Understanding Property Tax and Its Impact on Your South Jersey Business

Property taxes are an inevitable part of owning or leasing commercial property in South Jersey. But understanding how these taxes work—and how they impact your business—can feel overwhelming. Are rising property taxes eating into your profits? Are you unsure if your property’s tax assessment is fair? These questions can leave business owners stressed, especially in a region like South Jersey, where property taxes are among the highest in the nation.

This guide will help you break down the complexities of property taxes, explain how they impact your business, and offer actionable steps to manage them effectively. Whether you’re a retail shop owner in Gloucester County, a contractor in Deptford, or a restaurant owner in Cherry Hill, understanding property taxes can help you avoid costly mistakes and optimize your financial health.

What Is Property Tax and How Is It Calculated?

What Is Property Tax?

Property tax is a levy imposed by local governments on real estate properties to fund public services like schools, infrastructure, and emergency services. Business owners in South Jersey pay property tax either directly (if they own the property) or indirectly through their lease agreements.

How Is Property Tax Calculated in New Jersey?

New Jersey property tax is determined by two main factors:

- Assessed Property Value: The local tax assessor estimates your property’s value based on factors like size, location, and market trends.

- Local Tax Rate: This rate varies by municipality and is determined annually to meet budgetary needs.

Formula:

Property Tax = Assessed Value × Local Tax Rate

💡 Example: A commercial property in Washington Township assessed at $500,000 with a tax rate of 3% would have an annual property tax bill of $15,000.

Visual Suggestion: Include an infographic labeled “How Property Taxes Are Calculated in South Jersey” with a step-by-step breakdown.

The Impact of Property Taxes on South Jersey Businesses

A Fixed Cost with Variable Impacts

Property taxes are a significant operating expense, but they vary widely depending on location. South Jersey businesses face higher rates compared to other parts of the state, which can impact:

- Profit Margins: Higher taxes reduce your bottom line.

- Lease Costs: For tenants, landlords often pass property tax costs through to leases.

- Expansion Plans: High property taxes can deter businesses from expanding or relocating.

