TMD Accounting supports healthcare billing in South Jersey

Real-Life Results: A Case Study from Gloucester County

A pediatric clinic in Sewell was experiencing delayed reimbursements and patient billing complaints. After switching to a cloud-based billing service and partnering with a local accountant, they:

-

Reduced claim rejections by 37%

-

Improved monthly cash flow by 21%

-

Received patient praise for clearer bills

Quote from Office Manager:

“We didn’t realize how much revenue we were leaving on the table until we audited our billing practices. Partnering with a local expert made all the difference.”

Conclusion: Get Paid. Stay Compliant. Grow Stronger.

Billing may be back-office work, but its impact is front-and-center in your practice’s success. From revenue to reputation, accurate medical billing services support every part of your business.

Want to improve billing accuracy and protect your bottom line?

Contact TMD Accounting today for expert, healthcare-specific billing support right here in South Jersey.

❓ Frequently Asked Questions

1. Why is accurate medical billing so important?

It directly impacts your practice’s revenue, compliance standing, and patient satisfaction. Inaccurate billing leads to denied claims and potential legal risks.

2. What causes billing errors in small practices?

Common causes include coding misunderstandings, overworked staff, and manual billing systems that increase the risk of human error.

3. Can software help prevent errors?

Yes. Tools like Kareo or AdvancedMD offer automated claim checks, EHR integration, and real-time tracking that reduce errors significantly.

4. Is outsourcing billing a good option?

For many small practices, yes. Outsourcing provides access to certified billing experts and allows your in-house team to focus on patient care.

5. How can TMD Accounting help?

TMD offers healthcare-focused accounting and billing support, helping South Jersey providers improve accuracy, reduce denials, and boost cash flow.