Cash Flow Challenges in Construction: Solutions for Small Contractors

You’re landing jobs, your crews are busy, and yet—somehow—your checking account looks like you’re in a slow season. If that sounds familiar, you’re not alone. Cash flow issues in construction are one of the biggest silent killers of small contracting businesses, especially here in South Jersey where seasonal work, long payment cycles, and unpredictable expenses collide.

This article tackles the cash flow challenges in construction and offers actionable solutions tailored for small contractors. Whether you’re running a drywall team in Deptford or managing roofing projects across Gloucester County, these strategies can help you stay financially stable, even when your schedule is packed.

Understanding the Cash Flow Crunch in Construction

Why Construction Is Prone to Cash Flow Issues

Construction is one of the few industries where you often have to spend big before you get paid. From materials and permits to payroll and equipment rentals, your costs start piling up weeks before the first invoice is approved—and that’s assuming your client pays on time.

Here’s why cash flow gets tricky:

- Billing delays: Projects are often paid on a net-30, net-60, or even net-90 basis.

- Change orders: Unexpected client requests lead to increased costs that might not be reimbursed immediately.

- Retention holdbacks: Some clients withhold 5–10% of payment until the entire project is finished.

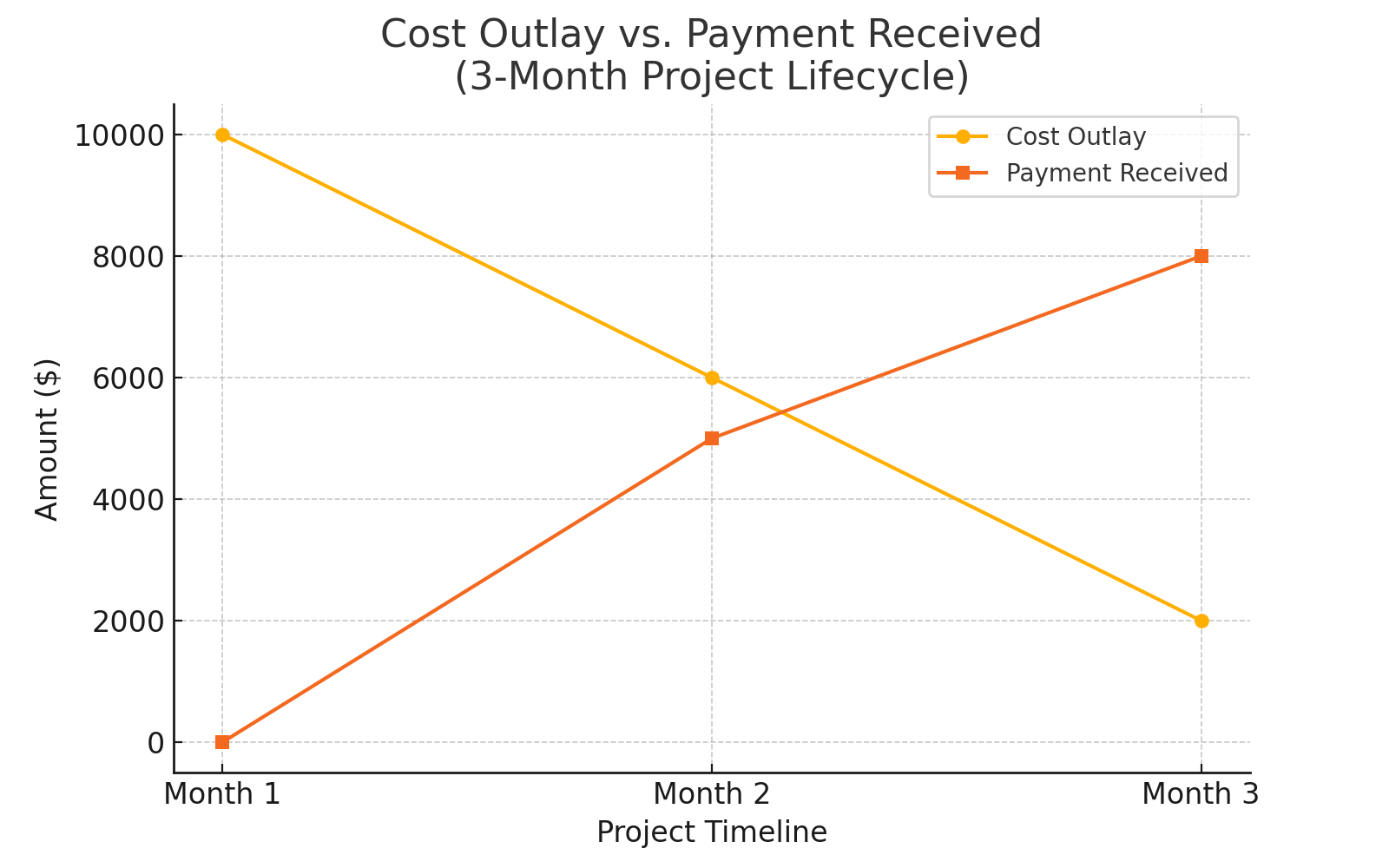

Cost Outlay vs. Payment Received

Common Mistakes Small Contractors Make

Common Mistakes Small Contractors Make

Poor Job Cost Estimation

One of the biggest pitfalls is underbidding—either to win the job or due to inaccurate cost forecasting. This leads to:

- Low or negative profit margins

- Surprise expenses that can’t be covered until the next job

Fix it: Use historical data and detailed scopes of work to estimate accurately, and add a contingency line for unexpected costs.

Lack of Project-Based Budgeting

Many small contractors manage their business finances in one lump sum, without breaking it down by project. The result? You don’t know which jobs are profitable—or bleeding cash.

Fix it: Use software like Buildertrend or CoConstruct to budget and track costs for each project phase.

Mixing Business and Personal Finances

This mistake makes it nearly impossible to assess your company’s true financial health and opens you up to tax headaches.

Fix it:

- Open a dedicated business checking account

- Use accounting software with project tracking (like QuickBooks Online)

Forecasting Your Cash Flow

Benefits of a Rolling Cash Flow Forecast

A rolling 12-week forecast helps you look ahead and see if (and when) you’ll run out of cash.

Why it works:

- Highlights timing gaps between revenue and expenses

- Enables preemptive action (e.g., delaying non-essential purchases)

