The Hidden Costs of Payroll Errors: A Small Business Owner’s Worst Nightmare

As a small business owner, you know there are many problems that can arise during tax season. Payroll errors are one such nightmare. A single payroll issue may lead to financial losses, compliance problems, and employee dissatisfaction. Don’t underestime the cost of these payroll errors; they have far-reaching consequences. It’s important to understand the common causes of payroll errors, their impact, and how to prevent them.

Key Takeaways

- Payroll errors can lead to financial penalties, audits, and legal issues, straining business resources.

- Common mistakes include misclassifying employees, miscalculating wages, tax errors, and late paychecks, all of which can impact compliance and employee trust.

- Inaccurate payroll damages morale and reputation, increasing turnover and making hiring more difficult.

- Prevent errors with payroll software, regular audits, accurate records, and compliance with tax laws, or by outsourcing to professionals.

- TMD Accounting ensures accurate, compliant payroll services, helping small businesses avoid costly mistakes and focus on growth.

What are Common Payroll Errors?

Payroll mistakes can occur for various reasons, from simple human errors to outdated systems that fail to account for updated labor laws. Even the smallest payroll miscalculation can lead to financial and legal consequences for a business. Here are some of the most common payroll errors and why they happen:

Incorrect Employee Classification

It’s common for businesses to misclassify workers as independent contractors rather than employees or vice versa. This mistake can result in serious tax penalties because independent contractors do not have payroll taxes withheld, while employees do. The IRS and state agencies closely monitor worker classifications, and errors in this area can lead to back taxes, fines, and even lawsuits.

Miscalculated Wages and Overtime

Misunderstanding federal or state wage laws can lead to incorrect employee payments. For instance, some employers fail to correctly calculate overtime pay for non-exempt employees, who should receive 1.5 times their regular hourly rate for overtime hours. Underpaying workers can result in wage disputes, labor violations, and costly lawsuits.

