How to Align Your Accounting Practices with Your Small Business’s Growth Goals: A Comprehensive Guide

Introduction

The Critical Connection Between Accounting and Growth

In the dynamic world of small business, growth isn’t just a goal—it’s a necessity for survival and competitiveness. However, many entrepreneurs overlook a critical component that can either propel or hinder this growth: accounting practices. Aligning your accounting practices with your small business’s growth goals is essential. It ensures that financial data accurately reflects your business’s performance, providing insights that inform strategic decisions.

Misaligned accounting and growth strategies can lead to several pitfalls. These include cash flow problems, inaccurate financial forecasting, missed opportunities for tax savings, and difficulties in securing financing. Without a clear financial roadmap, even businesses with strong market demand can struggle to scale effectively.

Purpose of the Guide

This comprehensive guide aims to equip small business owners with the knowledge and tools necessary to synchronize their accounting practices with their growth objectives. We’ll explore actionable steps and expert insights to help you:

- Define and assess your growth goals.

- Understand the strategic role of accounting in business expansion.

- Implement accounting practices that support and drive growth.

- Leverage financial data for better decision-making.

- Enhance financial transparency to attract investors and lenders.

By the end of this guide, you’ll have a clear understanding of how to transform your accounting function from a basic record-keeping role into a strategic partner in your business’s growth journey.

Understanding Your Small Business Growth Goals

1. Understanding Your Small Business Growth Goals

Defining Clear Growth Objectives

The first step in aligning your accounting practices with your growth goals is to clearly define what those goals are. Growth can take many forms, including:

- Revenue Increase: Boosting sales and income.

- Market Expansion: Entering new geographical areas or market segments.

- Product Diversification: Introducing new products or services.

- Customer Base Growth: Acquiring new customers or increasing customer retention.

- Operational Efficiency: Streamlining processes to reduce costs and improve margins.

To ensure these goals are actionable, apply the SMART criteria:

- Specific: Clearly define what you want to achieve.

- Measurable: Establish metrics to track progress.

- Achievable: Set realistic goals considering your resources.

- Relevant: Align goals with your overall business strategy.

- Time-bound: Set deadlines to create a sense of urgency.

Example: Instead of setting a vague goal like “increase sales,” specify “increase online sales by 20% in the next 12 months.”

Assessing Your Current Position

Before you can chart a path forward, you need a realistic understanding of where your business stands financially. This involves:

- Analyzing Financial Statements: Review your income statement, balance sheet, and cash flow statement.

- Evaluating Profitability: Determine your net profit margin to assess how much profit you’re generating from your revenues.

- Assessing Liquidity: Check your current ratio to understand your ability to meet short-term obligations.

- Identifying Trends: Look at financial data over time to spot positive or negative trends.

Key Performance Indicators (KPIs) relevant to growth include:

- Revenue Growth Rate

- Gross Profit Margin

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (CLV)

- Inventory Turnover

Regularly monitoring these KPIs will help you measure progress toward your growth goals and make informed decisions.

2. The Role of Accounting in Business Growth

Accounting as a Strategic Tool

Accounting is more than just bookkeeping; it’s a strategic tool that provides critical insights into your business’s financial health. Accurate accounting data allows you to:

- Make Informed Decisions: Determine which products or services are most profitable.

- Allocate Resources Effectively: Decide where to invest for the best return.

- Plan for the Future: Develop realistic budgets and financial forecasts.

Transitioning from basic bookkeeping to strategic financial planning involves:

- Implementing Advanced Accounting Software: Utilize tools that offer analytics and reporting features.

- Engaging in Financial Modeling: Use historical data to predict future financial performance under various scenarios.

- Regular Financial Reviews: Schedule periodic reviews to adjust strategies as needed.

Financial Transparency and Investor Confidence

Transparent and accurate financial reporting builds trust with stakeholders, including investors, lenders, and potential partners. Benefits include:

- Attracting Investment: Clear financials make your business more attractive to investors.

- Improving Creditworthiness: Lenders are more likely to offer favorable terms to businesses with solid financial records.

- Enhancing Reputation: Transparency demonstrates professionalism and reliability.

To improve financial transparency:

- Adopt Standardized Reporting: Use generally accepted accounting principles (GAAP).

- Conduct Regular Audits: Internal or external audits can validate the accuracy of your financial statements.

- Provide Detailed Reports: Go beyond basic statements to include notes and management discussions.