- Helps you prioritize which clients to chase for payments

Tools to Use

- Excel templates tailored for contractors

- QuickBooks’ Cash Flow Planner

- Specialized tools like Knowify or Planyard

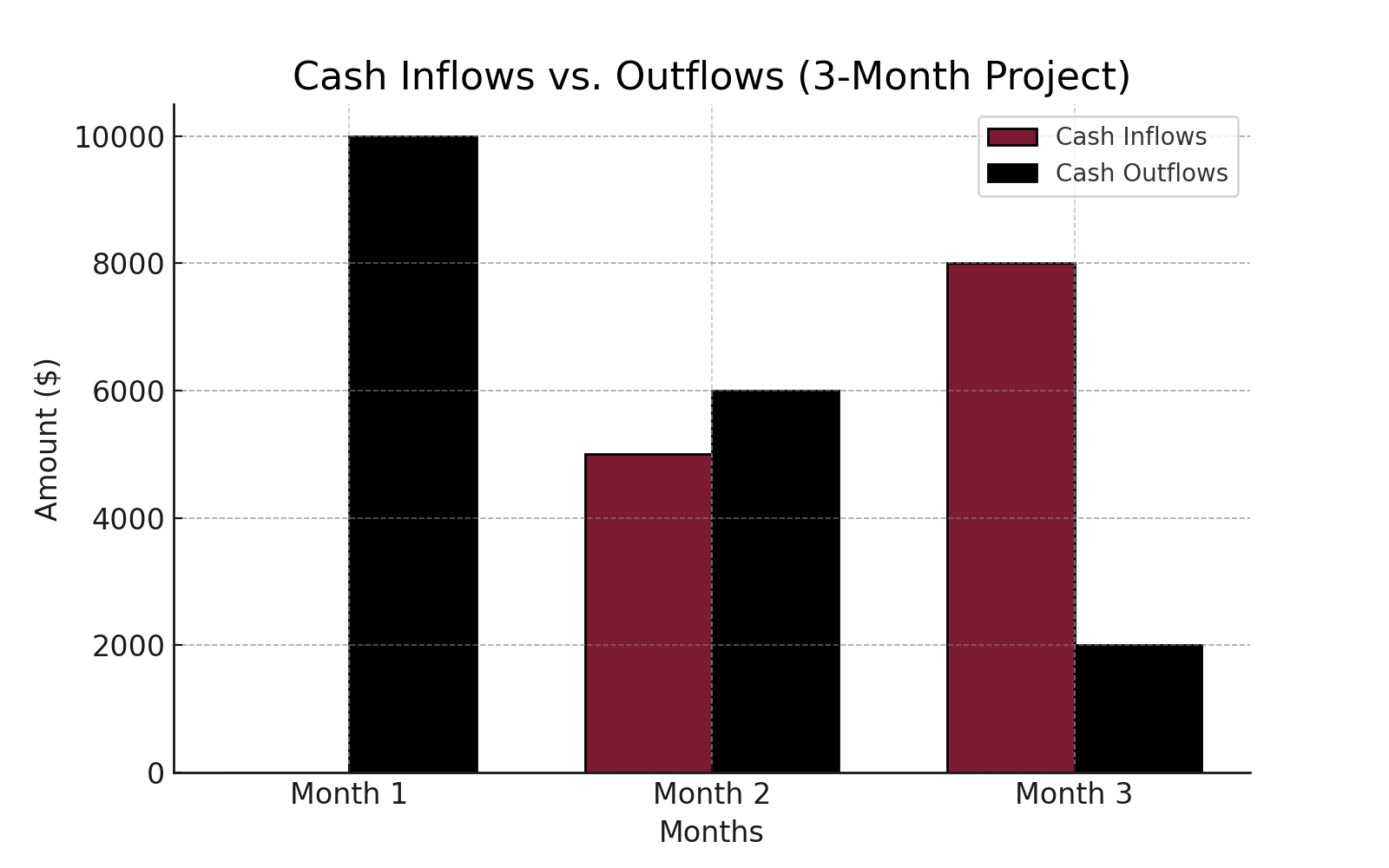

cash flow chart

Getting Paid Faster

Invoice on Milestones Instead of Completion

Don’t wait until the job is done to get paid. Break the contract into milestone-based payments (e.g., after demolition, framing, electrical, etc.).

Use Incentives and Late Fees

- Offer 1–2% discounts for early payment

- Implement reasonable late fees (check NJ legal limits)

Accept Digital Payments

Paper checks can delay payment by a week or more. Switch to:

- ACH transfers

- Credit card payments (consider processing fees in your quotes)

- Online payment portals like Bill.com or Stripe

Managing Payables Without Delaying Projects

Negotiate Vendor Terms

Your suppliers may offer net-30, net-45, or early pay discounts if you ask. Use these to align payments with client cash inflows.

Prioritize Payments Strategically

- Pay labor first to maintain workforce morale

- Prioritize materials that delay the schedule if unpaid

- Defer non-urgent overhead (e.g., equipment upgrades)

📌 Internal Link: Smart Accounting Practices for Contractors in NJ

Leveraging Financing Without Going into Debt

Short-Term Financing Options

- Business line of credit: Flexible, reusable, lower rates than credit cards

- Invoice factoring: Sell unpaid invoices for instant cash (beware of fees)

- Material financing: Get building materials now, pay after the job pays

When to Use Business Credit Cards

Use only for:

- Emergency purchases

- Small, recurring costs like gas or job site supplies

- Tracking expenses by employee or department

| Financing Method | Interest Rate / Fees | Repayment Terms | Best Use Case |

|---|---|---|---|

| Business Line of Credit | 7–15% APR | Flexible, revolving | Cover short-term cash gaps |