Local Challenges in South Jersey

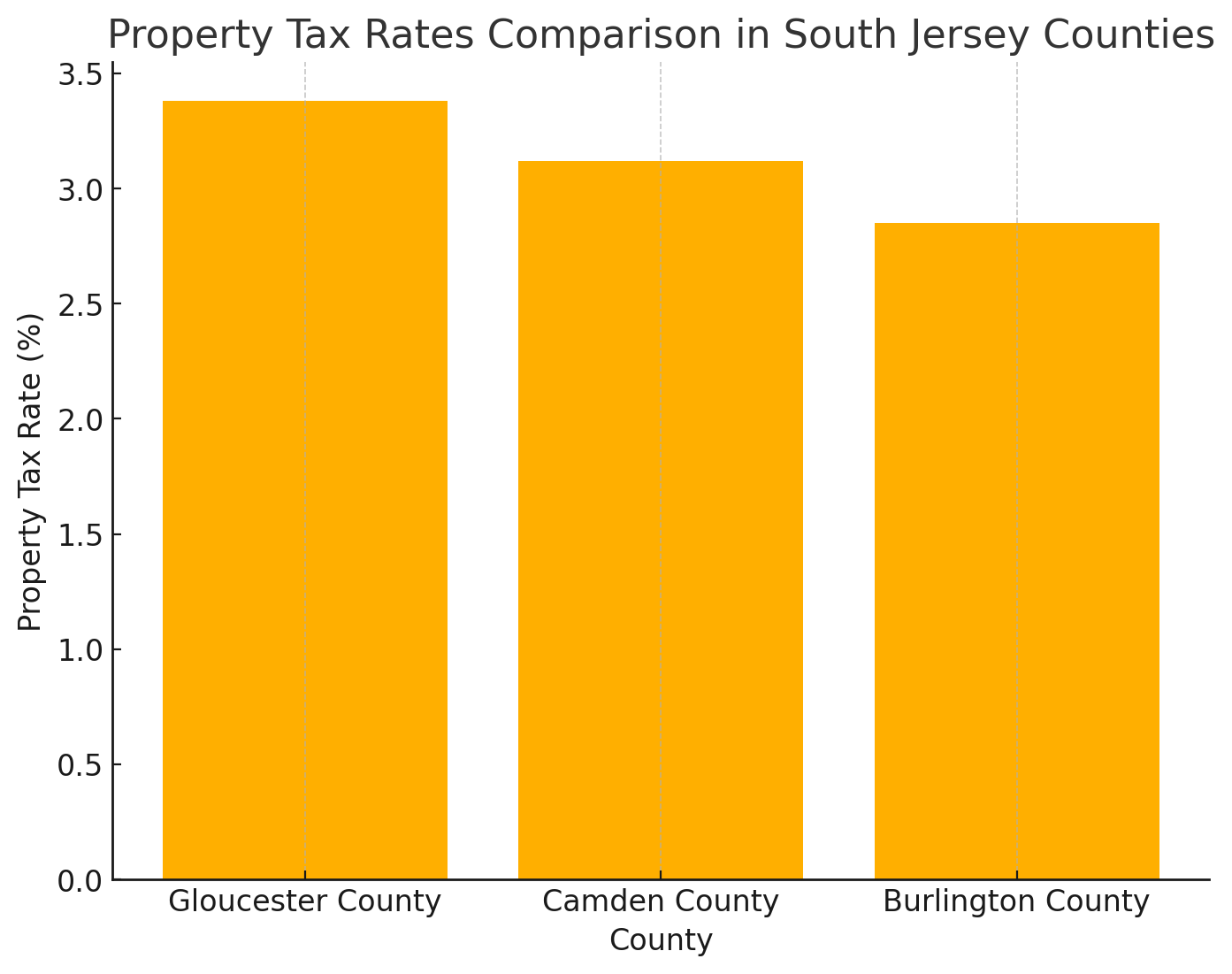

South Jersey’s property tax rates are among the highest in the country. For example:

- The average property tax rate in Gloucester County is 3.38%, compared to the national average of 1.08%.

- Municipalities like Deptford and Monroe Township often reassess properties, leading to sudden tax increases.

💡 Pro Tip: Review your municipality’s tax rate annually to anticipate changes.

Property Tax Rates Comparison In South Jersey Counties

Property Tax Rates Comparison In South Jersey Counties

Understanding Your Property Tax Assessment

What Is a Property Tax Assessment?

A property tax assessment is the valuation process local governments use to determine your property’s taxable value. Assessments consider factors like:

- Property size and condition.

- Recent sales of similar properties.

- Local market trends.

How to Verify Your Assessment

Errors in assessments are more common than you might think. Steps to verify:

- Request a copy of your property’s assessment from your local tax assessor.

- Compare your assessment with similar properties in your area.

- Look for discrepancies like incorrect square footage or outdated property details.

💡 Example: A Gloucester County business owner discovered a $10,000 overassessment due to an error in their property’s recorded square footage.

