How to Reduce Overhead Costs in Your South Jersey Restaurant

Running a restaurant in South Jersey can be both rewarding and challenging. The joy of serving your community is often balanced by the stress of managing expenses, especially in an environment where overhead costs can quickly spiral out of control. Are high utility bills, labor costs, and food expenses eating into your profits? The good news is, with the right strategies, you can cut overhead costs without sacrificing the quality and experience your customers love.

In this article, we’ll explore actionable ways to reduce overhead costs in your South Jersey restaurant. Whether you run a family-owned diner in Gloucester County or a cozy café in Cherry Hill, these tips will help you identify savings opportunities and improve your bottom line.

What Are Overhead Costs in a Restaurant?

Defining Overhead Costs

Overhead costs are the ongoing expenses required to run your business that aren’t directly tied to food or drink production. These include:

- Rent or mortgage payments.

- Utilities like electricity, water, and gas.

- Marketing and advertising costs.

- Insurance premiums.

- Equipment repairs and maintenance.

Unlike food or labor costs, overhead expenses remain relatively fixed and require strategic planning to manage effectively.

💡 Did You Know? In the restaurant industry, overhead costs typically account for 30% or more of total revenue. Reducing even a small percentage of these costs can lead to significant savings over time.

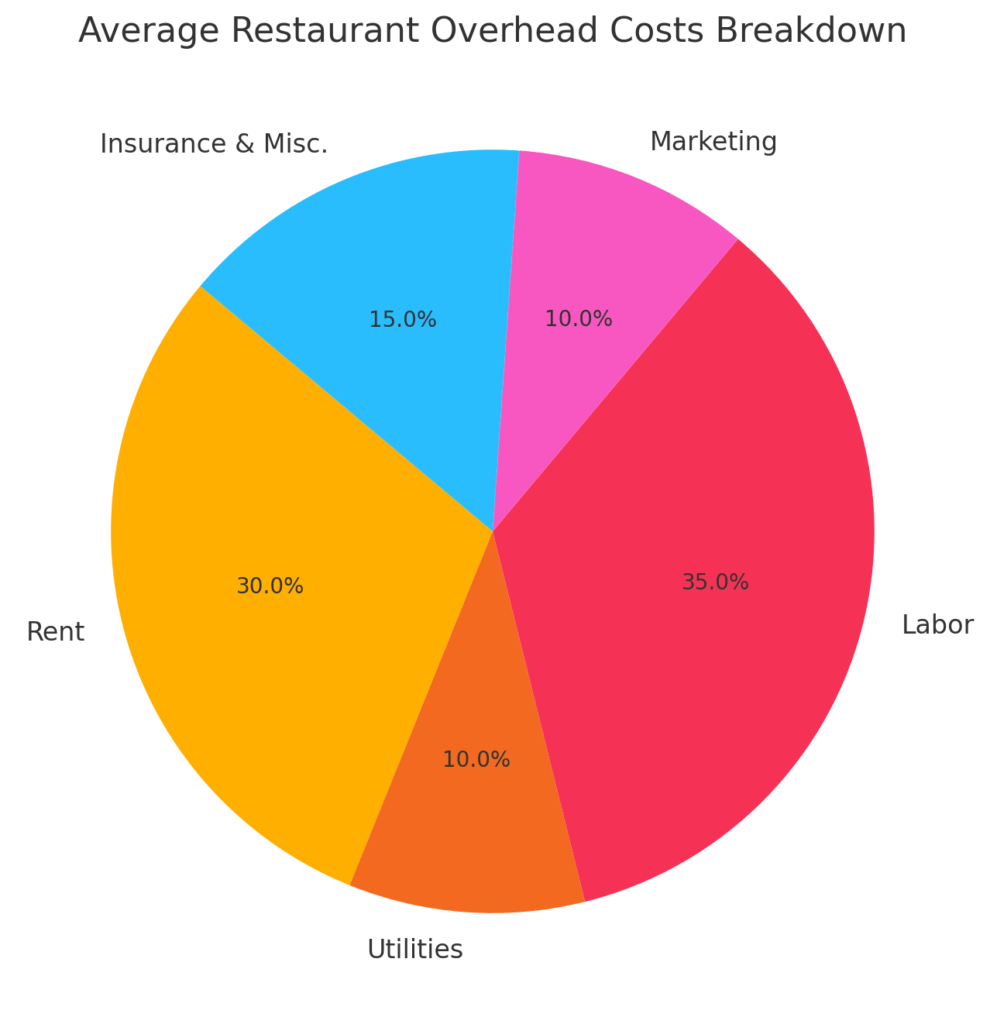

Average Restaurant Overhead Costs Breakdown

Conducting a Cost Audit: The First Step to Saving Money

Why a Cost Audit Is Crucial

You can’t reduce overhead costs if you don’t know where your money is going. A cost audit helps you identify inefficiencies and unnecessary expenses. This process involves:

