How Contractors Can Prevent Job Cost Overruns with Better Accounting Practices

Introduction

You wrapped up the project. The customer is thrilled. But when you review the numbers, something doesn’t add up. Despite what looked like a profitable job on paper, your margins have vanished—or worse, you’ve dipped into the red.

If this has happened to you, you’re not alone. Job cost overruns are one of the biggest threats to profitability for small contractors. From surprise material hikes to labor inefficiencies and untracked change orders, the culprits are often preventable.

In this article, we’ll explore how better accounting practices can help contractors prevent job cost overruns, with practical tips tailored to construction businesses right here in South Jersey. Whether you’re a general contractor in Glassboro or a specialty trade in Deptford, it’s time to protect your profits.

📝 Quick Summary

This article explores how contractors can prevent job cost overruns by implementing precise job costing systems, real-time expense tracking, change-order documentation, and proactive financial oversight. These accounting practices are crucial for maintaining budgets, maximizing profitability, and staying competitive in the construction industry.

Understanding Job Cost Overruns in Construction

What Is a Job Cost Overrun?

Simply put, a job cost overrun happens when the actual cost of a project exceeds the estimated or budgeted cost. It’s the gap between what you planned to spend and what you actually spent.

Here’s how it often shows up:

- You estimated $50,000 for materials, labor, and overhead.

- At completion, the final tally is $58,000.

- That $8,000 difference? That’s your overrun—and your profit just took the hit.

The High Cost of Not Knowing

The real danger isn’t just the overrun—it’s not knowing it’s happening until the job is over. Without real-time tracking, you might not spot small problems (like a labor cost creep or extra material orders) until they snowball.

Job Cost Drift- The Hidden Risk Of No Real-Time Tracking

Common Causes of Job Cost Overruns

Inaccurate Bidding or Estimating

It all starts at the bid. If you’re using outdated pricing or “gut feelings” to create quotes, you’re building on shaky ground.

Fix it:

- Use historical job data to refine estimates.

- Update your labor and material rates regularly.

📞 Want to Stop Job Cost Overruns?

Partner with TMD Accounting—South Jersey’s construction accounting experts. We help contractors implement precise job cost tracking, change order systems, and real-time financial reviews to protect profits.

Let’s ensure your projects stay on budget.

📞 Call 856‑228‑2205 or schedule your FREE consultation now.

Poor Change Order Management

How many times have you done extra work without an approved change order? If it’s more than once, you’re leaking revenue.

Fix it:

- Require written approvals for all scope changes.

- Tie change orders to updated budgets and invoicing.

Inefficient Labor Tracking

Labor is often your biggest expense—and your biggest variable. Without proper tracking, it’s easy to underestimate costs.

Fix it:

- Use time-tracking tools like ClockShark or TSheets.

- Compare planned hours vs. actual hours weekly.

💡 Did You Know?

Over 25% of contractors report project profit margins shrinking due to undocumented change orders and misallocated costs. Accurate accounting practices can fully recover those margins—and increase profits.

Material Overages and Waste

Whether due to overordering, theft, or breakage, untracked material costs add up quickly.

Fix it:

- Assign a material budget per project phase.

- Require sign-off for unplanned material purchases.