3. Conducting a Comprehensive Financial Analysis

Analyzing Financial Statements

A thorough financial analysis involves examining your:

- Balance Sheet: Understand your assets, liabilities, and equity to gauge financial stability.

- Income Statement: Assess revenues and expenses to determine profitability.

- Cash Flow Statement: Monitor cash inflows and outflows to manage liquidity.

Look for patterns such as increasing revenues but declining profits, which could indicate rising costs. Use ratio analysis to benchmark performance against industry standards.

Identifying Financial Strengths and Weaknesses

- Strengths: High liquidity, strong profit margins, low debt levels.

- Weaknesses: Cash flow issues, high operational costs, heavy reliance on a few customers.

Recognizing these areas allows you to capitalize on strengths and address weaknesses proactively.

4. Aligning Accounting Practices with Growth Strategies

Budgeting for Growth

A growth-oriented budget allocates resources to areas that drive expansion. Steps include:

- Setting Revenue Targets: Based on your growth goals.

- Estimating Expenses: Consider both fixed and variable costs, including new investments.

- Allocating Capital Expenditures: Plan for assets needed to support growth, like equipment or technology.

Implementing Robust Accounting Systems

Modern accounting software can automate processes, reduce errors, and provide real-time financial data. Features to look for:

- Scalability: Ability to handle increased transactions as you grow.

- Integration: Compatibility with other systems like CRM or inventory management.

- Reporting Tools: Customizable reports and dashboards.

Cost Management and Reduction

Effective cost control frees up resources for growth initiatives.

- Analyze Expenses: Identify non-essential costs to cut.

- Negotiate with Suppliers: Seek better terms or bulk discounts.

- Improve Operational Efficiency: Streamline processes to reduce waste.

