How to Prepare for Tax Season: A Month-by-Month Checklist for Small Businesses

Introduction

Tax season can be a stressful time for small business owners. With numerous deadlines, ever-changing tax laws, and the pressure to maximize deductions, it’s easy to feel overwhelmed. However, with proper planning and organization, you can navigate tax season smoothly and even uncover opportunities to save money.

In this comprehensive month-by-month guide, we’ll provide you with actionable steps to prepare for tax season effectively. By breaking down the process into manageable tasks, you’ll stay ahead of deadlines, maintain compliance, and position your business for financial success.

January: Kickstart Your Tax Preparation

1. Organize Financial Records

- Gather Documents: Collect all financial records from the previous year, including income statements, expense receipts, bank statements, and invoices.

- Update Accounting Books: Ensure your bookkeeping is up-to-date. Reconcile accounts and verify that all transactions are accurately recorded.

- Digital Organization: Use accounting software or cloud-based systems to store and organize documents digitally for easy access.

2. Issue Required Forms

- Form W-2: Provide W-2 forms to all employees by January 31.

- Form 1099-NEC: Send 1099-NEC forms to independent contractors and freelancers you’ve paid $600 or more during the year.

3. Review Tax Law Changes

- Stay Informed: Consult with a tax professional or refer to IRS resources to understand any new tax laws or changes that may affect your business.

- Adjust Strategies: Modify your tax planning strategies accordingly to remain compliant and take advantage of new opportunities.

February: Double-Check and Prepare

1. Verify Employee Information

- Confirm Details: Ensure all employee and contractor information (names, addresses, Social Security numbers) is correct on tax forms.

- Address Corrections: Update any incorrect or outdated information promptly.

2. Review Deductions and Credits

- Identify Eligible Deductions: Consider business expenses such as office supplies, travel, marketing costs, and home office deductions.

- Explore Tax Credits: Research available tax credits like the Small Business Health Care Tax Credit or credits for energy-efficient improvements.

3. Schedule a Meeting with Your Accountant

- Professional Consultation: Set up an appointment with your accountant to review your financials and discuss tax-saving strategies.

- Prepare Questions: List any concerns or topics you want to address during the meeting.

March: Finalize and File

1. Complete Your Tax Return

- Compile Necessary Forms: Gather all required IRS forms, such as Schedule C for sole proprietors or Form 1120 for corporations.

- Fill Out Accurately: Ensure all information is accurate to avoid processing delays or audits.

2. Review Before Filing

- Double-Check Entries: Verify all figures, calculations, and personal information.

- Check Deadlines: Remember that S-corporations and partnerships have a March 15 filing deadline, while sole proprietors and C-corporations have until April 15.

3. Consider Filing Extensions

- Need More Time? If necessary, file for an extension using Form 7004 for businesses.

- Understand Implications: An extension grants more time to file but not to pay any taxes owed. Estimate and pay any expected taxes to avoid penalties.

Stay ahead of tax season with our month-by-month preparation checklist for small businesses.

April: Meet the Deadline

1. File Your Tax Return

- Submit On Time: Ensure your tax return is filed by the appropriate deadline (April 15 for most businesses).

- Choose Filing Method: Decide between e-filing for faster processing or mailing a paper return.

2. Pay Taxes Owed

- Calculate Payment: Determine any taxes owed and submit payment by the deadline to avoid interest and penalties.

- Set Up Payment Plans: If you can’t pay in full, consider arranging a payment plan with the IRS.

3. Plan for Estimated Taxes

- Quarterly Payments: Mark your calendar for upcoming estimated tax payments due in June, September, and January.

- Calculate Estimates: Use your current financial data to estimate quarterly payments and avoid underpayment penalties.

May: Organize and Reflect

1. File and Store Tax Documents

- Create a Filing System: Organize your tax return and supporting documents in a secure location.

- Digital Backups: Scan and save electronic copies of all documents.

2. Analyze Tax Outcomes

- Review Results: Assess your tax liability or refund to understand your business’s financial health.

- Identify Trends: Look for patterns in income and expenses that can inform future planning.

3. Update Financial Projections

- Adjust Budgets: Incorporate tax outcomes into your financial forecasts and budgets.

- Plan for Growth: Use insights gained to strategize business expansion or investments.

June: Mid-Year Tax Planning

1. Evaluate Year-to-Date Performance

- Assess Financials: Review income statements and balance sheets for the first half of the year.

- Adjust Strategies: Modify business plans based on performance, focusing on areas needing improvement.

2. Review Estimated Tax Payments

- Second Quarter Payment: Remember to make your quarterly estimated tax payment by June 15.

- Recalculate Estimates: Adjust payment amounts if your income has significantly changed.

3. Consult with Your Accountant

- Mid-Year Check-In: Meet with your accountant to discuss tax strategies and potential savings for the rest of the year.

- Tax Law Updates: Stay informed about any mid-year tax law changes that could affect your business.

July: Implement Tax-Saving Strategies

1. Invest in Retirement Plans

- Contribute to Plans: Consider contributing to retirement plans like SEP IRAs or 401(k)s for tax benefits.

