Franchise Financial Management: Balancing Corporate Expectations and Local Challenges

Imagine you’re running a franchise—maybe a popular sandwich shop in Washington Township or a fitness center in Glassboro. You’ve got two voices in your ear: corporate HQ with its strict budgets and brand rules, and your local customers with unique needs, expectations, and seasonal habits. Sound familiar?

Franchise financial management isn’t just about keeping the books clean—it’s about balancing the demands of the big brand with the realities of life in South Jersey. If you’ve ever felt caught between compliance and community, this article’s for you.

Let’s explore how franchise owners in Gloucester County can meet corporate expectations while thriving locally—with financial strategies tailored for our unique market.

Understanding the Franchise Financial Model

Fixed Corporate Requirements

When you sign a franchise agreement, you agree to follow a specific playbook. That includes:

- Royalty payments (typically 4–8% of gross revenue)

- Marketing fund contributions

- Mandated vendors or pricing models

These rules protect the brand but can sometimes restrict flexibility in local operations.

Variable Local Expenses

Now add South Jersey’s local flavor to the mix:

- Higher utility rates in certain townships

- Seasonal workforce needs (shore traffic in summer, quieter winters)

- Local taxes and regulations specific to New Jersey

Creating Two Budgets: Corporate vs. Local

Think of this as wearing two financial hats. Your corporate budget ensures compliance with franchise targets, while your local budget allows flexibility for things like community event sponsorships or adjusting labor costs.

Pro Tip: Use cloud-based accounting software that lets you run dual budgets with scenario planning (QuickBooks Online or Xero).

Corporate Budget vs. Local Budget for Franchise Owners in NJ”:

| Feature | Corporate Budget | Local Budget (South Jersey Franchise) |

|---|---|---|

| Focus | Brand Consistency | Market Flexibility |

| Spending Authority | Restricted—guided by franchisor policies | Adaptable—based on local needs and trends |

| Examples | Royalty Payments, Marketing Fund Contributions | Community Event Sponsorships, Local SEO Spending |

| Tools Used | Corporate ERP Systems | QuickBooks or Xero with scenario planning |

| Decision-Makers | Franchisor | Local Franchisee (e.g., Washington Twp. owner) |