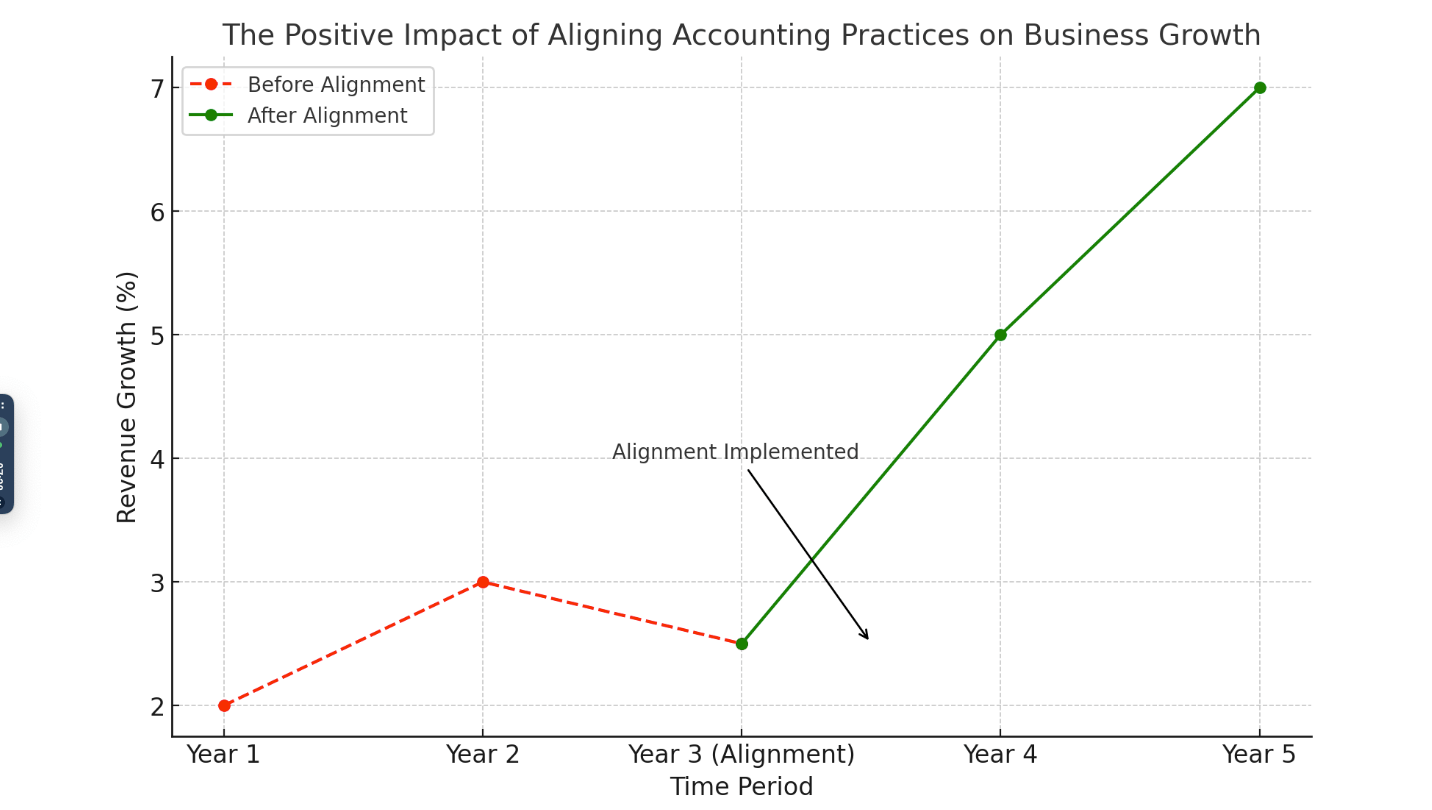

Here is the graph that illustrates the positive impact of aligning accounting practices on business growth. The red dashed line represents the slower growth rates before alignment, while the green solid line shows accelerated growth after alignment.

The key milestone, where alignment was implemented, is highlighted with an annotation. This visual helps demonstrate the correlation between improved accounting practices and business growth over time.

5. Cash Flow Management

Understanding Cash Flow Dynamics

Profitability doesn’t always equate to positive cash flow. Understanding the timing of cash inflows and outflows is crucial.

Improving Cash Flow

- Efficient Invoicing: Implement prompt billing and consider incentives for early payments.

- Inventory Management: Avoid overstocking to reduce holding costs.

- Expense Control: Monitor and adjust expenses in line with cash flow cycles.

Cash Flow Forecasting

Predict future cash positions to anticipate shortages or surpluses. This helps in:

- Planning Investments: Timing capital expenditures when cash is available.

- Securing Financing: Arranging lines of credit before cash crunches occur.

6. Tax Planning Aligned with Growth Goals

Proactive Tax Strategy

Effective tax planning minimizes liabilities and maximizes savings.

- Regular Reviews: Adjust tax strategies as your business evolves.

- Understand Tax Implications: Growth can change your tax obligations, especially if expanding into new states or hiring more employees.

Leveraging Tax Incentives

- Research and Development Credits: For businesses investing in innovation.

- Depreciation Deductions: Accelerated depreciation on equipment can reduce taxable income.

- State-Specific Incentives: New Jersey offers programs for small businesses; explore these options.

Working with a Small Business Tax Accountant

A professional can help navigate complex tax codes, ensure compliance, and identify savings opportunities.

7. Scaling Accounting Functions

When to Upgrade Your Accounting Team

Signs that you may need additional accounting support include:

- Rapid Growth: Increased transaction volume overwhelms current staff.

- Complex Financial Activities: Mergers, acquisitions, or new product lines.

- Compliance Challenges: Struggling to keep up with regulatory changes.

Outsourcing vs. In-House

- Outsourcing Benefits: Access to expertise, cost savings, scalability.

- In-House Benefits: Greater control, immediate availability.

Consider a hybrid approach to leverage the advantages of both.

Training and Development

Invest in your team’s professional development to enhance skills and adapt to new accounting standards.

8. Integrating Technology for Enhanced Accounting

Adopting Cloud-Based Accounting Solutions

In today’s digital age, leveraging technology is no longer optional—it’s essential for staying competitive and efficient. Cloud-based accounting solutions offer numerous advantages for small businesses aiming to enhance their accounting practices:

- Accessibility: Access your financial data anytime, anywhere, from any device with internet connectivity. This flexibility is invaluable for business owners on the move.

- Real-Time Updates: Transactions are recorded and updated in real-time, providing you with the most current financial picture. This immediacy aids in making timely decisions.

- Cost-Effective: Cloud solutions often operate on a subscription model, reducing upfront costs for software and hardware. They also eliminate the need for extensive IT support.

- Scalability: As your business grows, cloud-based systems can easily scale to accommodate increased transactions and additional users.

Recommended Platforms for Small Businesses:

- QuickBooks Online: A popular choice offering comprehensive features suitable for various industries.

