The #1 Mistake That Forces Small Business Owners to Dip Into Personal Savings

As a small business owner, financial stress often comes with the territory. But one of the most frustrating and avoidable challenges is having to dip into your personal savings to keep your business afloat. If you’ve been there—or fear it could happen—you’re not alone. Many small business owners face this situation, often without realizing what’s truly causing the issue.

So, what’s the #1 mistake that leads to this scenario? Poor cash flow management.

Failing to properly manage cash flow is one of the leading reasons small businesses find themselves in financial trouble. But the good news is that it’s avoidable with the right strategies and tools. In this article, we’ll explore why cash flow management is so important, common mistakes to avoid, and actionable steps to ensure your business stays financially healthy—without draining your personal savings.

The Hidden Danger: Why Small Business Owners Dip Into Personal Savings

Understanding the Problem

When unexpected expenses arise, or revenue dips below expectations, many business owners turn to personal savings as a safety net. While it might seem like a quick fix, this approach can strain both your personal and business finances.

Common triggers include:

- Unforeseen Expenses: Equipment failures, unexpected repairs, or emergency supply costs.

- Delayed Payments: Clients not paying invoices on time, leaving you with a cash shortfall.

- Lack of Planning: Failing to anticipate seasonal slowdowns or rising operational costs.

💡 Example: A café owner in South Jersey experienced a sudden drop in revenue during the winter months. With no cash reserve, they had to tap into personal savings to cover payroll and rent.

Understanding Cash Flow: The Lifeblood of Your Business

What Is Cash Flow?

What Is Cash Flow?

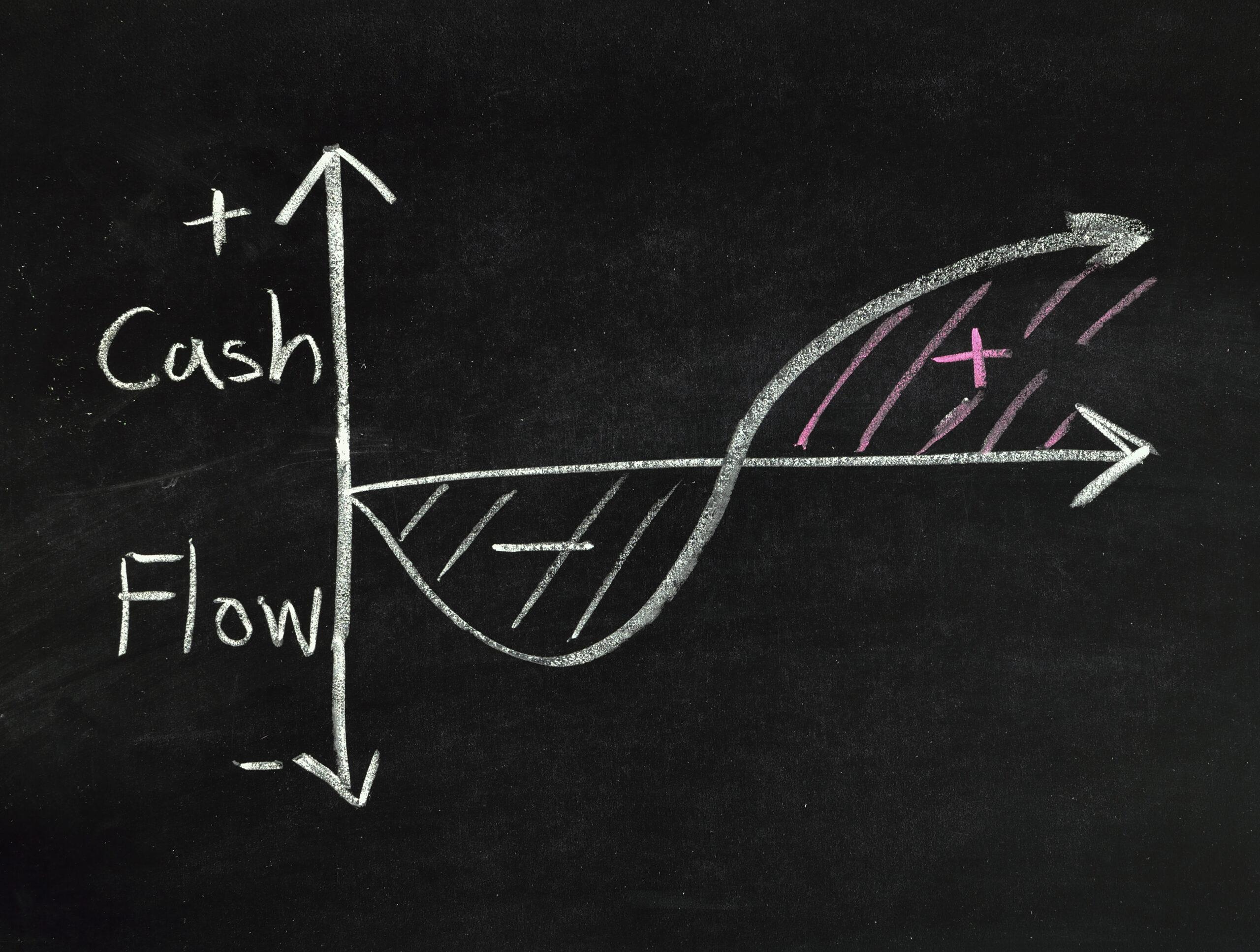

Cash flow refers to the money moving in and out of your business. Positive cash flow means you have more money coming in than going out, while negative cash flow indicates the opposite.