- Employer Contributions: Evaluate the feasibility of making employer contributions to employee retirement accounts.

2. Consider Depreciation Strategies

- Section 179 Deduction: Plan for the purchase of equipment or software that can be deducted.

- Bonus Depreciation: Understand how bonus depreciation can accelerate deductions on qualified assets.

3. Optimize Business Expenses

- Track Expenses: Ensure all business expenses are being recorded accurately.

- Implement Cost-Cutting Measures: Identify non-essential expenses that can be reduced or eliminated.

August: Stay Organized

1. Update Record-Keeping

- Reconcile Accounts: Match bank statements with your accounting records.

- Audit Proofing: Keep receipts and documentation organized to substantiate deductions.

2. Review Payroll Taxes

- Ensure Compliance: Verify that payroll taxes are being withheld and remitted correctly.

- Address Errors: Correct any discrepancies promptly to avoid penalties.

3. Plan for Year-End

- Tax Credits: Research and plan to take advantage of any tax credits before year-end.

- Charitable Contributions: Consider making donations that can provide tax benefits.

September: Prepare for Final Quarter

1. Third Quarter Estimated Taxes

- Due Date Reminder: Make your quarterly estimated tax payment by September 15.

- Adjust for Changes: Recalculate if your income or expenses have changed significantly.

2. Inventory Assessment

- Conduct Inventory Check: Evaluate stock levels to plan for year-end sales and deductions.

- Write-Off Obsolete Inventory: Identify and dispose of unsellable inventory for potential tax benefits.

3. Review Tax Strategies

- Maximize Deductions: Plan for additional expenses or investments that can reduce taxable income.

- Plan for Capital Expenditures: Consider purchasing equipment or property before year-end to take advantage of depreciation deductions.

October: Final Preparations

1. Extended Tax Return Filing

- Extension Deadline: If you filed for an extension, remember that October 15 is the final deadline.

- Complete Filing: Ensure all information is accurate and submitted on time.

2. Employee Benefits Review

- Plan Open Enrollment: Set up employee benefits enrollment periods if applicable.

- Tax-Advantaged Accounts: Encourage participation in HSAs or FSAs for tax benefits.

3. Year-End Tax Planning Meeting

- Strategize with Your Accountant: Discuss last-minute strategies to minimize tax liability.

- Review Financial Goals: Align tax planning with your overall business objectives.

November: Optimize and Adjust

1. Finalize Tax Strategies

- Implement Changes: Execute any remaining tax-saving strategies identified with your accountant.

- Document Actions: Keep detailed records of all transactions and decisions.

2. Update Accounting Software

- Software Maintenance: Ensure your accounting software is updated to the latest version.

- Integrate Add-Ons: Consider integrating tools that streamline tax preparation and financial management.

3. Prepare for Holiday Season

- Seasonal Expenses: Account for increased expenses or revenues during the holiday period.

- Marketing Investments: Plan promotional activities that can boost sales and offer tax benefits.

December: Wrap Up the Year

1. Make Final Purchases

- Capital Expenditures: Complete purchases of equipment or assets to qualify for deductions.

- Supplies and Inventory: Stock up on necessary supplies that can be expensed.

2. Conduct Year-End Payroll

- Bonuses and Compensation: Issue any year-end bonuses and ensure proper tax withholding.

- W-2 Preparation: Begin preparing W-2 forms for employees.

3. Charitable Contributions

- Donate to Charities: Make last-minute donations to qualified organizations for additional deductions.

- Document Donations: Keep receipts and acknowledgment letters for tax records.

4. Review and Reflect

- Assess Annual Performance: Compare actual performance against goals set at the beginning of the year.

- Set Goals for Next Year: Use insights gained to plan for the upcoming year.

Conclusion

Preparing for tax season doesn’t have to be a daunting task. By following this month-by-month checklist, small business owners can stay organized, maximize deductions, and ensure compliance with tax laws. Regular planning and consultation with a tax professional can alleviate stress and position your business for financial success.

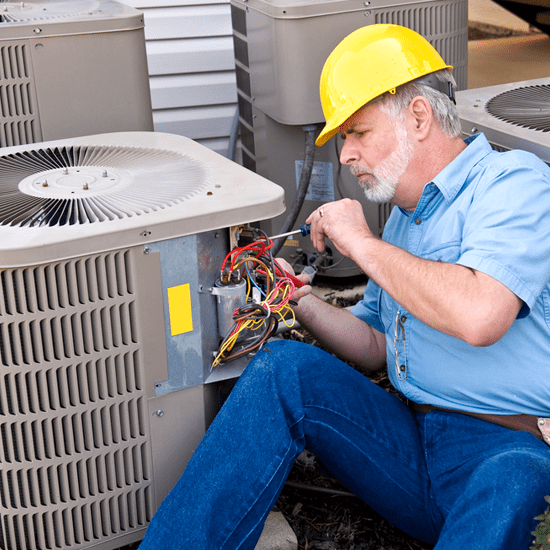

At TMD Accounting, we’re committed to helping small businesses in South Jersey navigate the complexities of tax preparation. With nearly 40 years of experience, our team offers personalized services tailored to your unique needs.