- Xero: Known for its user-friendly interface and robust invoicing capabilities.

- FreshBooks: Ideal for service-based businesses with time-tracking and billing needs.

Utilizing Data Analytics

Data analytics transforms raw financial data into actionable insights, helping you identify growth opportunities:

- Identify Sales Trends: Analyze which products or services are performing best, and adjust your offerings accordingly.

- Customer Behavior: Understand purchasing patterns to tailor marketing strategies.

- Cost Analysis: Pinpoint areas where expenses can be reduced without impacting quality.

Key Financial Metrics to Monitor Regularly:

- Gross Profit Margin

- Net Profit Margin

- Accounts Receivable Turnover

- Inventory Turnover Ratio

By keeping a close eye on these metrics, you can make informed decisions that align with your growth goals.

Cybersecurity Measures

Protecting your financial data is paramount. Cyber threats can compromise sensitive information, leading to financial loss and reputational damage.

Tips for Securing Accounting Systems:

- Strong Passwords: Implement complex passwords and change them regularly. Consider multi-factor authentication for added security.

- Regular Updates: Keep your software and systems updated to protect against known vulnerabilities.

- Employee Training: Educate your staff on recognizing phishing attempts and proper data handling procedures.

- Backup Data: Regularly back up your data to secure, off-site locations to prevent loss from hardware failures or cyber attacks.

9. Regulatory Compliance and Risk Management

Understanding Legal Obligations

Compliance with financial regulations is not just a legal requirement but also a cornerstone of sustainable business growth.

Essential Compliance Areas:

- Payroll Taxes: Ensure accurate calculation, withholding, and remittance of payroll taxes to federal and state authorities.

- Financial Reporting: Adhere to Generally Accepted Accounting Principles (GAAP) for transparent and standardized financial statements.

- Sales Tax Collection: Stay updated on nexus laws that determine where you owe sales tax, especially if operating in multiple states.

Risks of Non-Compliance:

- Financial Penalties: Late filings or inaccuracies can result in fines and interest charges.

- Legal Consequences: Severe violations may lead to legal action against the business or its owners.

- Reputational Damage: Non-compliance can erode trust with customers, suppliers, and investors.

Implementing Internal Controls

Strong internal controls help prevent fraud, errors, and ensure the integrity of your financial information.

Procedures to Consider:

- Segregation of Duties: Divide responsibilities among different employees to reduce the risk of fraud or mistakes.

- Regular Audits: Conduct periodic internal or external audits to verify accuracy and compliance.

- Authorization Protocols: Establish clear approval processes for financial transactions.

Insurance and Liability

Having the right insurance coverage is a critical aspect of risk management.

Recommended Business Insurance:

- General Liability Insurance: Protects against claims of bodily injury or property damage.

- Professional Liability Insurance: Also known as Errors and Omissions insurance, it covers claims related to professional services.

- Business Interruption Insurance: Provides compensation for lost income during events that halt business operations.

Insurance not only safeguards your assets but also provides peace of mind, allowing you to focus on growing your business.

Strategic Financial Planning

10. Strategic Financial Planning

Forecasting and Projections

Financial forecasting is the process of predicting your business’s future financial performance. It aligns your accounting practices with growth goals by:

- Budget Preparation: Establishing expected revenues and expenses guides your budgeting process.

- Resource Allocation: Helps in making informed decisions about where to invest capital for the best returns.

- Identifying Funding Needs: Forecasts can reveal potential cash shortfalls, giving you time to secure financing.

Role of Scenario Planning

Scenario planning involves creating multiple financial models based on different assumptions (best case, worst case, most likely case). This prepares you for various outcomes and helps in:

- Risk Management: Anticipate potential challenges and develop mitigation strategies.

- Strategic Flexibility: Adapt quickly to changing market conditions.

Capital Structure Optimization

Your capital structure—the mix of debt and equity financing—impacts your business’s growth and financial health.

Funding Options:

- Loans: Bank loans or SBA loans can provide necessary capital without diluting ownership but increase debt obligations.

- Equity Financing: Bringing in investors can infuse cash without debt but requires sharing ownership and profits.

Impact of Debt vs. Equity on Growth:

- Debt Financing: Interest payments are tax-deductible, but high debt levels can strain cash flow and limit future borrowing.

- Equity Financing: Reduces financial risk but may lead to loss of control over business decisions.

Evaluate your business’s specific needs and risk tolerance to determine the optimal balance.