Why Cash Flow Matters

- Keeps the Lights On: Cash flow ensures you can pay operational expenses like rent, utilities, and salaries.

- Prevents Financial Stress: With healthy cash flow, you won’t need to rely on personal savings or high-interest loans.

- Supports Growth: Positive cash flow allows you to reinvest in your business, hire staff, or expand your operations.

💡 Pro Tip: Regularly reviewing your cash flow statement can help you spot potential issues before they become major problems.

Common Cash Flow Mistakes That Drain Personal Savings

1. Overestimating Revenue

One of the most common mistakes is assuming your income will remain consistent or grow without setbacks. Overestimating revenue can lead to overspending and leave you vulnerable during slow periods.

2. Failing to Account for Hidden Expenses

Hidden costs like equipment maintenance, taxes, or supply price increases can eat away at your cash reserves if not planned for.

3. Allowing Irregular Billing Cycles

If your receivables don’t align with your payables, you may face cash shortages. For example, if you offer 30-day payment terms to clients but need to pay suppliers within 15 days, you’re stuck in a cash crunch.

4. Neglecting an Emergency Fund

Without an emergency fund, even minor unexpected expenses can force you to dip into personal savings.

Example: A construction company in Gloucester County struggled to meet payroll after a delayed payment from a client. With no buffer, the owner had to use personal funds to keep operations running.

Top Cash Flow Mistakes and How to Avoid Them

Cash Flow Mistake |

Why It’s a Problem |

How to Avoid It |

|---|---|---|

Overestimating Revenue |

Leads to overspending and creates cash shortages during slow periods. | Use conservative revenue projections and adjust based on actual performance. |

Failing to Account for Hidden Expenses |

Unexpected costs like maintenance or tax increases can drain cash reserves. | Regularly review expenses and budget for variable and hidden costs. |

Irregular Billing Cycles |

Mismatched receivables and payables cause cash flow gaps. | Align payment terms with clients and suppliers; implement strict invoicing practices. |

Neglecting an Emergency Fund |

Leaves no financial cushion for unexpected expenses, forcing reliance on personal savings. | Set aside a percentage of revenue regularly to build a business emergency fund. |

Poor Invoicing Practices |

Late payments from clients can create cash shortages. | Automate invoicing, send reminders, and offer early payment incentives. |

Ignoring Cash Flow Forecasting |

Makes it hard to predict financial shortfalls or plan for growth. | Create and update a cash flow forecast regularly to anticipate future needs. |

Uncontrolled Spending |

Overspending on non-essential items depletes cash reserves. | Review expenses periodically, prioritize essential costs, and eliminate wasteful spending. |

Relying Too Heavily on Credit |

Creates debt that adds interest expenses, worsening cash flow issues. | Use credit strategically and ensure you have the cash flow to cover repayments. |

Strategies to Avoid Dipping Into Personal Savings

1. Create a Cash Flow Forecast

A cash flow forecast helps you predict future inflows and outflows, allowing you to prepare for slow periods or upcoming expenses.

- Use accounting software like QuickBooks or Xero to automate cash flow tracking.

- Revisit your forecast regularly to adjust for changes in revenue or expenses.

2. Implement an Invoicing System

Efficient invoicing ensures you get paid on time:

- Send invoices promptly.

- Use automated reminders for overdue payments.

- Consider offering early payment discounts to incentivize clients.

3. Build an Emergency Fund

Set aside a percentage of your revenue each month to build a cash reserve for unexpected expenses.

4. Review Fixed and Variable Costs

- Audit your expenses to identify unnecessary spending.

- Negotiate with suppliers for better terms or switch to cost-effective alternatives.

💡 Case Study: A South Jersey retailer worked with TMD Accounting to develop a cash flow forecast, which allowed them to navigate a slow sales quarter without touching their personal savings.

The Role of Technology in Cash Flow Management

Benefits of Accounting Software

Benefits of Accounting Software

Modern accounting software offers tools to track cash flow in real-time, manage invoices, and monitor expenses. Popular options include:

- QuickBooks Online: Comprehensive features for small businesses.

- Wave: A free option for startups and sole proprietors.

Automating Financial Processes

Automation reduces errors and saves time, ensuring you’re always on top of your cash flow.

Why Personal Savings Should Be Off-Limits

The Risks of Using Personal Savings

- Financial Strain: Dipping into personal savings can jeopardize your financial security.

- Emotional Stress: Mixing personal and business finances creates additional stress for you and your family.

The Importance of Separation

Keep business and personal finances separate by:

- Opening a dedicated business bank account.

- Paying yourself a consistent salary instead of withdrawing funds as needed.

Conclusion

Managing cash flow is the key to protecting both your business and personal finances. By avoiding common mistakes like overestimating revenue and neglecting an emergency fund, you can build a sustainable business that doesn’t rely on your personal savings as a safety net.

If you’re struggling with cash flow or need help implementing better financial practices, TMD Accounting is here to help. With decades of experience serving South Jersey small businesses, we can provide the guidance and tools you need to succeed.

📞 Call us: (856) 228-2205

📧 Email us: info@tmdaccounting.com

📍 Visit us: 202 Ganttown Road, Turnersville, NJ 08012

🌐 Contact Us: TMDAccounting.com