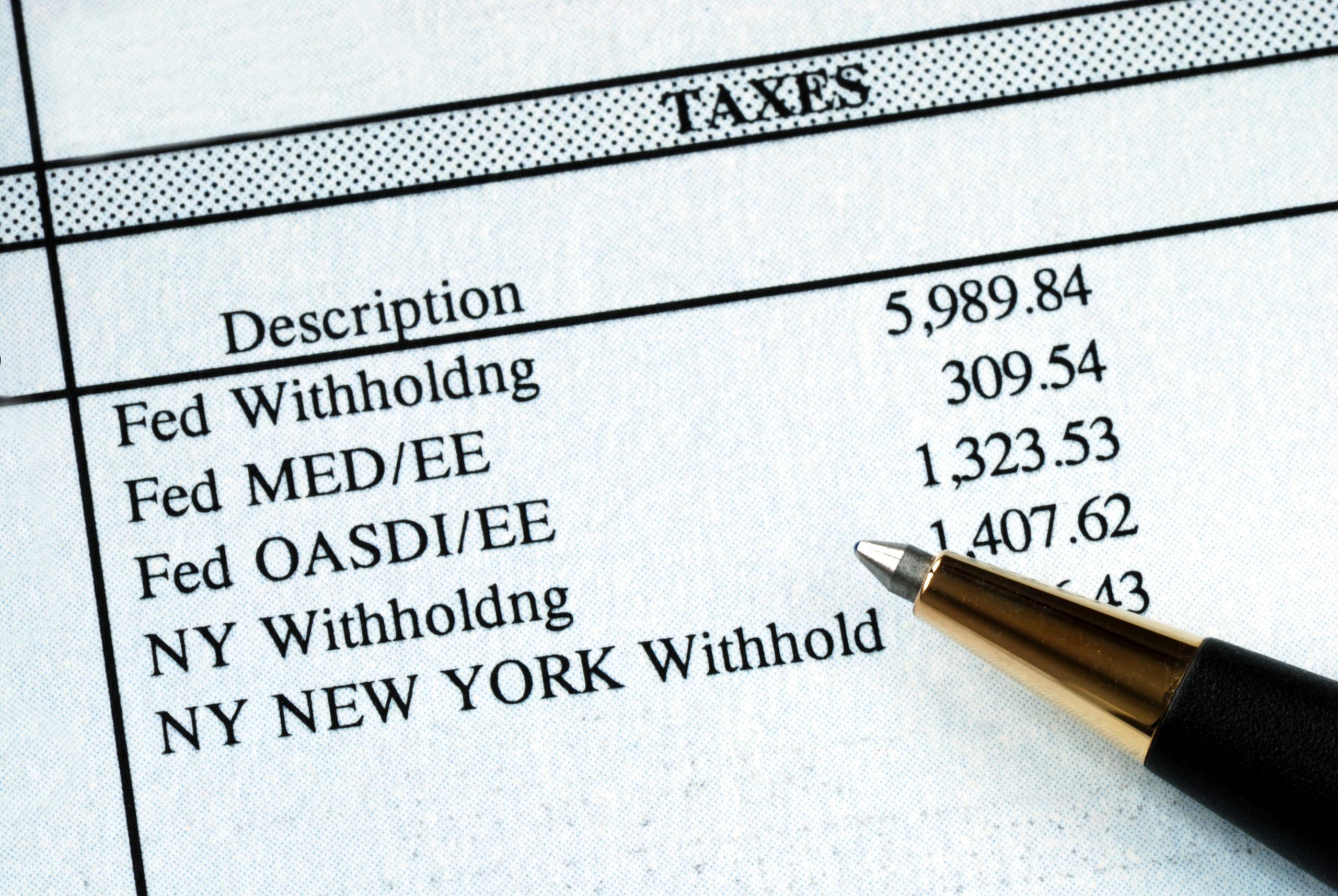

Payroll Tax Miscalculations

Payroll taxes must be accurately calculated, withheld, and paid on time to avoid penalties. Mistakes such as incorrect Social Security and Medicare withholdings, miscalculating state and local taxes, or failing to account for benefit deductions can lead to compliance issues. Missing tax deadlines can result in steep fines and interest charges from the IRS and state tax authorities.

Missed or Late Paychecks

Delays in payroll processing, whether due to clerical errors, banking issues, or lack of funds, can lead to serious problems. Employees rely on their paychecks to cover their expenses, and late payments can create financial hardships. In some cases, failing to pay employees on time may violate state labor laws, leading to legal repercussions.

Failure to Tack Paid Time Off (PTO) Properly

Mismanaging can cause disputes between employees and employers. If PTO accruals are not tracked correctly, employees may be shortchanged on vacation time or mistakenly paid for more time off than they have earned. Inaccurate PTO records can also create issues when employees leave a company and expect proper payouts for unused vacation time.

Garnishment and Deduction Forms

Court-ordered wage garnishments for child support, alimony, or unpaid debts must be handled accurately. Failing to withhold the correct amount can lead to legal consequences. Similarly, incorrect benefits deductions for healthcare, retirement plans, or voluntary contributions can result in compliance violations and employee dissatisfaction.

Failure to Maintain Payroll Records

Employers are required by law to maintain accurate payroll records for a set number of years. Losing or failing to update these records can cause problems during audits, tax filings, or disputes with employees over wages.

Professional accounting services can help small businesses avoid costly payroll errors.

What are the Consequences of Payroll Errors?

A payroll error can have serious financial, legal, and reputational consequences for your business. Even a small error may spiral into a time-consuming and stressful problem if not addressed promptly. Here is a look at some consequences you may face due to payroll errors:

Financial Penalties

Government agencies, such as the IRS or DOL, or state authorities may impose penalties for payroll mistakes. For instance, misclassifying an employee may lead to a fine. If such errors go uncorrected, you may have to pay interests and damages, straining cash flow.