Incorporating Seasonal Trends in South Jersey

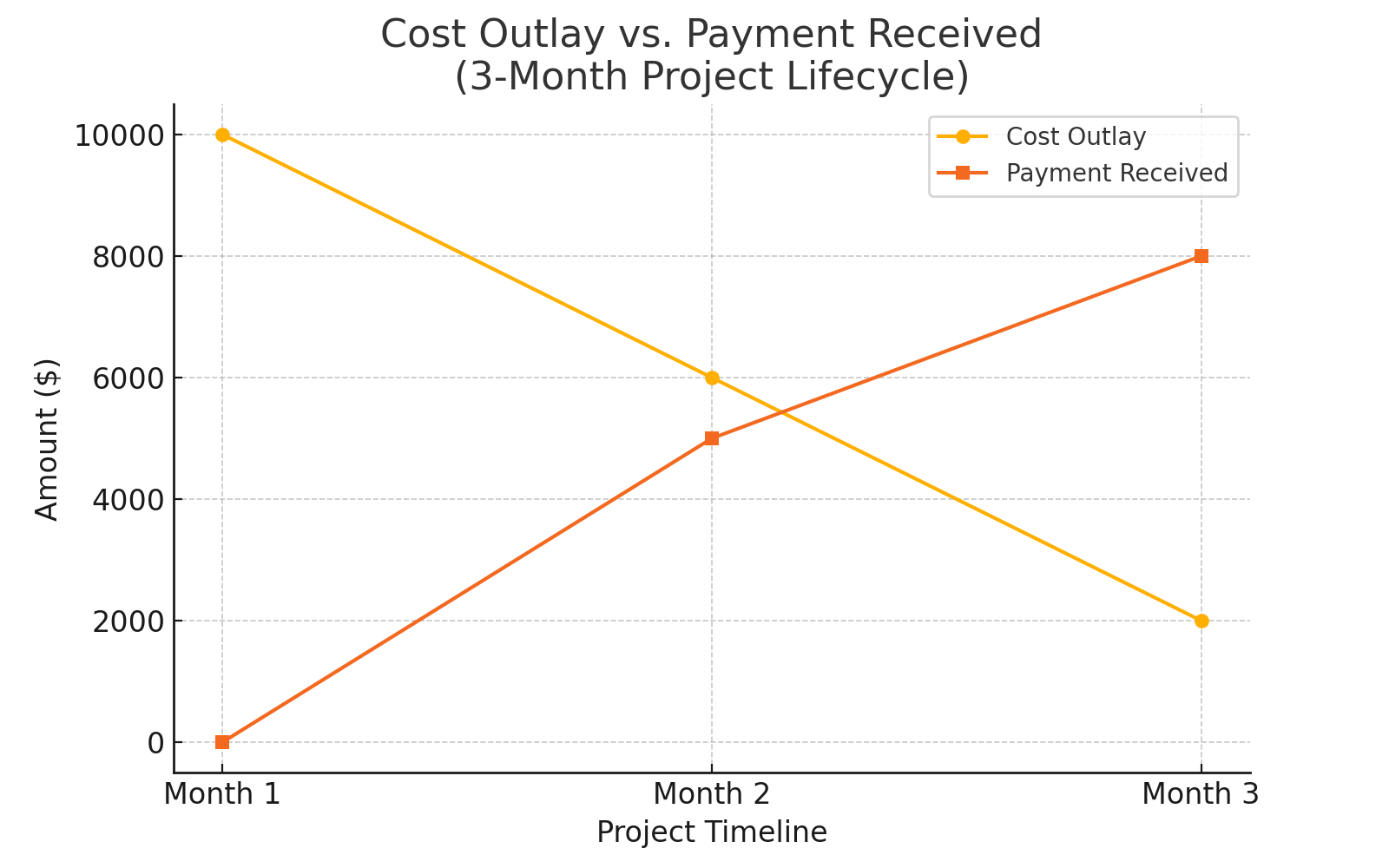

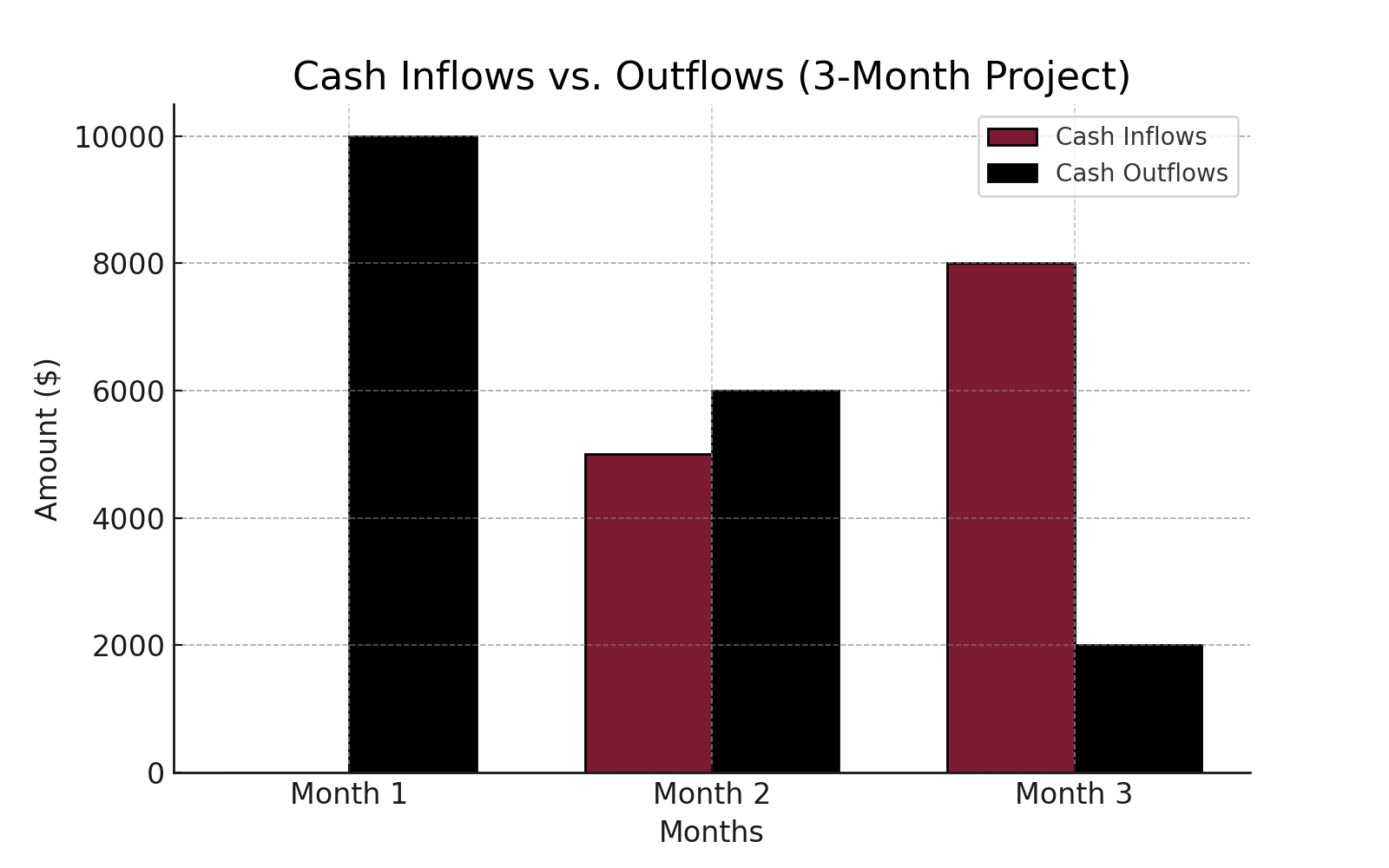

South Jersey’s seasons aren’t just about weather—they influence foot traffic, sales, and labor needs.

- Spring/Summer: Increased demand for food, fitness, and outdoor services

- Fall/Winter: Potential slowdown and higher utility bills

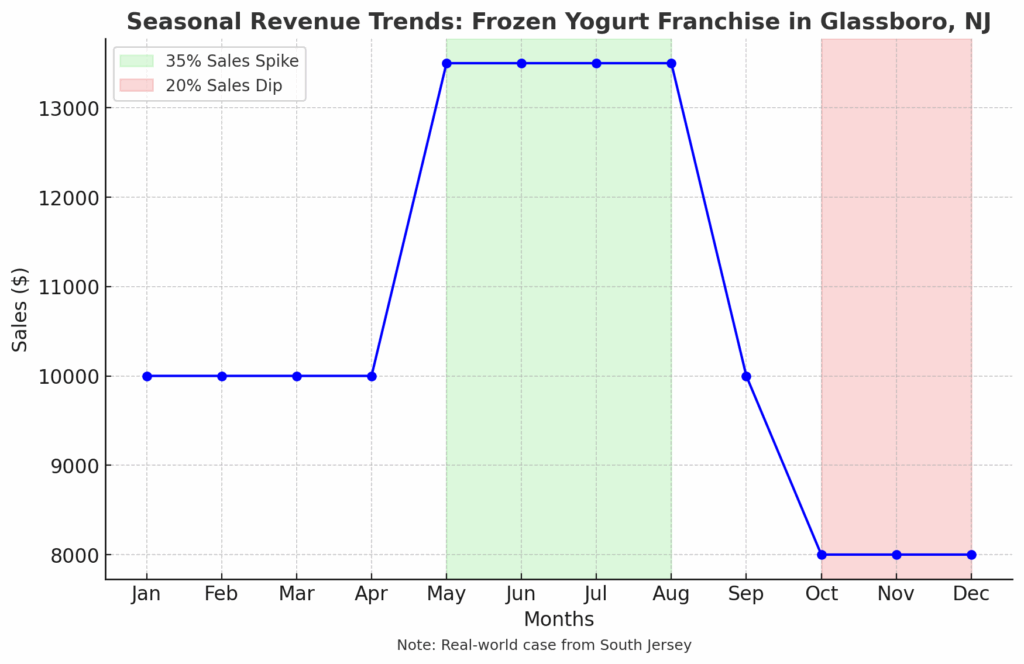

🔍 Example: A Glassboro frozen yogurt franchise reported a 35% sales spike from May to August, while seeing a 20% dip in Q4.

Seasonal Revenue Trends: Frozen Yogurt Franchise in Glassboro, NJ

Tax Compliance and Deductions for Franchisees

Navigating State vs. Federal Rules

New Jersey has its own quirks when it comes to tax:

- NJ sales tax is 6.625%—but with local variations

- State-level employment taxes and surcharges can surprise new franchisees

Working with a local accountant who knows both IRS and NJ Division of Taxation standards is critical.

Industry-Specific Deductions

Common (and often overlooked) deductions include:

- Franchise fees (amortized over time)

- Initial training costs

- Uniforms and branded materials

- Payroll taxes (especially with part-time seasonal staff)