Call to Action

Ready to simplify your tax season? Contact TMD Accounting today for expert guidance and support.

- Phone: 1-856-228-2205

- Email: info@tmdaccounting.com

- Website: tmdaccounting.com

FAQs

1. Why is year-round tax planning important for small businesses?

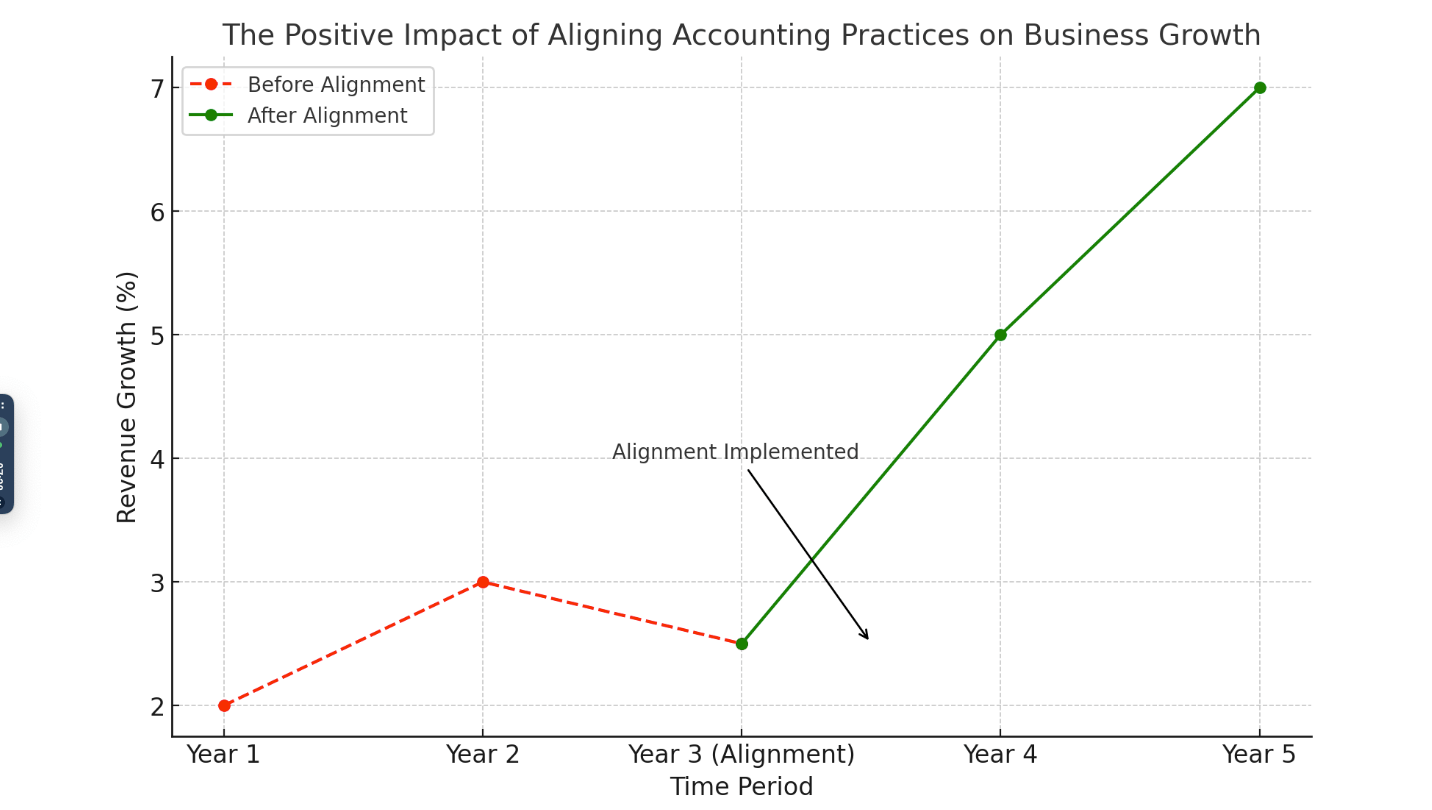

Year-round tax planning helps small businesses stay organized, maximize deductions, avoid last-minute stress, and ensure compliance with tax laws. It allows for proactive strategies that can reduce tax liabilities and improve financial performance.

2. How can TMD Accounting assist with tax preparation?

TMD Accounting offers comprehensive tax services, including preparation, planning, and consulting. Our experienced team can help you navigate complex tax laws, identify opportunities for savings, and ensure accurate and timely filing.

3. What are estimated tax payments, and do I need to make them?

Estimated tax payments are quarterly payments made by businesses and individuals to cover income tax liabilities. If you expect to owe $1,000 or more in taxes when you file your return, you are generally required to make these payments to avoid penalties.

4. What should I do if I can’t pay my taxes in full by the deadline?

If you cannot pay your taxes in full, you should still file your return on time to avoid penalties. You can contact the IRS to discuss payment plans or installment agreements to pay your tax debt over time.