Loss of Employee Trust

Payroll errors can quickly erode employee confidence in their employer. Workers expect to be paid accurately and on time, and any mistakes—especially repeated ones—can cause frustration and distrust. If employees feel they are being treated unfairly or are constantly dealing with paycheck issues, they may look for job opportunities elsewhere, increasing turnover rates.

Increased Administrative Burden

Fixing payroll errors is time-consuming and takes business owners and HR staff away from more productive tasks. This is due to the process of reprocessing payroll, filing amended tax documents, and communicating with employees about the issues.

Potential Audits

Frequent payroll errors may trigger audits by the IRS, DOL, or state tax agencies. These audits can be time-consuming, stressful, and costly, as businesses must provide extensive documentation to prove compliance. If violations are found, businesses may be required to pay back taxes, penalties, and legal fees.

Employee Lawsuits

Payroll disputes can escalate into legal action if employees feel they have been consistently underpaid or mistreated. Wage and hour lawsuits are common, particularly for unpaid overtime or misclassification issues.

How Can Payroll Errors Be Avoided?

Avoiding payroll mistakes may be as simple as implementing some best practices used by accountants like those at TMD Accounting. Here is a look at some things to help erase payroll problems:

- Use reliable payroll software: Use automated systems and AI to help reduce human error. There are a plethora of options to choose from. If you need help selecting payroll software, you can ask one of the accountants at TMD Accounting.

- Stay updated on tax laws and labor regulations: Staying compliant with federal and state regulations will help prevent additional penalities.

- Maintain accurate employee records: Ensure your employees are classified correctly and that tax forms are reviewed and updated when necessary.

- Schedule regular payroll audits: Reviewing payroll processes can catch mistakes beofre they become serious issues.

- Outsource payroll management: Working with a professional accounting service ensures accurate and compliant payroll processing (and also frees up some time for you to run your business). You also get peace of mind knowing that a professional is reviewing your records.

Professional accounting services can help small businesses avoid costly payroll errors.

Choose TMD Accounting for Accurate Bookkeeping and Payroll

Payroll errors can be a nightmare for small business owners, which is why it is essential to avoid them. TMD Accounting in South Jersey can help. Our team has been serving the community for over 40 years by providing reliable payroll and bookkeeping services, as well as tax preparation. We guarantee accuracy, compliance, and peace of mind. With our experience and knowledge, you can focus on growing your small business. Let us handle the complexities of payroll management.

Set up an appointment with an accountant at TMD Accounting today by calling 1-856-228-2205 or by filling out the online contact form. It’s time to streamline your payroll process and protect your business from costly errors.

FAQs

1. What are the most common payroll errors small businesses make?

Common errors include employee misclassification, incorrect wage calculations, missed tax deadlines, late paychecks, and inaccurate PTO or garnishment deductions.

2. Can payroll mistakes lead to IRS or state penalties?

Yes. Payroll tax errors, misclassifications, or missed deadlines can result in fines, interest charges, and even audits from the IRS or state tax agencies.

3. How do payroll errors affect employee morale?

Repeated paycheck issues or inaccuracies can cause employees to lose trust in their employer, leading to dissatisfaction, higher turnover, and recruitment challenges.

4. What tools can help prevent payroll mistakes?

Reliable payroll software, regular audits, up-to-date employee records, and outsourcing to professionals like TMD Accounting can significantly reduce payroll-related risks.

5. Are small businesses legally required to keep payroll records?

Yes. Employers must maintain accurate payroll records for several years to comply with federal and state labor laws and to prepare for potential audits or disputes.

6. How does outsourcing payroll benefit my business?

Outsourcing ensures accuracy, reduces administrative stress, and helps you stay compliant with evolving labor and tax laws—freeing you to focus on growing your business.

7. What are the signs that my business has payroll issues?

Frequent paycheck errors, employee complaints, delayed tax filings, and difficulty tracking PTO or deductions are all red flags of deeper payroll system problems.