- Reviewing all your monthly expenses.

- Categorizing costs into fixed (e.g., rent) and variable (e.g., marketing).

- Identifying patterns of overspending.

Tools to Track Expenses

- Accounting Software: Platforms like QuickBooks can simplify expense tracking and reporting.

- Spreadsheets: Use a detailed spreadsheet to log recurring costs and compare them month-to-month.

- Expense Tracking Apps: Mobile tools like Expensify can help you manage receipts and invoices on the go.

💡 Example: A Gloucester County restaurant owner reduced expenses by 15% after discovering unnecessary subscriptions during a cost audit.

Download – Restaurant Cost Audit Checklist

Reducing Food Costs Without Sacrificing Quality

Optimize Portion Control

Portion control is one of the simplest ways to reduce food waste and improve profitability. Train staff to use standardized portion sizes and invest in tools like portioning scales.

Source Ingredients Locally

Buying seasonal produce and partnering with local suppliers can reduce transportation costs and support the South Jersey economy.

Regularly Review Your Menu

Analyze your menu to identify high-cost, low-margin items. Replace them with profitable dishes that still resonate with your customers.

💡 Pro Tip: Restaurants that update their menu quarterly often see improved profits, as they adapt to seasonal availability and customer preferences.

Cost And Profit Margin Of Popular Menu Items

Menu Item |

Cost to Make ($) |

Selling Price ($) |

Profit ($) |

Profit Margin (%) |

|---|---|---|---|---|

Cheeseburger |

$4.50 | $12.00 | $7.50 | 62.5% |

Grilled Chicken Salad |

$5.00 | $14.00 | $9.00 | 64.29% |

Pasta Alfredo |

$3.75 | $11.00 | $7.25 | 65.91% |

Margherita Pizza |

$4.00 | $13.00 | $9.00 | 69.23% |

Fish Tacos |

$4.25 | $15.00 | $10.75 | 71.67% |

Managing Labor Costs More Effectively

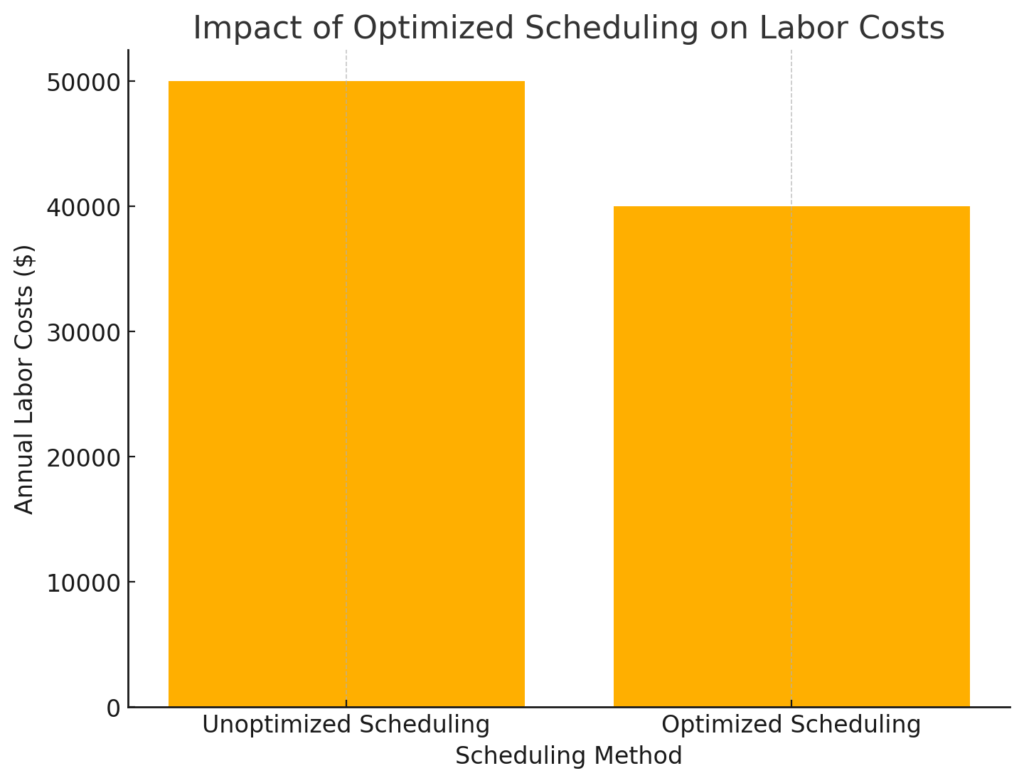

Optimize Employee Scheduling

Use historical sales data to align staff schedules with peak hours. Overstaffing during slow periods can eat away at your profits.

Cross-Train Employees

Training staff to handle multiple roles (e.g., waitstaff doubling as hosts during off-peak times) increases flexibility and efficiency.

Leverage Labor Management Tools

Software like Homebase or 7shifts helps automate scheduling, track labor costs, and avoid unnecessary overtime.

💡 Case Study: A Turnersville restaurant saved $10,000 annually by adopting a labor management system that streamlined scheduling and reduced overtime pay.

Impact of Optimized Scheduling on Labor Costs

Impact Of Optimized Scheduling On Labor Costs

Saving on Energy and Utility Costs

Upgrade to Energy-Efficient Equipment