sample property assessment report

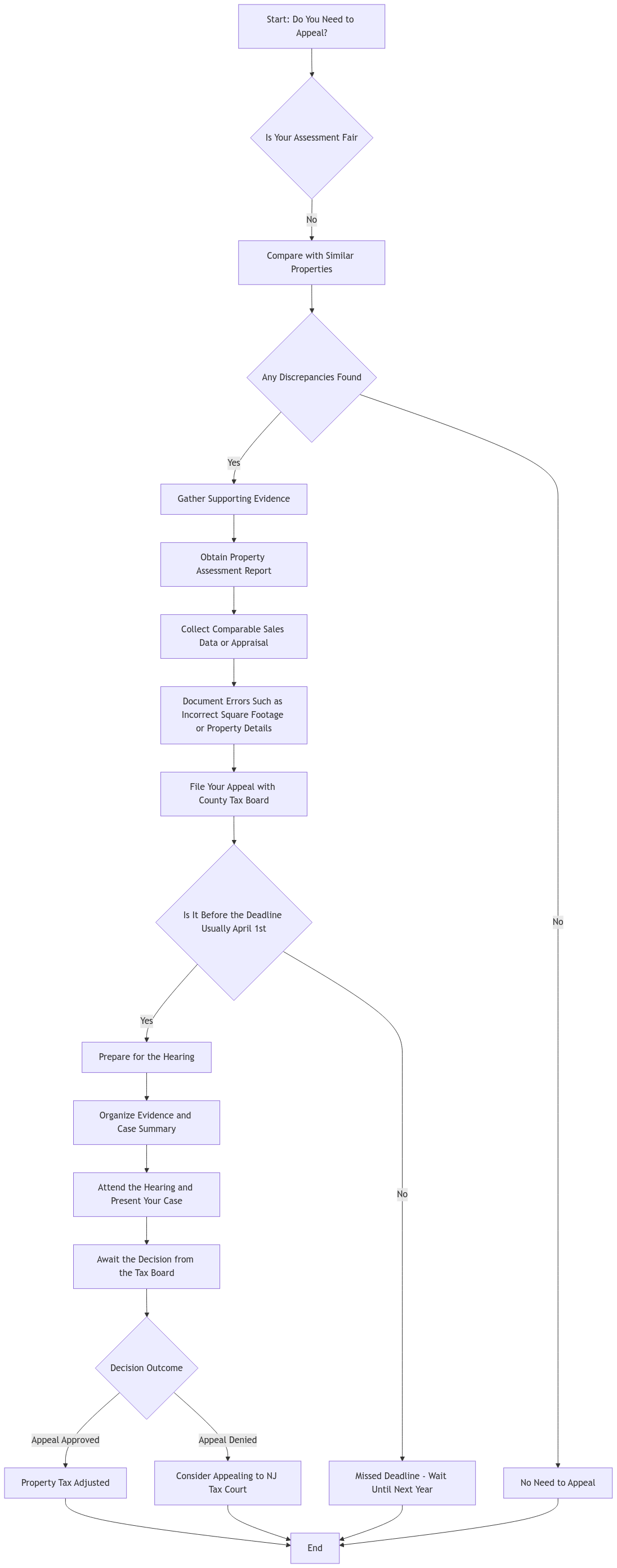

Appealing a Property Tax Assessment

When Should You Appeal?

If you believe your property has been overassessed, appealing can result in significant tax savings. Common reasons to appeal include:

- Your property is assessed higher than comparable properties.

- Incorrect property details (e.g., size or usage).

Steps to Appeal in New Jersey

- File a property tax appeal with your county’s tax board.

- Provide evidence, such as comparable sales data or a professional appraisal.

- Attend a hearing to present your case.

💡 Pro Tip: Filing deadlines are strict—usually April 1st in most South Jersey counties.

Visual Suggestion: Include a flowchart titled “How to Appeal Your Property Tax in New Jersey.”

Strategies to Manage Property Taxes Effectively

1. Budget for Tax Increases

Include property tax projections in your annual budget to avoid surprises.

2. Explore Tax Deductions

Certain improvements or renovations may qualify for tax deductions. Consult a tax professional to identify eligible expenses.

3. Work with a Local Accountant

A South Jersey accountant can help you uncover tax-saving opportunities and ensure compliance with local laws. At TMD Accounting, we’ve helped businesses reduce tax burdens and maximize deductions for nearly 40 years.

💡 Case Study: A Cherry Hill restaurant saved $7,000 in property taxes after we identified an overassessment and successfully filed an appeal.

Why Partnering with a Local Expert Matters

Benefits of Working with a South Jersey Accountant

- Local Knowledge: An accountant familiar with Gloucester County understands local tax rates and challenges.

- Personalized Support: Your business gets tailored advice rather than generic solutions.

- Audit Protection: Avoid costly mistakes by staying compliant with New Jersey tax regulations.

💡 Testimonial: “TMD Accounting helped us reduce our property tax liability and saved us thousands annually. Their expertise in South Jersey tax laws is unmatched!” – Local Business Owner, Turnersville.

Visual Suggestion: Include a photo of the TMD Accounting team with a caption about their expertise in helping local businesses.

Conclusion

Understanding property taxes is essential for South Jersey business owners looking to protect their profits and plan for growth. By learning how taxes are calculated, verifying your assessments, and exploring tax-saving strategies, you can turn a potential liability into a manageable expense.

If you’re ready to take control of your property taxes, contact TMD Accounting today. With nearly 40 years of experience serving Gloucester County, we’re here to help your business thrive.

Contact Us

📞 Call us: (856) 228-2205

📧 Email us: info@tmdaccounting.com

📍 Visit us: 202 Ganttown Road, Turnersville, NJ 08012

🌐 Contact Us: TMDAccounting.com