💡 Internal link: Explore our Tax Services for South Jersey Businesses

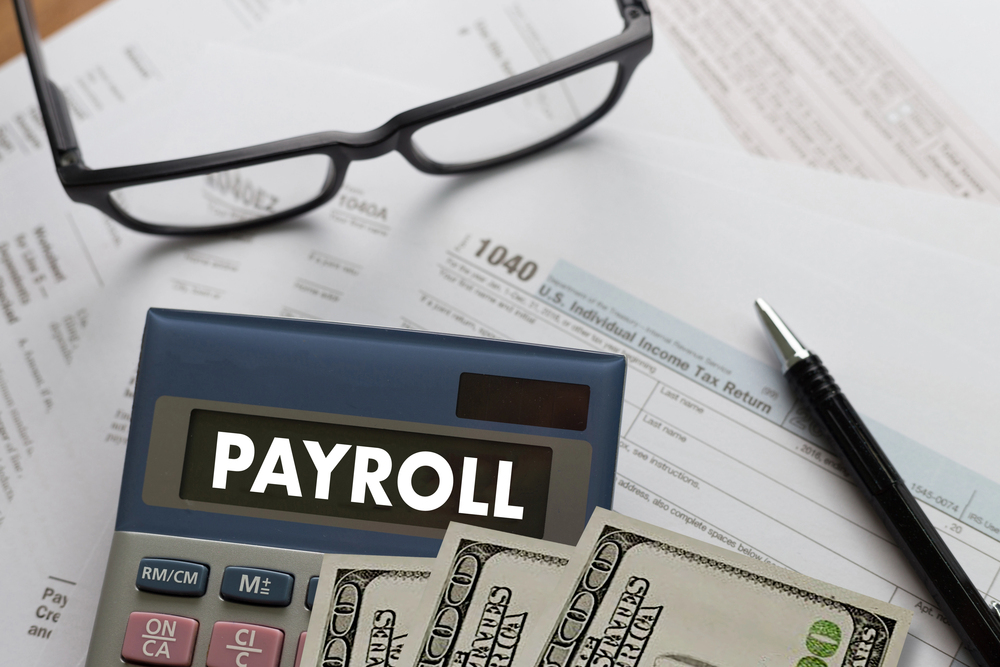

Managing Payroll and Staffing Challenges

Now Hiring” sign in a storefront, highlighting the staffing considerations for franchise owners, especially with seasonal hiring in mind.

Minimum Wage and Seasonal Hiring

New Jersey’s minimum wage increased to $15/hour for many businesses in 2024, which affects:

- Hiring timelines

- Training costs

- Employee turnover rates

You might need more staff in June but far fewer in January. Planning ahead avoids overspending or understaffing.

Payroll Services Tailored for Franchise Models

Using professional payroll services helps:

- Ensure on-time tax filings

- Manage benefits for full- and part-time staff

- Track hours and overtime by location

📌 Internal link: Learn how TMD Accounting supports Franchise Payroll

Internal Reporting and Performance Metrics

KPIs from Corporate vs. Local Metrics

Corporations love standardized metrics like:

- Sales per square foot

- Average transaction value

But Gloucester County franchises may need to look deeper:

- Local customer retention

- Online vs. in-store sales

- Staff turnover

Dashboard Tip: Use tools like Gusto or Square to integrate POS data with local financial reporting.

Navigating Financial Audits and Reviews

Preparing for Franchisor Audits

Many corporate offices conduct annual or surprise audits. Be prepared with:

- Digital records of transactions

- Signed vendor agreements

- Payroll and tax compliance reports

Conducting Your Own Internal Financial Reviews

Quarterly reviews allow you to catch issues before they become corporate compliance problems. Partnering with a South Jersey accountant who knows the franchise landscape can save you time and penalties.

A business professional analyzes financial reports, crucial for managing franchise finances and understanding performance metrics.

Real-World Success Stories in Gloucester County

Case Study: Fitness Franchise in Turnersville

When rising utility bills threatened profit margins, this franchise:

- Installed smart thermostats

- Partnered with a local CPA to identify missed energy deductions

- Cut costs by 18% without changing staffing levels

Case Study: Quick-Service Restaurant in Sewell

By shifting ad spend from national campaigns to targeted local SEO and Google Ads, the owner:

- Doubled weekend traffic

- Gained freedom from corporate pushback due to improved ROI

Finding Financial Freedom Within Franchise Limits

Corporate wants consistency. Your town wants personality. With smart franchise financial management, you can deliver both—and still sleep soundly at night.

Here’s the secret: know where you can bend, and where you must stay firm. The right financial strategy, backed by a local expert, makes all the difference.

🎯 Ready to get control of your franchise finances?

Contact TMD Accounting today for a free consultation with a Gloucester County small business specialist.

FAQs

Q: What’s the biggest financial challenge franchisees face?

A: Balancing mandated corporate expenses with unpredictable local costs—especially in areas with seasonal business like South Jersey.

Q: Can I negotiate with corporate on financial policies?

A: Sometimes, especially if you can show data-backed reasons for local adaptations. A strong local financial record helps your case.

Q: Is it worth hiring a local accountant if I already have corporate tools?

A: Absolutely. Corporate tools aren’t customized to New Jersey tax law or Gloucester County nuances. Local expertise prevents costly mistakes.