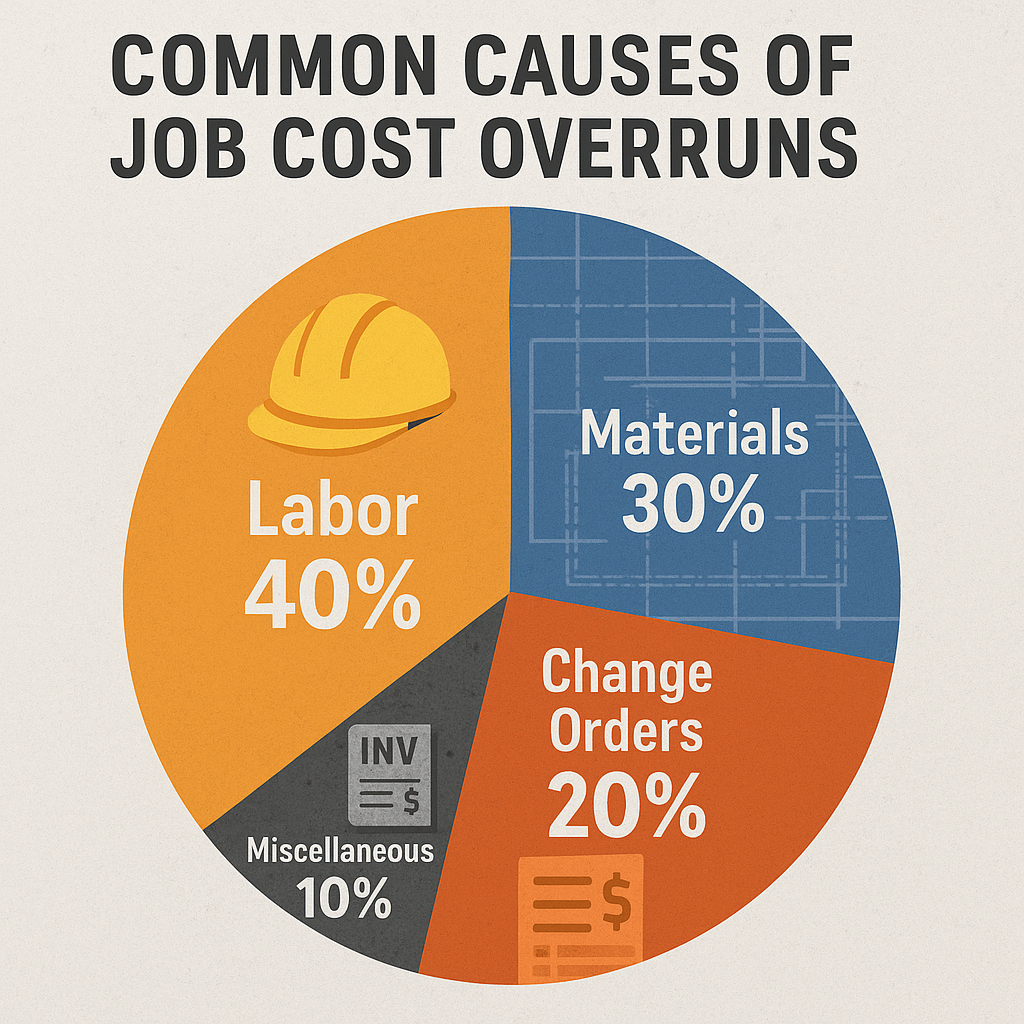

Pie chart showing a breakdown of typical cost overrun contributors (e.g., labor 40%, materials 30%, change orders 20%, other 10%)

How Better Accounting Practices Help

Implementing Project-Based Job Costing

Job costing means assigning every dollar spent to a specific project or job. But it’s not enough to just track it at a high level—you need to break it down.

Track by:

- Labor (hours, crew rates)

- Materials (by phase)

- Subcontractors

- Equipment usage

- Overhead allocation

Using Real-Time Financial Reporting

You can’t fix what you don’t see. Monthly reports are too late—issues need to be caught mid-project.

Tools to help:

- QuickBooks Online with construction add-ons

- Knowify or Buildertrend for integrated job costing dashboards

📍 Explore our Bookkeeping and Accounting Services for Contractors

Managing Change Orders with Accounting Software

Modern construction software lets you:

- Generate change orders from the field

- Get digital approvals

- Update project budgets automatically

Bonus: Apps like Procore and Joist offer mobile tools for real-time updates.

Tools That Improve Job Cost Accuracy

Construction-Focused Accounting Software

Recommended platforms:

- QuickBooks + Knowify: Great for small to mid-sized contractors

- Buildertrend: Full project management suite

- CoConstruct: Designed for custom builders

Integration with Payroll and Invoicing

One of the best ways to prevent overruns is syncing your:

- Time tracking

- Payroll

- Job budgets

- Client billing

This ensures you’re billing for all labor and materials accurately—and paying your team accordingly.

| Tool | Job Costing | Payroll Integration | Mobile Access | Change Order Automation |

|---|---|---|---|---|

| QuickBooks + Knowify | ✓ | ✓ | ✓ | ✓ |

| Buildertrend | ✓ | ✓ | ✓ | ✓ |

| CoConstruct | ✓ | ✓ | ✓ | ✓ |

Setting Up Internal Controls and Reviews

Weekly Job Cost Reviews

Get your team together once a week to compare:

- Estimated vs. actual labor hours

- Materials used vs. budget

- Any pending or approved change orders

Why it matters: Catching a $500 variance in Week 2 is better than finding a $5,000 overrun at project close.

Approval Processes for Expenses and Changes

Put guardrails in place:

- Require supervisor approval for any off-budget spending

- Track change orders in writing and attach to project budgets

✅ Pro tip: Digitize these processes to keep records clean and accessible.

Partnering with an Expert Construction Accountant

Why Industry-Specific Knowledge Matters

A general accountant might miss things like:

- Job phase costing

- Tax deductions for contractor equipment

- NJ-specific labor compliance

Work with someone who understands:

- Seasonality of construction in South Jersey

- Subcontractor payment regulations

- How to prevent cost overruns before they happen

How TMD Accounting Supports NJ Contractors

At TMD, we help contractors:

- Set up real-time job costing systems

- Integrate accounting software with payroll

- Stay compliant with New Jersey tax and labor rules

📍 Contact TMD Accounting for Contractor Accounting Help

❓ Frequently Asked Questions

- What is job costing and why is it important?

Job costing allocates expenses to specific projects so you can track profitability and adjust strategies in real-time. - How can contractors document change orders effectively?

Use standardized forms, obtain client sign-offs, and update accounting systems immediately. - Can software help with real-time expense tracking?

Yes—QuickBooks, Buildertrend, and CoConstruct offer real-time integration between field expenses and accounting records. - What financial reports should I review regularly?

Review job cost variance, budget vs actual, and cash flow statements monthly to catch overruns early. - How does TMD help contractors prevent overruns?

We implement job cost systems, reconcile field vs office data, ensure change orders are billed correctly, and provide monthly financial reviews.

Conclusion: Protect Your Projects—and Your Profits

Job cost overruns can eat your profits and put your business at risk. But with the right tools, processes, and support, you can catch issues early and make smarter decisions.

Don’t wait until the end of a project to discover you’ve lost money. A construction-savvy accountant can help you set up systems that track your true costs in real time.

🎯 Ready to eliminate cost overruns and maximize your job profits?

Schedule a free consultation with TMD Accounting and let’s protect your bottom line—one project at a time.

📚 Job Costing Resources

- IRS Construction Industry Guidance

- Construction Financial Management Association (CFMA)

- QuickBooks Construction Accounting Tools

- OSHA Construction Standards

These trusted resources support strong financial controls and job costing practices in the construction industry.