Energy-efficient appliances, such as ENERGY STAR-rated refrigerators and ovens, use less power and can significantly reduce utility bills.

Implement Energy-Saving Practices

- Turn off equipment during downtime.

- Install programmable thermostats to manage heating and cooling more efficiently.

- Use LED lighting to lower electricity costs.

Conduct Regular Maintenance

Keeping equipment in good condition ensures it operates efficiently, reducing unnecessary energy consumption.

💡 Did You Know? A South Jersey café owner cut their energy bills by 20% after upgrading to energy-efficient equipment and implementing LED lighting.

Cutting Costs on Marketing and Technology

Cutting Costs on Marketing and Technology

Use Free or Low-Cost Marketing Channels

- Leverage social media platforms like Instagram and Facebook to promote daily specials and events.

- Use email marketing to connect with loyal customers and share exclusive offers.

Focus on Local Partnerships

Collaborate with South Jersey influencers or sponsor community events to increase brand visibility without breaking the bank.

Audit Your Subscriptions

Evaluate the ROI of paid technology tools, like reservation platforms, and eliminate those that aren’t delivering value.

💡 Example: A Camden County pizzeria saved $2,500 annually by switching to a more affordable online ordering system.

Partnering with a Local Accountant for Financial Guidance

Why Work with a Local Expert?

A local accountant understands the unique financial challenges South Jersey restaurants face, such as New Jersey-specific tax regulations and seasonal fluctuations in revenue.

How TMD Accounting Can Help

- Conduct cost audits to uncover inefficiencies.

- Provide tax-saving strategies tailored to your business.

- Offer budgeting tools to manage cash flow and plan for seasonal trends.

💡 Testimonial: “TMD Accounting helped me cut overhead costs and identify tax deductions I didn’t even know existed. Their expertise saved my business thousands!” – A Gloucester County Restaurant Owner.

Conclusion

Reducing overhead costs in your South Jersey restaurant is essential for long-term success. By auditing your expenses, optimizing food and labor costs, adopting energy-efficient practices, and leveraging affordable marketing strategies, you can significantly improve your profit margins. Remember, every dollar saved is a dollar you can reinvest in your business.

If you’re ready to take control of your finances and boost your restaurant’s profitability, TMD Accounting is here to help. With nearly 40 years of experience serving South Jersey businesses, we provide personalized guidance to help you thrive.

Contact Us

📞 Call us: (856) 228-2205

📧 Email us: info@tmdaccounting.com

📍 Visit us: 202 Ganttown Road, Turnersville, NJ 08012

🌐 Contact Us: TMDAccounting.com