Investment Analysis

Before committing resources to new projects or assets, perform a thorough investment analysis.

Methods for Evaluating Investments:

- Return on Investment (ROI): Measures the profitability of an investment relative to its cost.

- Net Present Value (NPV): Calculates the present value of future cash flows, helping assess long-term projects.

- Internal Rate of Return (IRR): Estimates the profitability of potential investments.

By systematically analyzing investments, you ensure that your capital is deployed effectively to support growth.

11. Collaborating with Professional Accounting Services

Benefits of Professional Guidance

Partnering with experienced accountants brings numerous advantages:

- Tailored Strategies: Experts can develop customized accounting solutions that align with your specific growth goals.

- Compliance Assurance: Stay updated with the latest tax laws and regulations to avoid penalties.

- Time Savings: Outsourcing accounting tasks allows you to focus on core business activities like sales, marketing, and customer service.

Why Choose TMD Accounting

With nearly 40 years of experience, TMD Accounting has built a reputation for excellence in serving small businesses throughout New Jersey.

- Expertise in Small Business Accounting Services: We understand the unique challenges small businesses face and offer solutions that drive growth.

- Personalized Attention: Our team works closely with you to understand your business and tailor services accordingly.

- Comprehensive Services: From bookkeeping and payroll services to strategic financial planning and tax preparation, we cover all your accounting needs.

12. Action Plan for Aligning Accounting with Growth

Step-by-Step Guide

- Define Clear Growth Goals: Use the SMART framework to set specific objectives.

- Assess Current Accounting Practices: Identify gaps and areas for improvement in your financial processes.

- Conduct Financial Analysis: Analyze financial statements to understand your business’s strengths and weaknesses.

- Implement Robust Accounting Systems: Adopt cloud-based solutions and automate where possible.

- Optimize Cash Flow Management: Improve invoicing, manage expenses, and forecast cash flow.

- Engage in Proactive Tax Planning: Leverage tax incentives and work with a professional tax accountant.

- Integrate Technology: Utilize data analytics and ensure cybersecurity measures are in place.

- Ensure Regulatory Compliance: Stay informed of legal obligations and implement internal controls.

- Strategic Financial Planning: Create forecasts, consider funding options, and analyze investments.

- Collaborate with Professionals: Partner with accounting experts like TMD Accounting for tailored support.

Checklist for Readers:

- Set SMART growth goals.

- Review and update accounting software.

- Schedule regular financial reviews.

- Train staff on new systems and cybersecurity.

- Consult with a tax professional.

- Develop a strategic financial plan.

- Monitor KPIs regularly.

Setting Milestones and Reviewing Progress

- Quarterly Reviews: Assess financial performance against projections.

- Annual Audits: Conduct comprehensive evaluations of accounting practices.

- Adjust Goals as Needed: Be prepared to refine your growth objectives based on performance and market conditions.

- Schedule Assessments with Professionals: Regular meetings with your accountant can keep you on track and adapt strategies as your business evolves.

Conclusion

Aligning your accounting practices with your small business’s growth goals is a strategic imperative that can significantly impact your success. By following this comprehensive guide, you’re equipped to make informed decisions, optimize resources, and navigate the complexities of business expansion with confidence.

Take the Next Step

Don’t let outdated accounting practices hinder your growth potential. TMD Accounting is here to provide the expertise and personalized service you need to achieve your business objectives.

Contact us today at 1-856-228-2205 or visit TMD Accounting to schedule a consultation. Let’s work together to turn your growth aspirations into reality.

FAQs

-

Why is integrating technology important for accounting?

Integrating technology streamlines accounting processes, improves accuracy, provides real-time financial data, and enhances decision-making capabilities, all of which support business growth.

-

How can professional accounting services benefit my small business?

Professional accountants offer expertise in financial management, tax planning, compliance, and strategic planning, freeing up your time to focus on core business activities and driving growth.

-

What are the risks of non-compliance with financial regulations?

Non-compliance can result in financial penalties, legal action, reputational damage, and operational disruptions, which can significantly hinder business growth.

-

How often should I update my accounting systems and practices?

Regularly review your accounting systems, ideally annually or during significant business changes, to ensure they remain aligned with your growth goals and technological advancements.

By aligning your accounting practices with your growth goals and leveraging professional expertise, you set your small business on a path toward sustained success. Let TMD Accounting be your trusted partner in this journey.