| Invoice Factoring | 2–5% per invoice | Paid upon invoice payment | Instant cash for outstanding invoices |

| Material Financing | Varies by supplier | Due after job payment | Purchase materials without upfront payment |

| Business Credit Card | 15–25% APR | Monthly minimums | Emergency or recurring small expenses |

Partnering With the Right Financial Professionals

Why a Construction-Savvy Accountant Matters

Not every accountant understands job costing or how weather delays affect revenue. Choose one who:

- Specializes in construction cash flow management

- Helps with tax deductions unique to contractors (like per diem rates, depreciation on tools, and project-based write-offs)

How TMD Accounting Supports NJ Contractors

We help local contractors with:

- Project-based financial reporting

- Budgeting and forecasting tools

- Payroll and tax compliance specific to New Jersey labor laws

📍 Internal Link: Accounting for Construction Businesses in New Jers

From Crunch to Control

Cash flow doesn’t have to be a rollercoaster. With the right systems, tools, and partners, you can keep your projects moving—and your bank account in the black.

You don’t have to manage it alone. At TMD Accounting, we’ve helped South Jersey contractors streamline their finances, increase profitability, and sleep better at night.

🎯 Ready to take control of your construction cash flow?

Contact us today for a free consultation tailored to your business.

FAQs

Q: Why is cash flow such a big issue in construction?

A: Because you often spend thousands on labor and materials long before clients pay their invoices.

Q: What is the best way to forecast cash flow for my business?

A: Use a rolling 12-week cash flow model and update it weekly. Include all receivables, payables, and expected job starts.

Q: Can I use personal funds to cover business expenses in a pinch?

A: You can—but you shouldn’t. It complicates taxes and makes it hard to track business health.